Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

-

Hey there! Welcome to TFC! View fewer ads on the website just by signing up on TF Community.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Am I over leveraged for SBI?

- Thread starter AlooDum

- Start date

- Replies 95

- Views 6K

As your ITR is 30L and your limits across cards is 43L you're not over leveraged (<1.5times)

- If your Credit limit range crosses above 2-2.5 times (Estimated) your ITR then SBI may consider you over leveraged.

- If your Credit limit range crosses above 2-2.5 times (Estimated) your ITR then SBI may consider you over leveraged.

SBI kept rejecting my request to upgrade to from SimplyClick to Air India Signature. My CL was ~5L on SBI. My CLs across all cards is lower than my Income but still. So, I decided to close SBI and never worry about their tantrums.

I know one case where person tried 3 times with interval of 90 days last one year but still SBI keep rejecting him as overleveraged.As your ITR is 30L and your limits across cards is 43L you're not over leveraged (<1.5times)

- If your Credit limit range crosses above 2-2.5 times (Estimated) your ITR then SBI may consider you over leveraged.

Indeed he is overleveraged but all 3 times he did not submit any income documents and cibil does not have his income details. He is self employed. Wonder how sbi declared him overleveraged?

Does he have any relationship with SBI like current account or SB Account or any other relationship with bank??I know one case where person tried 3 times with interval of 90 days last one year but still SBI keep rejecting him as overleveraged.

Indeed he is overleveraged but all 3 times he did not submit any income documents and cibil does not have his income details. He is self employed. Wonder how sbi declared him overleveraged?

In that case SBI would’ve known his ITR while talking loan. And they would’ve been considering his Home loan into consideration while giving limit enhancement.Sbi -> Savings account, big home loan amount 50L, existing 1 sbi Cc simply click.

PNB gave me CL of mere 75K, lolAnd here, PNB rejected my application - "Rejected by Sanctioning Authority-DECLINED. TOO MANY CREDIT CARDS WITH HIGH VOLUME AVAILED FROM OTHER BANKS"

I have around 25 cards with a combined limit of less than 1.5x my annual income.

I used to have a secured card with PNB (don't ask why). PNB HO suggested to close that to get unsecured card. And when I did they started declining. now asking to take the secured card again. 😂PNB gave me CL of mere 75K, lol

Currently I hold close to 10 cards with ITR of 30L & overall credit limit across all the cards 43L.

I don't have any SBI credit card and looking to apply one.

CIBIL of 781 & no defaults.

So my question is am I over leverage according to SBI??

Shall I apply directly or reduce my exposure?

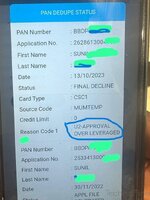

My total credit limit on my CC is approx 75L, but in CIBIL, it is reported as 1.2 CR approx due to multiple card accounts from banks like HDFC, ICICI, Axis, etc. I have an SBI Cashback Card, but when I applied for an SBI SimplyClick in Oct, 2023, it was instantly rejected due to over-leverage. Check decline reason in below screenshot. Luckily, last month I got an SBI SimplySave RuPay offer in the SBI app (was able to split existing limit from cashback card).

Attachments

No, banks these days checking Income and Credit limits along with Credit report regarding payment history and everything from bureau.Is there a relation between ITR filing and credit limit? I guess only credit report is only checked.

Yes, SBI is doing these days on over leverage. All banks reporting multiple card with shared limits also as separate accounts. But ICICI has a different pattern though.My total credit limit on my CC is approx 75L, but in CIBIL, it is reported as 1.2 CR approx due to multiple card accounts from banks like HDFC, ICICI, Axis, etc. I have an SBI Cashback Card, but when I applied for an SBI SimplyClick in Oct, 2023, it was instantly rejected due to over-leverage. Check decline reason in below screenshot. Luckily, last month I got an SBI SimplySave RuPay offer in the SBI app (was able to split existing limit from cashback card).

Aapke saath Prenk ho gaya. HahahahaI used to have a secured card with PNB (don't ask why). PNB HO suggested to close that to get unsecured card. And when I did they started declining. now asking to take the secured card again. 😂

So far, it's being noticed that PSU banks and some Pvt also like HSBC hesitate to approve new cards after one gets multiple cards from different banks. So it's better to take PSU bank's cards first like SBI, PNB, Canara, etc.

But still if any of them launches new card in future, like SBI Cashback, until then you will be over leveraged for them.

Second thoughts: See credit cards are a high risk, high profit business for banks. They always seeks newbies who's not into the game, and either misses the due date or makes only Min. due payment and keeps paying interest to bank. So, this could also be the reason. (Assumption)

But still if any of them launches new card in future, like SBI Cashback, until then you will be over leveraged for them.

Second thoughts: See credit cards are a high risk, high profit business for banks. They always seeks newbies who's not into the game, and either misses the due date or makes only Min. due payment and keeps paying interest to bank. So, this could also be the reason. (Assumption)

This is exactly what happened to me. I got SBI as my second card more than 10 years ago. Now, they wouldn't let me upgrade or apply for a new card. So, I closed my relationship.So far, it's being noticed that PSU banks and some Pvt also like HSBC hesitate to approve new cards after one gets multiple cards from different banks. So it's better to take PSU bank's cards first like SBI, PNB, Canara, etc.

But still if any of them launches new card in future, like SBI Cashback, until then you will be over leveraged for them.

Second thoughts: See credit cards are a high risk, high profit business for banks. They always seeks newbies who's not into the game, and either misses the due date or makes only Min. due payment and keeps paying interest to bank. So, this could also be the reason. (Assumption)

Similar threads

- Question

- Replies

- 1

- Views

- 419

- Question

- Replies

- 0

- Views

- 251

- Replies

- 12

- Views

- 402