Evaluating the Value of Your Credit Card Fee

When considering whether a credit card is worth its annual fee, it's essential to calculate the net reward rate effectively. Here's a scenario to illustrate this:Scenario

- Spent: ₹1,000

- Cashback Earned: ₹10

- Discount Received: ₹10

- Annual Fee Paid: ₹30

Methods of Calculation

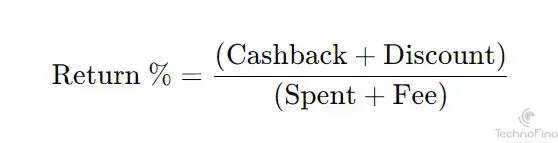

You can evaluate the net reward rate using two different approaches:A. Return Percentage Calculation (Including Fee)

This method considers the fee as part of the overall spending, allowing for a broader perspective on the card's performance.Formula:

Calculation:

Return % = (₹10 + ₹10) / (₹1,000 + ₹30) ≈ 1.94% // Fee paid considered as spent, so no impact of fee

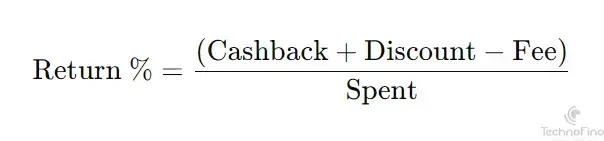

B. Return Percentage Calculation (Excluding Fee)

This method subtracts the annual fee from the rewards earned to assess the true value gained from the card.Formula:

B. Return % = (₹10 + ₹10 - ₹30) / ₹1,000 ≈ -1% // to know the impact of annual fee by deducting fee paid from Cashback/Discounts

Which Method Should You Consider?

- Option A is useful for understanding the general reward rate and how the card performs relative to overall spending, including fees.

- Option B provides a clearer picture of the impact of the annual fee on your net rewards, showing whether the benefits are worth the cost.

Method A: when we generally consider fee as total spend amount, then usually we can't identify bad cards in our portfolio. Everything positive but can compare with LTF card if that provide more benefits compare to paid card.

So, here reward % can only be used to compare other cards and see whether the fee worth for the card or not

Method B: when we considered fee as part of our benefits, it usually and explicitly tells whether that card provided benefits when compared to fee directly, without much comparison. because here you'll get negative value which generally tells our brain, this card eating your money.

So, ideally it depends on personal preferences but if using any method for one card, then same applies all cards and comparison should present incase method A.

Conclusion

Ultimately, your choice depends on what you value more: understanding the card's overall performance or focusing on how the fee affects your rewards. If you're primarily concerned with maximizing benefits against costs, Option B is the more accurate measure.:: LTF Only people, ignore this post. And post mainly about inclusion of fee, remaining all are optional.

Last edited: