Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

-

Hey there! Welcome to TFC! View fewer ads on the website just by signing up on TF Community.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

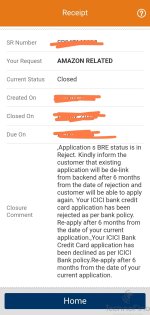

Amazon pay ICICI card rejection reason

- Thread starter cardy

- Start date

cryoengine

TF Premier

That's weird. Is your Amazon account and existing cc linked to the same mobile number? Did you apply using the existing icici credit card number? Did you take any CC from icici in the last 6 months?

YesThat's weird. Is your Amazon account and existing cc linked to the same mobile number? Did you apply using the existing icici credit card number? Did you take any CC from icici in the last 6 months?

Yes

Yes coral rupay 2months ago

cryoengine

TF Premier

it was pre-approved and was given to everyone, I assume you got it the same way. Since you are on 6 months cooldown now anyway, I would try escalating through multiple layers of customer care and hope one of them will see the reason. Good luckYes coral rupay 2months ago

Kumar93196

TF Legend

Bre = bureau score. Its other than cibil scoreI have 3icici card and icici sb account.

772 cibil score.

What is the meaning of internal policies.

What do you guys think why my application got rejected ?

How can I know the exact reason.

Do you have any experience regarding this?

Yes pre-approved.it was pre-approved and was given to everyone, I assume you got it the same way. Since you are on 6 months cooldown now anyway, I would try escalating through multiple layers of customer care and hope one of them will see the reason. Good luck

And i am working on that

1st level complete with amzcc, custcare and social x

I don't think thatBre = bureau score. Its other than cibil score

It's more like a status maybe

shake-all-Sphere

TF Select

Even though you have a good relationship with ICICI there are certain factors which can affect your application .Internal policies refer to the specific rules, guidelines, and criteria that a financial institution, such as ICICI in this case, uses internally to evaluate credit card applications. These policies can encompass various factors like credit score requirements, income thresholds, existing relationship with the bank, credit history, and more. They're typically established by the institution to manage risk and ensure responsible lending practices.

As for why your credit card application might have been rejected despite having an ICICI savings account and existing ICICI cards, several reasons could be at play:

I will tell you one more important thing, your bank account and credit card accounts have no connection whatsoever to ICICI. Speak to your RM or BM about it, they might help you with exact reason

As for why your credit card application might have been rejected despite having an ICICI savings account and existing ICICI cards, several reasons could be at play:

- Credit Score: While a 772 CIBIL score is generally considered good, other factors within your credit report could influence the decision. It might be worth checking your complete credit report for any discrepancies or negative factors that could have affected the decision.

- Income or Financial Situation: Your income, existing debt, or other financial obligations might not meet ICICI's internal criteria for the specific card you applied for. The bank may have certain income requirements for different card tiers or features.

- Credit Utilization: Even with a good credit score, if your existing ICICI cards have high balances relative to their limits (high credit utilization), it might raise concerns about your ability to manage additional credit.

- Internal Risk Assessment: The bank might have an internal risk assessment model that considers various undisclosed factors when evaluating applications. These could range from industry-specific risk factors to changes in their lending strategies.

- Application Frequency: Applying for multiple cards within a short period can sometimes raise concerns for lenders, as it might indicate a sudden need for credit or financial stress.

I will tell you one more important thing, your bank account and credit card accounts have no connection whatsoever to ICICI. Speak to your RM or BM about it, they might help you with exact reason

shake-all-Sphere

TF Select

Rohith-2009

TF Legend

[*]Credit Utilization: Even with a good credit score, if your existing ICICI cards have high balances relative to their limits (high credit utilization), it might raise concerns about your ability to manage additional credit.

For this point, icici will not give additional limit generally. Only one shared limit.

For this point, icici will not give additional limit generally. Only one shared limit.

Riya

TF Legend

That's strange because ICICI cardholders are almost certain for APay approval on the spot... Something wrong with your cibil or account maybe 🤔I have 3icici card and icici sb account.

772 cibil score.

What is the meaning of internal policies.

What do you guys think why my application got rejected ?

How can I know the exact reason.

Do you have any experience regarding this?

My cibil is 772 and account is regular active account and 3yr old with no problemThat's strange because ICICI cardholders are almost certain for APay approval on the spot... Something wrong with your cibil or account maybe 🤔

Last edited:

Nothing derogatory marks. Clean history

Please check in your all the credit reports where ICICI enquiry has appeared. (CIBIL, CRIF, Equifax & Experian). Check if you have any derogatory remarks in the reports where this enquiry is appearing.

Riya

TF Legend

I had ICICI account for 15 years but I was also rejected twice... But as soon as got one base level card, my card was approved instantlyMy cibil is 772 and account is regular active account and 3yr old with no problem

Thanks for such an elaborated and informational reply. I understand the points. I have eye on my credit report every month.Even though you have a good relationship with ICICI there are certain factors which can affect your application .Internal policies refer to the specific rules, guidelines, and criteria that a financial institution, such as ICICI in this case, uses internally to evaluate credit card applications. These policies can encompass various factors like credit score requirements, income thresholds, existing relationship with the bank, credit history, and more. They're typically established by the institution to manage risk and ensure responsible lending practices.

As for why your credit card application might have been rejected despite having an ICICI savings account and existing ICICI cards, several reasons could be at play:

Understanding the specific reason for rejection can be challenging, as banks often don't provide detailed explanations. If possible, reaching out to ICICI's customer service or credit department might offer some insights. Additionally, taking a comprehensive look at your credit report and addressing any issues might improve your chances in the future.

- Credit Score: While a 772 CIBIL score is generally considered good, other factors within your credit report could influence the decision. It might be worth checking your complete credit report for any discrepancies or negative factors that could have affected the decision.

- Income or Financial Situation: Your income, existing debt, or other financial obligations might not meet ICICI's internal criteria for the specific card you applied for. The bank may have certain income requirements for different card tiers or features.

- Credit Utilization: Even with a good credit score, if your existing ICICI cards have high balances relative to their limits (high credit utilization), it might raise concerns about your ability to manage additional credit.

- Internal Risk Assessment: The bank might have an internal risk assessment model that considers various undisclosed factors when evaluating applications. These could range from industry-specific risk factors to changes in their lending strategies.

- Application Frequency: Applying for multiple cards within a short period can sometimes raise concerns for lenders, as it might indicate a sudden need for credit or financial stress.

I will tell you one more important thing, your bank account and credit card accounts have no connection whatsoever to ICICI. Speak to your RM or BM about it, they might help you with exact reason

Rm is not able to provide exact reason.

But in my understanding may be a reason that recently I have taken another ICICI credit card and then applied apay within a month of getting the card.

Somewhere may be i have seen that icici doesn't approve two applications within three months. I am telling about two user initiated application here. Not pre approved or customer care option.

Utilisation at that time was only 4% overall[*]Credit Utilization: Even with a good credit score, if your existing ICICI cards have high balances relative to their limits (high credit utilization), it might raise concerns about your ability to manage additional credit.

For this point, icici will not give additional limit generally. Only one shared limit.

But icici utilisation was nearly 15%

Similar threads

- Question

- Replies

- 11

- Views

- 217

- Replies

- 33

- Views

- 2K

- Replies

- 107

- Views

- 3K