Hello everyone,

I am sharing my journey of hdfc cards .

In year 2017 May, I applied for Regalia First as this was one of the mid segment card which was offering international lounge access even for add on cards through PP ( no spend tnc back then ). applied this card only for lounge access for the add on, as an international trip was upcoming.

Initial CL - 2Lac . Total spends - 90k-1lac

Dec 2017 - CLI to 2.6 Lac.. Total spends 1.10 lac

Jul 2018 - CLI to 4 lac - Total Spends - 20k

Oct 2018- CLI to 4.3 lac and upgrade to Regalia - Total spends 1.10la

Nov 2019- CLI to 5.16 lac - Total Spends 1.10 lac

Nov 2020- CLI to 6.19 lac - Total Spends 1.05 Lac

Regalia First and Regalia was LTF

Jan 2021 - was offered LTF DCB but missed to avail the offer as was in doubt about the cashback expected on the Regalia and customer care was clueless.

Missed the bus

Thereafter mailed to grievances and priority redressal to have the same offer again but they were only offering DCB as FYF ... didn't take

Jan 2022- CLI to 7.42 Lac Regalia - 3.80Lac Total spends

Aug 2022 - CLI to 8.88 lac - Total spends 1.85 Lac

Again wrote to priority and grievances to upgrade to LTF DCB but they didn't agreed, finally in Nov 2022 I opted for FYF DCB.

Aug 2023- CLI to 10.38 lac on DCB plastic.. Total spends less than 10 K (received the activation offer then only used) 😛

since from Jan 2023 I got Magnus and completely devoted in completing it's monthly milestone target.

I was about to close the DCB plastic as didn't wanted to pay the renewal fee due in Nov'23 and then one lucky day I got the upgrade offer to FYF DCB metal in Oct 2023 ..so took it as Magnus was devalued and StanC ultimate closed.

After reading through the forum I learnt that limit of 10 lac plus and spend of 7.5lac plus in 6 months makes an eligible case for upgrade to Infinia.

So from Nov 2023 to Feb 2024- did big spends not entirely mine ..total of 8.5lac plus ..hit the quarterly milestone twice ..

So one fine day I again wrote to the priority redressal asking for upgrade to Infinia citing DCB acceptability issue ( did attached some failed transaction screenshots) and to my surprise I was declined the Infinia upgrade. Was asked to provide more details on the failed transactions, where what how blah blah..

I was so confident about the upgrade as I met the spend and limit criteria.

I think they didn't looked into my unbilled spends (3lac plus) only counted the billed one 5.5lac plus .. so immediately wrote to them CC d grievances, PNO , saying these would be the last spends you would see on my card ..transferring all my banking relationship to the Axis Bank and Magnus card ( I don't have a Bank account with HDFC and have closed Magnus already 😉 )

Next day got priority redressal reply that they are fine upgrading this to FYF Infinia . So I took it. Not sure if Ill meet the fee waiver criteria of 10 lac spends in the next anniversary year but won't mind paying that extra 2250 towards GST.

Awaiting the card dispatch🙂

Thanks for reading the long post only wanted to share my journey.

I am sharing my journey of hdfc cards .

In year 2017 May, I applied for Regalia First as this was one of the mid segment card which was offering international lounge access even for add on cards through PP ( no spend tnc back then ). applied this card only for lounge access for the add on, as an international trip was upcoming.

Initial CL - 2Lac . Total spends - 90k-1lac

Dec 2017 - CLI to 2.6 Lac.. Total spends 1.10 lac

Jul 2018 - CLI to 4 lac - Total Spends - 20k

Oct 2018- CLI to 4.3 lac and upgrade to Regalia - Total spends 1.10la

Nov 2019- CLI to 5.16 lac - Total Spends 1.10 lac

Nov 2020- CLI to 6.19 lac - Total Spends 1.05 Lac

Regalia First and Regalia was LTF

Jan 2021 - was offered LTF DCB but missed to avail the offer as was in doubt about the cashback expected on the Regalia and customer care was clueless.

Missed the bus

Thereafter mailed to grievances and priority redressal to have the same offer again but they were only offering DCB as FYF ... didn't take

Jan 2022- CLI to 7.42 Lac Regalia - 3.80Lac Total spends

Aug 2022 - CLI to 8.88 lac - Total spends 1.85 Lac

Again wrote to priority and grievances to upgrade to LTF DCB but they didn't agreed, finally in Nov 2022 I opted for FYF DCB.

Aug 2023- CLI to 10.38 lac on DCB plastic.. Total spends less than 10 K (received the activation offer then only used) 😛

since from Jan 2023 I got Magnus and completely devoted in completing it's monthly milestone target.

I was about to close the DCB plastic as didn't wanted to pay the renewal fee due in Nov'23 and then one lucky day I got the upgrade offer to FYF DCB metal in Oct 2023 ..so took it as Magnus was devalued and StanC ultimate closed.

After reading through the forum I learnt that limit of 10 lac plus and spend of 7.5lac plus in 6 months makes an eligible case for upgrade to Infinia.

So from Nov 2023 to Feb 2024- did big spends not entirely mine ..total of 8.5lac plus ..hit the quarterly milestone twice ..

So one fine day I again wrote to the priority redressal asking for upgrade to Infinia citing DCB acceptability issue ( did attached some failed transaction screenshots) and to my surprise I was declined the Infinia upgrade. Was asked to provide more details on the failed transactions, where what how blah blah..

I was so confident about the upgrade as I met the spend and limit criteria.

I think they didn't looked into my unbilled spends (3lac plus) only counted the billed one 5.5lac plus .. so immediately wrote to them CC d grievances, PNO , saying these would be the last spends you would see on my card ..transferring all my banking relationship to the Axis Bank and Magnus card ( I don't have a Bank account with HDFC and have closed Magnus already 😉 )

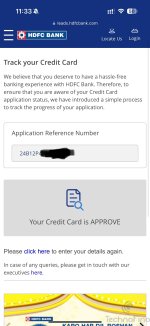

Next day got priority redressal reply that they are fine upgrading this to FYF Infinia . So I took it. Not sure if Ill meet the fee waiver criteria of 10 lac spends in the next anniversary year but won't mind paying that extra 2250 towards GST.

Awaiting the card dispatch🙂

Thanks for reading the long post only wanted to share my journey.

Last edited: