From my knowledge,

a. Should I move from HDFC to other bank, if yes SBI better or Saraswat bank better. OR you suggest any other bank. - After merger HDFC is no longer a separate institution, it is HDFC Bank itself. SBI will give you an advantage in flexible repayment, but do the analysis in profit you are getting.

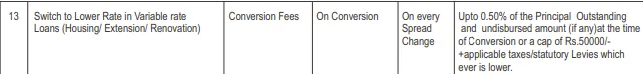

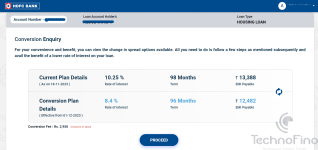

b. Till date HDFC was charging interest considering the loan tenure of 20 years, If I move to other bank I will need to foreclose the HDFC loan account, that means I just used HDFC loan money for 9 years. Will HDFC consider this and convert my overall paid EMI and reduce my principal as the interest rate should be lower for 9 years comparing to 20 years - No, whatever you paid will principal+interest, they are not going to calculate your entire EMI as principal. The current interest rate 8.5% and by paying a small conversion fee(around 3000) around this time last year, you could have reduced 2-3 years in your repayment period. But better late than never, do it asap.

c. If I opt for HDFC conversion option for how many months or years my interest rate will be at 8.5% or they will again start increasing it quarterly. - It will stay the same as long as the repo rate remains same. Always please keep an eye on RBI repo rate.

d. I want to keep the EMI same and reduce the tenure. Rather increase the EMI (from 25K to 30K) to reduce the tenure. Not sure keep the EMI same and pay additional Rs 5000 per month separately to reduce the principal. I heard that whatever you pay over and above the EMI that get reduced from principal. What is the best option? - keep the EMI the same/more and reduce the tenure, but if you can make prepayments over and above EMI, do it periodically. But other than SBI, I don't know which other banks provide the option of pay as you wish more than the EMI. Other members can pitch in.