Currently, consumers do not have the ability to lock their credit reports to prevent unauthorised access. Banks and NBFCs not only periodically check our credit reports but also make hard inquiries without our explicit consent, resulting in unwanted entries on our credit reports.

Have you ever applied for a credit card through an SBI Card agent at locations like shopping malls or railway stations? These agents often save your details and contact you later to process credit card applications. Unfortunately, even if you decline to apply for a new credit card, they sometimes submit random applications using your old information, leading to unwanted hard inquiries and fulfilling their lead generation targets.

When applying for a credit product from a bank, they should only check your credit once. However, multiple hard inquiries for a single credit product application are prevalent. Banks even conduct hard pulls on consumer credit data without any new applications.

Such practises are increasingly common nowadays.

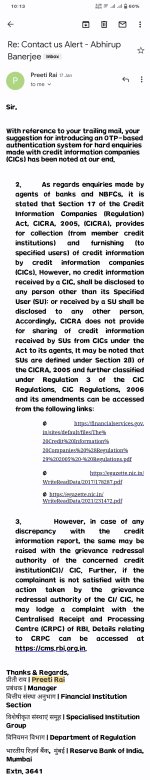

We urgently need a robust system to protect consumers from fraudulent hard inquiries. Just like the Aadhaar biometric lock, we should be able to lock our credit reports as well. It is essential for the Reserve Bank of India (RBI) to address this issue and establish comprehensive guidelines for all banks and NBFCs.

We hope the RBI will take the necessary steps to safeguard consumers' credit information and prevent unauthorised hard inquiries in the future.

Have you ever applied for a credit card through an SBI Card agent at locations like shopping malls or railway stations? These agents often save your details and contact you later to process credit card applications. Unfortunately, even if you decline to apply for a new credit card, they sometimes submit random applications using your old information, leading to unwanted hard inquiries and fulfilling their lead generation targets.

When applying for a credit product from a bank, they should only check your credit once. However, multiple hard inquiries for a single credit product application are prevalent. Banks even conduct hard pulls on consumer credit data without any new applications.

Such practises are increasingly common nowadays.

We urgently need a robust system to protect consumers from fraudulent hard inquiries. Just like the Aadhaar biometric lock, we should be able to lock our credit reports as well. It is essential for the Reserve Bank of India (RBI) to address this issue and establish comprehensive guidelines for all banks and NBFCs.

We hope the RBI will take the necessary steps to safeguard consumers' credit information and prevent unauthorised hard inquiries in the future.