- Interest charges will be revised to 3.75% per month.

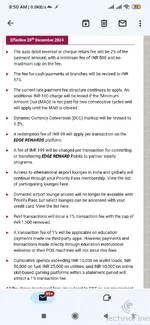

- The auto debit reversal or cheque return fee will be 2% of the payment amount, with a minimum fee of INR 500 and no maximum cap on the fee

- The fee for cash payments at branches will be revised to INR 175

- The current late payment fee structure continues to apply. An additional INR 100 charge will be levied if the 'Minimum Amount Due (MAD)' is not paid for two consecutive cycles and will apply until the MAD is cleared

- Dynamic Currency Conversion (DCC) markup will be revised to 1.5%

- Rent transactions will incur a 1% transaction fee with the cap of INR 1,500 removed

- INR 99 per redemption transaction on all redemptions

- INR 199 per redemption transaction for conversion/transfer of EDGE miles to other partner loyalty programs (e.g. Accor, Kris Flyer, United, Flying Returns, Club Vistara etc)

- A transaction fee of 1% will be applicable on education payments made via third-party apps. However, payments and transactions made directly through education institutional websites or their POS machines will not incur this fees

- Cumulative spends exceeding INR 10,000 on wallet loads, INR 50,000 on fuel, INR 25,000 on utilities, and INR 10,000 on online skill-based gaming platforms within a statement period will attract a 1% transaction fee

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

-

Hey there! Welcome to TFC! View fewer ads on the website just by signing up on TF Community.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Axis Atlas Atlas devaluation starting 20th December

- Thread starter _ayush

- Start date

- Replies 55

- Views 4K

-

- Tags

- 2024 atlas axis axis atlas devaluation

thewittypanda

TF Select

Always had this doubt with Axis but I was making up my mind to go after higher ranked Axis Cards for sometime now... but then thanks to this!! Get the LTF cards of Axis or if one paid has to be the Axis Airtel.... settle with the cashbacks and discounts and be happy. Axis cannot be trusted beyond that.

These are the 'exclusive benefits and privileges' on the card for Indians brought on by a world-class bank in New India.

The way banks are going, this will become a debit card/ cash economy soon. Of late, Indian banks are becoming more and more rogue in choking the spend categories and usage by way of charges, and to think that in some cases, they are now enabled and emboldened to even remove caps on fees.

This is NOT a good omen, but quite deserved.

We are going backwards in a lot of ways when it comes to banking services and charges.

The way banks are going, this will become a debit card/ cash economy soon. Of late, Indian banks are becoming more and more rogue in choking the spend categories and usage by way of charges, and to think that in some cases, they are now enabled and emboldened to even remove caps on fees.

This is NOT a good omen, but quite deserved.

We are going backwards in a lot of ways when it comes to banking services and charges.

Buttman

TF Premier

Agreed! If you keep miles in acc for a high value redemption then there’s a possibility that they will block miles citing business txn.WTF is this redemption fee on 99 and 199 for all redemptions.

Looks like Axis doesn't even want genuine middle class spenders to use this card!

If you keep transferring miles (like i do) to Accor so that Axshit doesn’t rob you off of em then be prepared to pay 236 every time.

Certified cunts!

Its anyways majorly cash economy. Only a small percentage of credit card users are there.The way banks are going, this will become a debit card/ cash economy soon. Of late, Indian banks are becoming more and more rogue in choking the spend categories and usage by way of charges, and to think that in some cases, they are now enabled and emboldened to even remove caps on fees.

Its anyways majorly cash economy. Only a small percentage of credit card users are there.

Indeed it is, more than it was before the infamous 'cleanup' operation. And the way things are going, it seems that the dispensation is hell-bent on converting that percentage into cash/ debit card economy as well. The banks have never been so aggressive as they are lately, when it comes to devaluing their products and charging consumers for the smallest of things, that make no sense at all in this day and age.

You missed UptoThere is "Revaluation" as well. They are providing 5000 edge miles again for annual paid renewal. Hence , it's renewal for most who are below 15L spenders.

GASAHU79

TF Buzz

Yeah thanks bro. 🙁 .You missed Upto

Looks like Atlas is going into dry waste this time following it's more magical brother magnus from last year. Unless they offer me some free miles. I feel using infinia is much better.

bing1309

TF Premier

axis is good for LTF only. next year onwards you will see mass cancellations of cards in axis and mass cancellations will go for ltf cards only and next year no LTF cards will be issued, axis knows what to do, their internal teams have issues and also first they issued cards like tap water, with abnormal limits and no checks and balances, now defaults are happening rather than paying interest in cc. now they have made issuing a card nightmare, and then combined limits and now devaluation by devaluation in a larger scale, (axis tried to compete with HDFC but failed in such a bad way, that instability growth leads to this mess. axis learnt in hard way. where people misused the card left and right but whatever it is axis still has not been able to solve misuse because of poor software and poor skilled people in the banking segment. but nevertheless, unless axis flushes out people they are in a mess. Hope Axis shows what the reality of their CC is and as a consumer, we have learnt a message (but the reality is no bank will give offers like other country banks can give offers to their people) (India can't handle such unsecured debt, because the people who file Itr and who don't have itr also have unsecured cards and the spend to itr is never matching hence its better to wait for 2 more years, and after 2 years only reality can be seen in credit cards.

GASAHU79

TF Buzz

Only if Accor is partner. Infinia rewards are as good as cash. Accor is not available in touristic destinations in India and it's prices are getting higher and higher in India. After some point it will become difficult to make use of Accor rewards, once you are done with Thailand , Malaysia , Bali etc.Atlas still offers better rewards on online and offline transactions

But accor points can be redeemed all over the worldOnly if Accor is partner. Infinia rewards are as good as cash. Accor is not available in touristic destinations in India and it's prices are getting higher and higher in India. After some point it will become difficult to make use of Accor rewards, once you are done with Thailand , Malaysia , Bali etc.

Infinia also charges convenience fees on flight redemption. Every redemption costs you around 500.

Only if Accor is partner. Infinia rewards are as good as cash. Accor is not available in touristic destinations in India and it's prices are getting higher and higher in India. After some point it will become difficult to make use of Accor rewards, once you are done with Thailand , Malaysia , Bali etc.

i think you are talking about partner convenience fee which is charged by EMT, Goibibo, etc..... I dont think there is any redemption fee for redeeming points (saying from DCB experience)Infinia also charges convenience fees on flight redemption. Every redemption costs you around 500.

yes but how is it different from redemption fees?i think you are talking about partner convenience fee which is charged by EMT, Goibibo, etc..... I dont think there is any redemption fee for redeeming points (saying from DCB experience)

Similar threads

- Question

- Replies

- 4

- Views

- 789

- Replies

- 2

- Views

- 560

- Question

- Replies

- 58

- Views

- 6K

- Question

- Replies

- 12

- Views

- 957

- Question

- Replies

- 3

- Views

- 2K