American Express is a global Card company present almost everywhere around the world. They are mainly known for their travel and lifestyle-related credit cards. There are many ways to earn extra Membership Reward points (MR points), and one of them is by referring your friends, family members, and colleagues. Yes, Amex does offer a referral bonus to all of its Card Members - the program is called "Member Get Member" (MGM). Let's delve into more detail about it.

What is the MGM Program?

American Express allows all eligible Card Members to refer new people to Amex, and for every successful referral, both the referrer and the referee get some bonus MR points. You can refer your family members, friends, or colleagues and earn easy bonus MR points.

How many bonus points do you get for every successful referral?

This depends on the card you are holding. You can check the referrer and referee benefits from the table below.

If you (MGMer) are holding an American Express Membership Rewards Credit Card or American Express Platinum Travel Credit Card or American Express Platinum Reserve Credit Card or American Express Gold Card, you can refer people to these cards and enjoy the associated benefits:

If you (MGMer) are holding the American Express SmartEarn Credit Card, you can refer people to these cards and enjoy the associated benefits:

#If you (MGMer) are holding an American Express Membership Rewards Credit Card, American Express Platinum Travel Credit Card, American Express Platinum Reserve Credit Card, American Express Gold Card or SmartEarn Credit Card, you can earn a total of 150,000 MR Points in a calendar year from the MGM program per Amex card.

If you (MGMer) are holding the American Express Platinum Card or American Express Centurion Card, you can refer people to these cards and enjoy the associated benefits:

#If you are holding the American Express Platinum Card or American Express Centurion Card, then you can earn a total of 500,000 MR Points in a calendar year from the MGM program per Amex card.

MGMees will also enjoy discounted card membership fees on few Amex cards if they apply via someone's referral link. Here, I'm posting a chart comparing the charges for a card approved via a referral link and a card approved directly:

The current MGM campaign is valid until March 31, 2024. Therefore, you have the opportunity to earn up to 3 Lakhs MR Points in total per card (1.5 Lakhs in 2023 and another 1.5 Lakhs in 2024). If you hold the Platinum Card or Centurion Card, you can earn up to 10 lakhs MR points in total (5 Lakhs in 2023 and another 5 Lakhs in 2024).

Special festival offer: Additionally, Amex India is currently running a special festival offer. If someone applies for an Amex card during the offer period from September 14, 2023, to October 31, 2023, both the referee and the referrer will receive a set of Limited-Edition Playing Cards from Amex, upon approval of referee’s card.

Here are the images of the special edition payment card kit I received from Amex India:

How to get the referral link?

You can generate a referral link by logging in to your Amex Online Card account or through the Amex mobile app.

From Amex Online Card account:

Now, why should someone consider getting an Amex Card?

American Express is a globally renowned credit card issuer known for offering powerful and highly rewarding credit and charge cards, with a strong focus on travel and lifestyle benefits. Let me highlight some key advantages of having an Amex card:

What is the MGM Program?

American Express allows all eligible Card Members to refer new people to Amex, and for every successful referral, both the referrer and the referee get some bonus MR points. You can refer your family members, friends, or colleagues and earn easy bonus MR points.

How many bonus points do you get for every successful referral?

This depends on the card you are holding. You can check the referrer and referee benefits from the table below.

If you (MGMer) are holding an American Express Membership Rewards Credit Card or American Express Platinum Travel Credit Card or American Express Platinum Reserve Credit Card or American Express Gold Card, you can refer people to these cards and enjoy the associated benefits:

The Card your friend applies for (MGMee) | Their reward (MGMee) | Your reward (MGMer) |

|---|---|---|

| American Express SmartEarn Credit Card | 2,000 Membership Rewards Points upon spending INR 5,000 in the first 90 days of MGMee Cardmembership | 8,000 MR Points on approval of MGMee's Card |

| American Express Membership Rewards Credit Card | 2,000 Membership Rewards Points upon spending INR 5,000 in the first 90 days of MGMee Cardmembership | 8,000 MR Points on approval of MGMee's Card |

| American Express Gold Card | 2,000 Membership Rewards Points upon spending INR 5,000 in the first 90 days of MGMee Cardmembership | 8,000 MR Points on approval of MGMee's Card |

| American Express Platinum Travel Credit Card | 2,000 Membership Rewards Points upon spending INR 5,000 in the first 90 days of MGMee Cardmembership | 8,000 MR Points on approval of MGMee's Card |

| American Express Platinum Reserve Credit Card | 4,000 Membership Rewards Points upon spending INR 5,000 in the first 90 days of MGMee Cardmembership | 8,000 MR Points on approval of MGMee's Card |

| American Express Platinum Card | 10,000 Membership Rewards Points upon spending INR 5,000 in the first 90 days of MGMee Cardmembership | 8,000 MR Points on approval of MGMee's Card |

If you (MGMer) are holding the American Express SmartEarn Credit Card, you can refer people to these cards and enjoy the associated benefits:

The Card your friend applies for (MGMee) | Their reward (MGMee) | Your reward (MGMer) |

|---|---|---|

| American Express SmartEarn Credit Card | 2,000 Membership Rewards Points upon spending INR 5,000 in the first 90 days of MGMee Cardmembership | 5,000 MR Points on approval of MGMee's Card |

| American Express Membership Rewards Credit Card | 2,000 Membership Rewards Points upon spending INR 5,000 in the first 90 days of MGMee Cardmembership | 5,000 MR Points on approval of MGMee's Card |

| American Express Gold Card | 2,000 Membership Rewards Points upon spending INR 5,000 in the first 90 days of MGMee Cardmembership | 5,000 MR Points on approval of MGMee's Card |

| American Express Platinum Travel Credit Card | 2,000 Membership Rewards Points upon spending INR 5,000 in the first 90 days of MGMee Cardmembership | 5,000 MR Points on approval of MGMee's Card |

| American Express Platinum Reserve Credit Card | 4,000 Membership Rewards Points upon spending INR 5,000 in the first 90 days of MGMee Cardmembership | 5,000 MR Points on approval of MGMee's Card |

| American Express Platinum Card | 10,000 Membership Rewards Points upon spending INR 5,000 in the first 90 days of MGMee Cardmembership | 5,000 MR Points on approval of MGMee's Card |

#If you (MGMer) are holding an American Express Membership Rewards Credit Card, American Express Platinum Travel Credit Card, American Express Platinum Reserve Credit Card, American Express Gold Card or SmartEarn Credit Card, you can earn a total of 150,000 MR Points in a calendar year from the MGM program per Amex card.

If you (MGMer) are holding the American Express Platinum Card or American Express Centurion Card, you can refer people to these cards and enjoy the associated benefits:

The Card your friend applies for (MGMee) | Their reward (MGMee) | Your reward (MGMer) |

|---|---|---|

| American Express Platinum Card | 10,000 Membership Rewards Points upon spending INR 5,000 in the first 90 days of MGMee Cardmembership | 25,000 MR Points on approval of MGMee's Card |

#If you are holding the American Express Platinum Card or American Express Centurion Card, then you can earn a total of 500,000 MR Points in a calendar year from the MGM program per Amex card.

MGMees will also enjoy discounted card membership fees on few Amex cards if they apply via someone's referral link. Here, I'm posting a chart comparing the charges for a card approved via a referral link and a card approved directly:

| Card Name | Fees, if applied directly | Fees, if applied via referral link |

|---|---|---|

| American Express SmartEarn Credit Card | First year fee: Rs. 495 plus applicable taxes Second year onwards: 495 plus applicable taxes | Annual fee: Rs. 495 plus applicable taxes |

| American Express Membership Rewards Credit Card | First year fee: Rs. 1000 plus applicable taxes Second year onwards: 4500 plus applicable taxes | First year fee: Nil Second year onwards: 1500 plus applicable taxes |

| American Express Gold Card | First year fee: Rs. 1000 plus applicable taxes Second year onwards: 4500 plus applicable taxes | First year fee: Rs. 1000 plus applicable taxes Second year onwards: 4500 plus applicable taxes |

| American Express Platinum Travel Credit Card | First year fee: Rs. 3500 plus applicable taxes Second year onwards: 5000 plus applicable taxes | First year fee: Nil Second year onwards: 5000 plus applicable taxes |

| American Express Platinum Reserve Credit Card | First year fee: Rs. 5000 plus applicable taxes Second year onwards: 10000 plus applicable taxes | First year fee: Rs. 5000 plus applicable taxes Second year onwards: 10000 plus applicable taxes |

| American Express Platinum Card | Annual fee: Rs. 66000 plus applicable taxes | Annual fee: Rs. 66000 plus applicable taxes |

The current MGM campaign is valid until March 31, 2024. Therefore, you have the opportunity to earn up to 3 Lakhs MR Points in total per card (1.5 Lakhs in 2023 and another 1.5 Lakhs in 2024). If you hold the Platinum Card or Centurion Card, you can earn up to 10 lakhs MR points in total (5 Lakhs in 2023 and another 5 Lakhs in 2024).

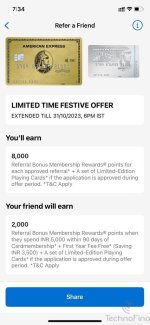

Special festival offer: Additionally, Amex India is currently running a special festival offer. If someone applies for an Amex card during the offer period from September 14, 2023, to October 31, 2023, both the referee and the referrer will receive a set of Limited-Edition Playing Cards from Amex, upon approval of referee’s card.

Here are the images of the special edition payment card kit I received from Amex India:

How to get the referral link?

You can generate a referral link by logging in to your Amex Online Card account or through the Amex mobile app.

From Amex Online Card account:

- Log in to your Amex India account.

- In the middle of the page, you'll see a banner that says "Refer Friends. Get Rewarded." Click on the "Refer Now" blue button.

- On that page, you'll find your personalized referral link.

- Log in to your Amex India mobile app.

- Click on "Account."

- At the bottom of the page, you'll find "Refer and Earn." Click on it.

- On the next screen, you'll see a blue "Share" button at the bottom. Click on it to copy your referral link.

- Now, you can share the link with your family members, friends, or colleagues.

Now, why should someone consider getting an Amex Card?

American Express is a globally renowned credit card issuer known for offering powerful and highly rewarding credit and charge cards, with a strong focus on travel and lifestyle benefits. Let me highlight some key advantages of having an Amex card:

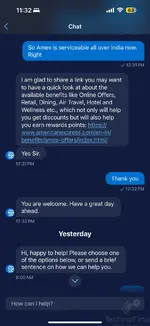

- World-Class Customer Service: Amex is known for its customer service across the world.

- Travel & Lifestyle-Focused Cards: Amex offers cards tailored to travel and lifestyle enthusiasts.

- Strong Reward System: Amex Membership Rewards is considered one of the best credit card reward programs in the world.

- Abundant Transfer Partners: Amex has numerous airline and hotel transfer partners, making it easy to convert MR points into airline miles or hotel loyalty points.

- Unique Event Invitations: Higher variant Amex cards offer exclusive invitations to unique and private events.

- Amex Concierge Service: Amex Concierge is widely regarded as one of the best in the world.

Last edited: