Editor’s note: This is a recurring post, regularly updated with new information and offers. Last Updated 22nd May 2024.

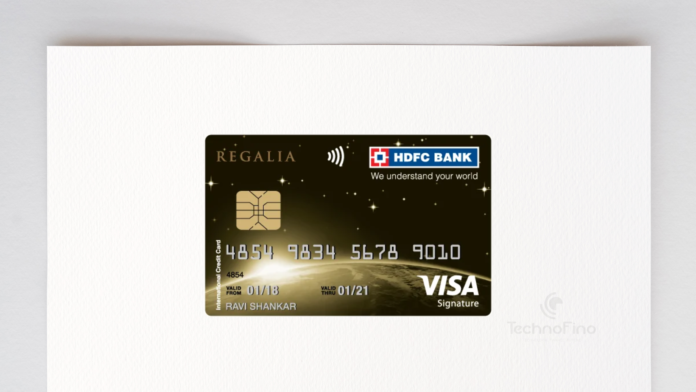

HDFC Regalia must be the most common card among HDFC credit cardholders and is offered as a super-premium offering from HDFC Bank positioned just below the HDFC luxury twins HDFC Infinia Credit Card and HDFC Diners Club Black Credit Card. However, I would like to rate it as a mid-range premium card. Here’s everything you wish to know about the card.

Contents

Charges and Welcome Benefits

| Joining Fees | ₹2500 + GST |

| Welcome Benefits | 2500 Reward Points (Applicable only on payment of fees) |

| Renewal Fees | ₹2500 + GST |

| Renewal Benefits | 2500 Reward Points (Applicable only on payment of fees) |

| Renewal Fee Waiver | Spend ₹3L or more in a year. |

Reward Points/Cashback Accrual

| Spends Area | Reward Rate | Maximum Capping per Calendar Month |

| All retail* spends | 4 Reward Points per ₹150 spent | No capping |

*Except EasyEMI, Wallets, Rent, Property Management, Packers & Movers, and Government transactions.

- Reward points are valid only for 2 years from the date of accumulation.

- Reward points accrued for Insurance and Grocery transactions will have a maximum cap of 2,000 Reward Points per day each.

HDFC SmartBuy

HDFC Bank has a dedicated portal named SmartBuy with which we get some extra rewards and cashback. The strategy for maximizing gains via SmartBuy has been shared later in the article.

| SmartBuy Benefits | Total Cashback | Capping |

| HDFC SmartBuy Reward Points | Upto 10X Reward Rate | 4000 Reward points per calendar Month (Max 2000 RPs per day) |

- It supports merchants like MakeMyTrip, Apple Tresor, and IRCTC likes. It also supports multiple partners for travel bookings.

TechnoFino Tip

Align your billing cycle of the HDFC Credit Cards as much as possible with the calendar month by asking the bank to shift your billing cycle date to the 2nd of every month to minimize the calculations related to the capping of CashPoints and SmartBuy cashback. HDFC doesn’t allow the first and last two days of the month as your billing cycle date.

Reward Points Redemption

| Modes of Redemption | Value per point | Reward Rate | Redemption Charges |

| Flights and hotel bookings via SmartBuy | 1 RP = ₹0.5 | ~1.33% | ₹99 + GST |

| Products and Vouchers via Netbanking or SmartBuy | 1 RP = upto ₹0.35 | ~0.93% | ₹99 + GST |

| Cashback (Statement Credit) | 1 RP = ₹0.20 | ~0.53% | None |

| Airmiles | 1 RP = 0.5 Air Mile | ₹99 + GST |

HDFC Regalia gives the most value when redemption is done for flights and hotel bookings and not for cashback. We would highly recommend you go for travel redemptions instead of cash. And if your points are near expiry and you don’t have a travel plan in the near future then redeem them for Amazon vouchers which is equivalent to cash instead of going for a statement credit.

- Customers can redeem up to a maximum of 70% on travel bookings (Flights, hotels and experiences) using Reward Points. The balance amount will need to be paid via credit card.

- Airmiles Conversion is another good option since it has Club Vistara and KrisFlyer as the transfer partners which can give quite a good value for your Regalia Points

- Statement credit makes no sense the value provided is quite low.

Milestone Benefits

Regalia rewards highly only high spenders who can reach at least ₹5L spend milestone. Below that threshold reward rate is really poor. I wish they had given a standard reward rate of 2% on all spending for a card of this category.

- Earn a Bonus of 10,000 Reward Points when you spend ₹5L in the anniversary year. (Additional ~0.4% to ~1%)

- Earn an additional 5,000 Reward Points when you spend ₹8L in the anniversary year. (Additional ~0.33% to ~0.83%)

- The anniversary year is defined as 12 months from card setup or last upgrade/downgrade date.

- Bonus Reward points will be posted within 2 days of the milestone achievement by the customer.

Other Benefits

Airport Lounge Access

Access Via – Credit Card

Domestic Limit – 2 Visits/ Calendar quarter within India on spending ₹1Lakh in previous calendar quarter (Shared between Primary & maximum 3 Add-on cardholders but both cards cannot be used for the same lounge, same day).

Network – Visa Signature/ MasterCard World

Access Via – Priority Pass

Complimentary International Limit – 6 Visits/ Calendar year (Shared between Primary & Add-on cards)

- You can apply for a Priority Pass for yourself and 3 add-on members once you complete a minimum of 4 retail transactions on your HDFC Bank Regalia Credit Card.

- If you exceed the 6 Complimentary visits, you will be charged at US $27 + GST per visit.

Fuel Surcharge Waiver

1% fuel surcharge waiver at all fuel stations across India. (On minimum transaction of ₹400 & maximum transaction of ₹5,000. Maximum waiver of ₹500 per statement cycle).

Insurance Coverage

- Accidental air death cover worth Rs. 1 Crore

- Emergency overseas hospitalization: up to Rs. 15 lakhs

- Lost Card Liability Cover: Upto Rs 9 lakhs

24×7 Concierge

Enjoy the exclusive 24/7 Concierge Services on your HDFC Bank Regalia Credit Card. Simply call the bank toll-free on 1860 425 1188 (India) / Email ID: regalia.support@smartbuyoffers.co

Forex Markup

- FCY Markup Fee: 2%+GST

- Reward Rate: 1.3%

- Net: –1% (loss)

But with the Global Value Program of HDFC Bank which is offered on Regalia, you can get 1% cashback on all international spends and thus you spend at no loss no gain. I will be covering this later in detail in an article.

Eligibility

Officially the bank has the following criteria but can vary as per your relationship with the bank.

For Salaried Indian national

- Age: Min 21 years & Max 60 Years

- Net Monthly Income > Rs 1 Lakh

For Self Employed Indian national

- Age: Min 21 years & Max 65 Years

- ITR > Rs 12 Lakhs per annum.

Unofficially, If you are an existing HDFC Credit Cardholder then you can ask for an upgrade if there is a 3L limit on your existing card.

TechnoFino Recommends

HDFC Regalia Credit Card is a highly rewarding and lifestyle credit card. Though some people find this card a tad bit expensive but the value it offers, over its younger avatar called HDFC Millennia Credit Card, justifies the fee as the ceiling of the HDFC SmartBuy rewards gets higher plus the reward points become uncapped. But the card’s real worth can only be realized if you can go for travel redemptions. Although racking up reward points is a bit difficult now compared to the olden days since its devaluation twice but still, its charm is not all lost.

Also, the shared domestic and international lounge access is unique to a card of this price range and will make your international travels comfortable plus save you a lot of money on the expensive meals you may have with your family while hopping airports. As of now HDFC is not issuing this card openly and only HDFC Regalia Gold is being pushed to new customers.

What has been your strategy for minting points on this card? Feel free to share in the comments below.

Chief Editor, TechnoFino.

Personal finance nerd! Physics enthusiast and trainer. When not into Physics, he is minting points and hunting for the next best credit card for himself.

Can we pay for others LIc premium from own credit card for Cashback

yes… but do not overuse, like spending 2 or 3L per month for other people.

I got Upgrade regalia recently if spend 1lakh in 90 days will my LTf

Or smartpay offers for LTF

This is valid only for new customers. For existing cardholders attaching a utility bill via smartpay within 90 days can make the card LTF but kindly confirm with bank.

Just a week ago i got this card after reading millenia article little bit confused whether regalia is better or millenia but this article cleared all the doubts.

We will soon be comparing both the cards in a very detailed manner.

Sumanta, Bhavye, thanks for this excellent article and for all that you have been doing to cater the community.

I would like to point out one small thing in this article that might have to be corrected: “Currently, all the HDFC Credit Cards except HDFC Infinia Credit Card are being offered under a special lifetime free” .

As pet the current MID, as circulated HERE there are two more exceptions now namely, Diners Black, Intermiles Diners and Infinia (Metal Edition) are all excluded from spend-based LTF offers.

Please correct me if I am wrong.

I had written as per the MID available with me during ban on Diners Club. Thanks for the information. I have updated the article.

Waah Guruji Waah .

Thanks sir.

I have Regalia First from June 2020 and got a limit increase to 3L in February this year. Now, it’s been 10 months, but I’ve received no upgrade/limit enhancements.

Should I keep waiting? Or should I send the upgrade form to Chennai?

Will my new card be LTF if I upgrade via sending the form?

you can try sending upgrade form. they don’t offer LTF, but you can spend 1L in 90 days and convert your new regalia into LTF card.

Thanks for your response, Sumanta.

Are you sure that HDFC will honour the 90 days offers for a card upgrade?

The 90 days offer is only for new cards, so curious to know if it’s also available for existing card upgrades as well, by sending the form.

No it’s not valid for existing cards. It’s valid only for new onboards. Either you can wait for LTF upgrade offer or else upgrade by sending the form to Chennai and then attach a biller to smartpay and pay the first bill within the first 90 days.

Hi,

Is it possible to get regalia first credit card on CARD TO CARD BASIS.

i have icici mmt signature credit card.

My annual pay is 420000

Please let me know how can i get it.

Thanks

HDFC Bank not issuing regalia first anymore, try to get regalia or millennia

I have travel job so i need one card where i can get priority pass complimentary. I’m not sure if I’m eligible for regalia card or not on pay basis.

Can you suggest me what shall i do.

Is it possible to get regalia on card to card basis. I have icici mmt signature visa right now.

Or any other card where i can get priority pass complimentary.

It would be great if you could help out.

Btw i got mmt signature after watching you video only to get dragonpass.

Thanks

yes apply card on card for regalia… or just Geta ny Hdfc bank card and then wait for upgrade.

I got upgrade to regalia, no joining fee, but there’s is annual fee how can i convert into LTF, is it real if we spend 1L in 90 days it becomes LTF?

No it’s not valid for existing cards. It’s valid only for new onboards. Attach a biller to smartpay and pay the first bill within the first 90 days. But do confirm from CC before doing this.

Thank you

Can I add Mutual Fund SIP as biller to make it LifeTimeFree??

You can’t pay MF from your credit card… it’s not possible

Edited the Article and also add card network RuPay.

Network – Visa Signature/ MasterCard World/ RuPay Select

Conversion to airmiles now possible only with Krysflyer (not Club Vistara or Intermiles any more)

I spent more than 1 lakh in April 2025. The netbanking site offers me two vouchers for lounge benefit to be used during the quarter April-June. This does not agree with what you have said — that the spend should be in the previous calendar quarter. Can you please clarify. Thanks.

I spent Rs 100000 on my Regalia card in April 2025. On the rewards page, I am being presented with two vouchers for airport lounge benefit. The dates mentioned on that page say from 01-Apr-2025 to 30-Jun-2025. What I understood from you review is that the benefit would be for the quarter following the calendar quarter in which the Rs. 1 lakh was spent. Can you please clarify if these vouchers can be used during the period mentioned, or in the quarter beginning 01-Jul-2025?