MisterSimple

TF Buzz

Hey guys,

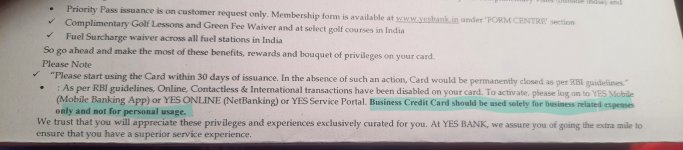

I just received a Yes Bank Priority Business Credit card (against my maternal uncle's shop). Since it is a business credit card, it is written in the booklet that it should not be used for personal spends. What should I do- Should I let it get closed after 37 days of inactivation, or start using it for personal spends?

I just received a Yes Bank Priority Business Credit card (against my maternal uncle's shop). Since it is a business credit card, it is written in the booklet that it should not be used for personal spends. What should I do- Should I let it get closed after 37 days of inactivation, or start using it for personal spends?