Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

-

Hey there! Welcome to TFC! View fewer ads on the website just by signing up on TF Community.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

AmEx Platinum Reserve Card - New Benefits (Worth the fees now?)

Apart from the new benefits, there are changes- which is a devaluation. the monthly vouchers were previously given at 25k, and I think golf benefits didn't have any minimum spend requirements.

Also, the spend based fees waiver (which was actually 5 lakhs and a Taj voucher) have been increased.

Don't get mislead by these "added benefits". Seems like it's time for me to close my Amex card- I will definitely do that before my next fees is charged.

Also, the spend based fees waiver (which was actually 5 lakhs and a Taj voucher) have been increased.

Don't get mislead by these "added benefits". Seems like it's time for me to close my Amex card- I will definitely do that before my next fees is charged.

You can choose between Bookmyshow/Bigbasket/Myntra and a couple of other options.Any idea what the 12k worth of vouchers on spending 50k are ?

Some benefits seems to have changed but I wasn't aware of the 5L fee waiver, you did get a 10K Taj voucher on 5L and above spends but when you paid the annual fees.Apart from the new benefits, there are changes- which is a devaluation. the monthly vouchers were previously given at 25k, and I think golf benefits didn't have any minimum spend requirements.

Also, the spend based fees waiver (which was actually 5 lakhs and a Taj voucher) have been increased.

Don't get mislead by these "added benefits". Seems like it's time for me to close my Amex card- I will definitely do that before my next fees is charged.

But I would still prefer re-valuation of cards rather than de-valuation as it still leaves some hope for the users.

It's a revaluation actuallyApart from the new benefits, there are changes- which is a devaluation. the monthly vouchers were previously given at 25k, and I think golf benefits didn't have any minimum spend requirements.

Also, the spend based fees waiver (which was actually 5 lakhs and a Taj voucher) have been increased.

Don't get mislead by these "added benefits". Seems like it's time for me to close my Amex card- I will definitely do that before my next fees is charged.

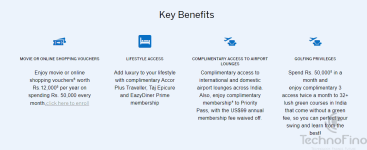

International lounge access added

Accor plus traveller added

10 lakhs for fees waiver

Earlier 25k - 500 Rs voucher changed to 1k voucher - 50k spend ( this one is same )

10k Taj Voucher is still there on 5 lakhs spend , as there is nothing mentioned on that

OkNow enjoy an annual fee waiver of ₹10,000 on simply spending ₹10,00,000 instead of a Taj voucher of ₹10,000 on reaching a spend milestone of ₹5,00,000 in a Cardmembership year.

10k taj voucher is removed.

Haven't seen this on the mail.

Anyway that Taj voucher was not that good as it was given only on paying card fees and not just 5 lakhs spends.

It's devaluation in my view,guys like me and most of my friends are holding this card simply because of the golf benefits.There wasn't any spending criteria for golf booking previuosly,they added 50k spending to do golf booking in the revised criteria.That's a deal breaker for me.I can spend 40k on idfc wealth card and get 2 golf rounds,that's looks like a better option.Golf is the USP of this card and adding spend criteria for golf simply kills this card.It's a revaluation actually

International lounge access added

Accor plus traveller added

10 lakhs for fees waiver

Earlier 25k - 500 Rs voucher changed to 1k voucher - 50k spend ( this one is same )

10k Taj Voucher is still there on 5 lakhs spend , as there is nothing mentioned on that

Yeah, this is an interesting factor because previously, there was no way to make this card free.fee waiver 10L

Now, if you spend more than 50K, you even get the 1K vouchers and have the potential to make it free along with the free Accor membership.

Bhai but why were you holding a 10k fee card for golf when there are much easier to get cards that will give you golf for free or almost freeIt's devaluation in my view,guys like me and most of my friends are holding this card simply because of the golf benefits.There wasn't any spending criteria for golf booking previuosly,they added 50k spending to do golf booking in the revised criteria.That's a deal breaker for me.I can spend 40k on idfc wealth card and get 2 golf rounds,that's looks like a better option.Golf is the USP of this card and adding spend criteria for golf simply kills this card.

I know there are a lot of banks providing world master card with less fee,but there are a lot of conditions for booking a golf round with master card.You need to name one member of the golf club for a weekday,and for a weekend booking you need to mention 2 members you are playing the round.This condition makes it almost impossible to book a weekend round of golf.Amex is good in that aspect,the online booking is flawless and Amex has confirmed slots with every golf club,that means if your booking goes through,you are almost sure to get the confirmation of booking.Bhai but why were you holding a 10k fee card for golf when there are much easier to get cards that will give you golf for free or almost free

Ah. Thanks for the input. I’ve never used the service so didn’t know these detailsI know there are a lot of banks providing world master card with less fee,but there are a lot of conditions for booking a golf round with master card.You need to name one member of the golf club for a weekday,and for a weekend booking you need to mention 2 members you are playing the round.This condition makes it almost impossible to book a weekend round of golf.Amex is good in that aspect,the online booking is flawless and Amex has confirmed slots with every golf club,that means if your booking goes through,you are almost sure to get the confirmation of booking.

This card was never meant for gold actually.It's devaluation in my view,guys like me and most of my friends are holding this card simply because of the golf benefits.There wasn't any spending criteria for golf booking previuosly,they added 50k spending to do golf booking in the revised criteria.That's a deal breaker for me.I can spend 40k on idfc wealth card and get 2 golf rounds,that's looks like a better option.Golf is the USP of this card and adding spend criteria for golf simply kills this card.

You can take Yes Marquee , that has golf

Plus MC World provides free golf anyway even with DC

Official Changes effective May 1st 2024:

Design: Dark Grey shaded inline with New American Express Card makeover.

Joining Fee: 10000 + Taxes

Joining Benefits: 11000 MR Points

Annual Fee: 10000 + Taxes

Reward Rate: Earn 1 Membership Rewards® Point for every2 Rs. 50 spent except for spend on Fuel, Insurance, Utilities, Cash Transactions and EMI conversion at Point of Sale

Fee Waiver: The Annual Membership Renewal fee of Rs.10,000 will be 100% waived off if total spends on American Express Platinum Reserve Credit Card in the immediately preceding membership year is Rs.10,00,000 and above.

New and Major Changes:

American Express Platinum Reserve Card | Amex Platinum

Enjoy luxury lifestyle rewards with the Platinum Reserve Credit Card from American Express. Apply now for Platinum Reserve card!

www.americanexpress.com

Design: Dark Grey shaded inline with New American Express Card makeover.

Joining Fee: 10000 + Taxes

Joining Benefits: 11000 MR Points

Annual Fee: 10000 + Taxes

Reward Rate: Earn 1 Membership Rewards® Point for every2 Rs. 50 spent except for spend on Fuel, Insurance, Utilities, Cash Transactions and EMI conversion at Point of Sale

Fee Waiver: The Annual Membership Renewal fee of Rs.10,000 will be 100% waived off if total spends on American Express Platinum Reserve Credit Card in the immediately preceding membership year is Rs.10,00,000 and above.

New and Major Changes:

No, not the worth. Milestone benefit also increased to 50K per month.Nice design looks good. Can we start applying for card replacement already....

Similar threads

- Replies

- 3

- Views

- 581

- Replies

- 10

- Views

- 921

- Replies

- 5

- Views

- 1K

- Question

- Replies

- 5

- Views

- 902

- Question

- Replies

- 16

- Views

- 4K