You're wondering if an Amex card is even worth it?

Or thinking of getting a new credit card that offers you free hotel stays?

Amex is often disregarded as the luxury card or one with the expensive yearly fees but your opinions are about to change.

Everyone's dream card is the Black Card, also known as the Centurion card.

It comes with a whooping ₹11,00,000 joining fees(yes, you read that right! 11L is the joining fees and 3L annual fees)

But we're not going to discuss that today, we're normal people so let's discuss a card for normal people.

That's where the American Express Membership Rewards Credit Card comes in.

Why should you get MRCC?

1. INTERNATIONAL TRANSACTIONS

Want to buy that item in the Black Friday sale? Amex works.

Want to buy something exclusive from Amazon.com? Amex works.

Want to buy that VPN to watch the Korean/French series on Netflix? Amex works.

Where nothing works, Amex has stayed with me and surprisingly worked smoothly.

Read this post, I blindly suggested Amex and it didn't let me down.

2. DISPUTE RESOLUTIONS

Did you buy something and feel the seller scammed you?

You have two options, run to the bank, complain about how UPI is bad and the reversal methods are crap!

Or swipe your Amex and remain stress-free always. Call the support, share your reason and the money is back in your account.

I have tried this on different merchants, swiped at shady places and entered on websites I shouldn't have.

The customer care always had my back and prevented me from embarrassing stories!

3. REWARDS

How can we forget the most important point? If it's not rewarding, it's not worth it.

With MRCC, you just need to spend ₹6000 to get 1000 MR points which offers an insane 16.67% returns*.

Spend more and hit ₹20,000 and get 2000 bonus MR points(10% returns*)

Not to forget these are just bonus points, you get an additional points for 1 MR point for every ₹50 that you spend on the card.

If you spend smartly and get vouchers, you can even get 2 MR points for every ₹50!

(Use the Amex Gyftr multiplier page to buy vouchers with multiplier rewards)

That's 1240 points for every ₹6,000 spent which is 20.66% returns, one of the highest in the credit cards industry.

OR 2800 points for every ₹20,000 spent which is 14% returns, still pretty amazing.

And how much does it cost?

FREE for the first year!

₹1500 for the second year(can be negotiated with CC based on your spends)

Optimal Usage Guide for Amex MRCC:

To get the most points, you need to hit a minimum of ₹6,000 per month.

You can do that by buying 1500 x 4 Amazon vouchers, this balance can be used to pay your bills, recharges and shopping.

There are 30+ brand vouchers that you can buy from! You don't need to buy them in advance.

Let's say if you're shopping at Reliance Trends, instead of paying with your card there, just buy the voucher online instantly and pay with those instead.

This will get you 2x rewards instead of the usual swiping benefits.

Or just swipe them anywhere to hit the 20k milestone, any and all transactions are counted towards this.

These rewards sound great, but where do I redeem them?

I'm glad you asked!

The percentages* that I have mentioned above are considering you love to travel and wander the country in your free time!

You can claim 1 MR point = 1 Marriott Bonvoy point which can be redeemed at ₹1 at several of their properties.

(Even at ₹2 or more if you travel internationally and spot the right deal)

To sweeten it further, Amex runs a yearly offer(valid right now) where you get a 30% bonus on redeeming it for MB points.

If you make a booking in Maldives Marriott right now, the room costs ₹1,81,000 or 100K points to book for a night.

With the current Amex offer, you need 80k MR points to redeem that night!

That's ₹2.26 in value for every point!

But honestly, how many of us will travel to Maldives and stay in that luxury resort?

Let's just say even if you redeem them in India for 10k-15k properties, you should still get ₹1 value per point.

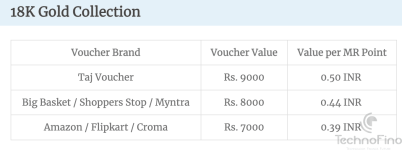

Don't like Marriott? You can redeem them for Taj vouchers at ₹0.5 per point.

Don't like Taj? You can redeem them for slightly lower at Shoppers Stop, Tanishq or even Amazon/Flipkart.

But I see a lot of people complaining - Amex is for the rich, no rewards, why so?

A lot of people say Tesla is bad, they probably haven't even seen one.

A lot of people say SRK is bad, they probably haven't met him.

A lot of people say a lot of things, you decide for yourself.

Apply for Amex MRCC Card for free using the link in my signature!

DM me if you have any questions.

If you can spend 4L a year, you can get the Platinum Travel variant!

(Offers you even higher rewards - 40K points + Taj voucher on 4L annual purchases)

Or thinking of getting a new credit card that offers you free hotel stays?

Amex is often disregarded as the luxury card or one with the expensive yearly fees but your opinions are about to change.

Everyone's dream card is the Black Card, also known as the Centurion card.

It comes with a whooping ₹11,00,000 joining fees(yes, you read that right! 11L is the joining fees and 3L annual fees)

But we're not going to discuss that today, we're normal people so let's discuss a card for normal people.

That's where the American Express Membership Rewards Credit Card comes in.

Why should you get MRCC?

1. INTERNATIONAL TRANSACTIONS

Want to buy that item in the Black Friday sale? Amex works.

Want to buy something exclusive from Amazon.com? Amex works.

Want to buy that VPN to watch the Korean/French series on Netflix? Amex works.

Where nothing works, Amex has stayed with me and surprisingly worked smoothly.

Read this post, I blindly suggested Amex and it didn't let me down.

2. DISPUTE RESOLUTIONS

Did you buy something and feel the seller scammed you?

You have two options, run to the bank, complain about how UPI is bad and the reversal methods are crap!

Or swipe your Amex and remain stress-free always. Call the support, share your reason and the money is back in your account.

I have tried this on different merchants, swiped at shady places and entered on websites I shouldn't have.

The customer care always had my back and prevented me from embarrassing stories!

3. REWARDS

How can we forget the most important point? If it's not rewarding, it's not worth it.

With MRCC, you just need to spend ₹6000 to get 1000 MR points which offers an insane 16.67% returns*.

Spend more and hit ₹20,000 and get 2000 bonus MR points(10% returns*)

Not to forget these are just bonus points, you get an additional points for 1 MR point for every ₹50 that you spend on the card.

If you spend smartly and get vouchers, you can even get 2 MR points for every ₹50!

(Use the Amex Gyftr multiplier page to buy vouchers with multiplier rewards)

That's 1240 points for every ₹6,000 spent which is 20.66% returns, one of the highest in the credit cards industry.

OR 2800 points for every ₹20,000 spent which is 14% returns, still pretty amazing.

And how much does it cost?

FREE for the first year!

₹1500 for the second year(can be negotiated with CC based on your spends)

Optimal Usage Guide for Amex MRCC:

To get the most points, you need to hit a minimum of ₹6,000 per month.

You can do that by buying 1500 x 4 Amazon vouchers, this balance can be used to pay your bills, recharges and shopping.

There are 30+ brand vouchers that you can buy from! You don't need to buy them in advance.

Let's say if you're shopping at Reliance Trends, instead of paying with your card there, just buy the voucher online instantly and pay with those instead.

This will get you 2x rewards instead of the usual swiping benefits.

Or just swipe them anywhere to hit the 20k milestone, any and all transactions are counted towards this.

These rewards sound great, but where do I redeem them?

I'm glad you asked!

The percentages* that I have mentioned above are considering you love to travel and wander the country in your free time!

You can claim 1 MR point = 1 Marriott Bonvoy point which can be redeemed at ₹1 at several of their properties.

(Even at ₹2 or more if you travel internationally and spot the right deal)

To sweeten it further, Amex runs a yearly offer(valid right now) where you get a 30% bonus on redeeming it for MB points.

If you make a booking in Maldives Marriott right now, the room costs ₹1,81,000 or 100K points to book for a night.

With the current Amex offer, you need 80k MR points to redeem that night!

That's ₹2.26 in value for every point!

But honestly, how many of us will travel to Maldives and stay in that luxury resort?

Let's just say even if you redeem them in India for 10k-15k properties, you should still get ₹1 value per point.

Don't like Marriott? You can redeem them for Taj vouchers at ₹0.5 per point.

Don't like Taj? You can redeem them for slightly lower at Shoppers Stop, Tanishq or even Amazon/Flipkart.

But I see a lot of people complaining - Amex is for the rich, no rewards, why so?

A lot of people say Tesla is bad, they probably haven't even seen one.

A lot of people say SRK is bad, they probably haven't met him.

A lot of people say a lot of things, you decide for yourself.

Apply for Amex MRCC Card for free using the link in my signature!

DM me if you have any questions.

If you can spend 4L a year, you can get the Platinum Travel variant!

(Offers you even higher rewards - 40K points + Taj voucher on 4L annual purchases)

Last edited: