| Category | Zenith | Zenith+ |

| 1RP | 0.2p^ - 0.25p (^voucher redemption) | 1 Rs. |

| Dining & Food Apps | 5% (max. upto 25k/month) | 2% |

| Grocery, Departmental | 2.5% | 1% |

| International | 2.5% (- Markup Fee: 2.35%) = 0.15% | 2% (- Markup Fee: 1.17%) = 0.83% |

| Travel | 1.25% | 2% |

| Insurance and Utility | 0.25% (max. upto 10k/month) | 1% |

| Rent, education, and Govt | 0% | 1% |

| BBPS | 0% | 0% |

| All Other merchants | 1.25% | 1% |

| Milestone benefits | +1000Rs. extra = 0.5% // 2L in a Calendar Quarter -- all spends included | +1000 Rs. extra = 1.3% // 75k in a Calendar Month -- Special MCCs* excluded |

| Epicure Membership | 8L in Card Anniversary | 12L in Card Anniversary |

| Birthday Benefit | 625Rs. on min. 100 spend | - |

| Domestic Lounge | 2 per Quarter on min. 20k spend | 4 per Quarter |

| International Lounge | 2 per Quarter | 4 per Quarter |

| Railway Lounge | 2 per Quarter | - |

| BookmyShow | BOGO (3 per Quarter) max. 250 | BOGO (4 per Quarter) max. 500 |

| Golf | - | 2 per Quarter |

| Meet and Greet | - | 1 per Quarter |

| Fee / Waiver / Renewal Benefits | 9439Rs. / 5L in Card Anniversary / None | 5899Rs. / 8L in Card Anniversary / None. |

Special MCCs* - Special Categories Marchant Category Codes: Rent, Education & Govt, Insurance, Utility, Fuel, Cash & EMI transactions are not eligible for monthly milestone calculation.

updated with 1st April, 2024 changes: https://www.aubank.in/tnc-of-cc-rev...card-usage-terms-condition_1st_march_2024.pdf

updated with 17th Nov, 2025 changes:

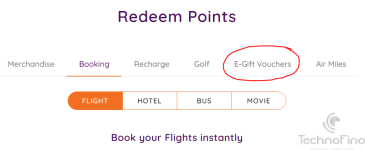

^ voucher redemption (Zenith):

Except vouchers, remaining categories 0.25p (Ex: Flight/hotel booking etc.) https://rewardz.aubank.in/

Redemption fee (both cards): 118rs. also do note single checkout has single denomination voucher, no way to purchase multiple vouchers or multiple quantity. So, each checkout 118rs. redemption.

Last edited: