Believer

TF Buzz

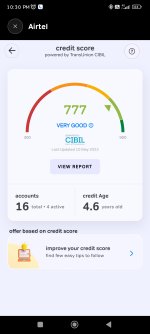

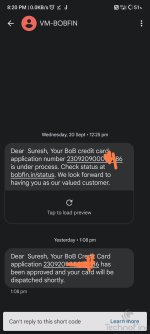

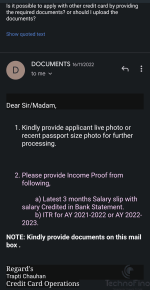

I apply bob credit card on last 08/05/2023 and give current bill statement of my HDFC Bank credit card as income proof which limit is 50.000 rupees and this card is more than six months old. My cibil score is 777. I checked the application status online today and found that the application has been rejected. Now what can I do?