In the world of personal finance, many people are always looking for ways to manage their money better and get the most out of their spending. One popular strategy that's gaining traction is using debit cards to pay off credit card bills. This allows you to earn cashback on expenses that wouldn't normally earn rewards. In this article, we'll explore this concept and look at some of the best debit card options for paying off credit card bills.

In today's financial world, getting the most cashback means thinking creatively and planning strategically. Using the right debit card to pay your credit card bills can earn you extra rewards and improve your overall financial situation. Whether it's getting cashback on everyday purchases or finding new ways to use your rewards, there are plenty of opportunities for those who are open to trying out innovative financial strategies.

Update- 4900 MCC eligible for CB for RBL enterprise & MCC for PayTM transaction is 6051 So RBL SPDC is also not eligible for CB On Paytm

Understanding the Strategy

Typically, credit card bills are paid using money from a bank account, either automatically or by manual transfer. While these payments don't usually earn rewards, some banks offer cashback incentives for using their debit cards to pay bills. By strategically using a debit card for credit card payments, you can earn cashback on expenses that wouldn't otherwise earn rewards.Choosing the Right Debit Card

When choosing a debit card for paying credit card bills, there are a few things to consider:- Cashback Percentage: Look for a debit card that offers a good cashback percentage on bill payments.

- Debit Card Fees: Consider any fees associated with the debit card, such as monthly fees or transaction fees.

- Account Requirements: Make sure you meet any requirements to qualify for the debit card you're interested in.

Top Picks For Best Debit Cards:

| Debit Card Name | Debit Card Fees | Bill Payment Platforms | Cashback/Reward Rate | Maximum Capping | Milestone Benefits |

|---|---|---|---|---|---|

| HDFC Platinum Debit Card | Rs. 750 + GST For Normal Account; Nil For SavingsMax or higher variant accounts/programs | HDFC Bank Bill Payment Portal | 1% Cashback | Rs. 750 Per Month | Not Available |

| HDFC Millennia Debit Card | Rs. 500 + GST For Normal Account; Nil For SavingsMax or higher variant accounts/programs | Load Amazon Wallet & Pay Bill; Use HDFC Bill Payment Portal, Mobikwik | 1% Cashback (Amazon Wallet) 2.5% (HDFC Bill Payment Portal) | Rs. 400 Per Month | Not Available |

| RBL Enterprise Debit Card | Joining: Rs. 7500 + GST Annual: Rs. 2000 + GST | SBI Unipay | 5% Cashback As Voucher | Rs. 1000 Per Month | Spend 5L In A Year & Get Voucher Worth Of Rs. 2000 Additional Rs. 3000 Voucher On Spending 10L & Another Rs. 4000 Voucher On Spending 15L In A Year. |

| RBL Signature Plus Debit Card | Joining: Rs. 5000 + GST Annual: Rs. 1500 + GST | SBI Unipay | 1% Cashback As Voucher | Rs. 1000 Per Month | Rs. 5000 Voucher On Spending Rs. 5L In A Year |

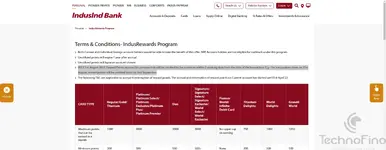

| IndusInd Bank Exclusive Debit Card | Nil For Exclusive Account | PayTM, SBI UniPay | ~0.93% Cashback | Rs. 1050 Per Month (Cash Value) | Not Available |

| IndusInd Bank Select Debit Card | Nil For Select Account | PayTM, SBI UniPay | ~0.93% Cashback | Rs. 1050 Per Month (Cash Value) | Not Available |

| IndusInd Pioneer Debit Card | Nil For Pioneer Account | SBI UniPay, PayTM | 0.50% Cashback | Unlimited | Not Available |

| IDFC First Private Debit Card | Nil For Private Account | SBI UniPay | 1% Reward (Voucher) After Rs. 50,000, Reward Rate Will Become: 2.50% | Rs. 1,25,000 Per Month (Cash Value) | Not Available |

| IDFC First Wealth Debit Card | Nil For Wealth Account | SBI UniPay | 0.67% Reward (Voucher) After Rs. 50,000, Reward Rate Will Become: 2.50% | Rs. 12500 Per Month (Cash Value) | Not Available |

| IDFC First Select Debit Card | Nil For Select Account | SBI UniPay | 0.5% Reward (Voucher) After Rs. 50,000, Reward Rate Will Become: 2.50% | Rs. 7500 Per Month (Cash Value) | Not Available |

| Standard Chartered Priority Visa Infinite Debit Card | Nil For SC Priority Banking | PayTM, SBI UniPay, Etc. | 1.25% Cashback (Voucher) | Unlimited | Not Available |

In today's financial world, getting the most cashback means thinking creatively and planning strategically. Using the right debit card to pay your credit card bills can earn you extra rewards and improve your overall financial situation. Whether it's getting cashback on everyday purchases or finding new ways to use your rewards, there are plenty of opportunities for those who are open to trying out innovative financial strategies.

Update- 4900 MCC eligible for CB for RBL enterprise & MCC for PayTM transaction is 6051 So RBL SPDC is also not eligible for CB On Paytm

Last edited by a moderator: