Many new Credit Card users confuse Minimum Due amount with total bill and get trapped in credit card debt.

This terminology is used by all credit card providers and it is necessary for everyone to understand.

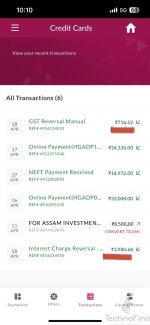

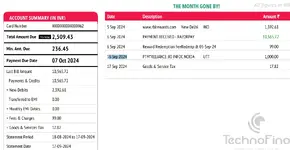

Total Outstanding: This is the total outstanding value of credit card - which contains all unbilled amounts, any unpaid amount from last bill, any EMI value plus GST and interest values along with fees (if any - eg: Joining/Annual fee, Late Payment penalty etc.)

Due Date/Due On: Due date by which the credit card billed amount should be paid to avoid any late fees or interest

Billed Amount/Last Billed Amount: Generated Billed amount which needs to be paid on or before Due Date

Min. Due: Minimum amount you need to pay before the due date to continue using credit card without any restriction.

Let's consider a user spent 10,000 in a billing cycle. After the bill generation date, the user spent 5,000 more.

Total Outstanding = 15,000

Due Date = 01 Apr 20xx

Billed Amount = 10,000

Min. Due = 100

In above scenario, the user has to pay atleast 10,000 (billed amount) to avoid any extra cost in terms of late payment fees and interest. Users can pay more (consider 50) and that amount will be reduced from the unbilled amount 5,000 spent after bill generation date. Next bill would be generated as [5,000 (-) 50 extra amount user paid = 4950]

Now the scenario where new users are trapped in Credit debt:

User pays min. due = 100

Unpaid bill = 9,900

From 02 Apr 20xx, user will be charged late payment fees + interest on the unpaid dues. The interest will be calculated from the 1st day of transaction.

This terminology is used by all credit card providers and it is necessary for everyone to understand.

Total Outstanding: This is the total outstanding value of credit card - which contains all unbilled amounts, any unpaid amount from last bill, any EMI value plus GST and interest values along with fees (if any - eg: Joining/Annual fee, Late Payment penalty etc.)

Due Date/Due On: Due date by which the credit card billed amount should be paid to avoid any late fees or interest

Billed Amount/Last Billed Amount: Generated Billed amount which needs to be paid on or before Due Date

Min. Due: Minimum amount you need to pay before the due date to continue using credit card without any restriction.

Let's consider a user spent 10,000 in a billing cycle. After the bill generation date, the user spent 5,000 more.

Total Outstanding = 15,000

Due Date = 01 Apr 20xx

Billed Amount = 10,000

Min. Due = 100

In above scenario, the user has to pay atleast 10,000 (billed amount) to avoid any extra cost in terms of late payment fees and interest. Users can pay more (consider 50) and that amount will be reduced from the unbilled amount 5,000 spent after bill generation date. Next bill would be generated as [5,000 (-) 50 extra amount user paid = 4950]

Now the scenario where new users are trapped in Credit debt:

User pays min. due = 100

Unpaid bill = 9,900

From 02 Apr 20xx, user will be charged late payment fees + interest on the unpaid dues. The interest will be calculated from the 1st day of transaction.