Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

-

Hey there! Welcome to TFC! View fewer ads on the website just by signing up on TF Community.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

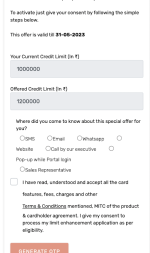

BOB offering 20% limit increase

- Thread starter anirban.choudhury

- Start date

- Replies 69

- Views 5K

Which highest variant is truly LTFIf LTF, what's the harm ?

PREMIER.Which highest variant is truly LTF

How many times did you use it so far during offer daysIf LTF, what's the harm ?

Premier.Which highest variant is truly LTF

bhavik886151

TF Premier

Its LTF and get offer 2-3 times a year on Flipkart Amazon so holding itIs it worth to hold it just for flipkart amazon cashback offers?

bhavik886151

TF Premier

Almost every timeHow many times did you use it so far during offer days

bhavik886151

TF Premier

yes it is LTFIf LTF, what's the harm ?

Same. PREMIER LTF.yes it is LTF

Technically, it's not a debt, but you have the potential to be in that debt. That is why I mentioned the time frame: if you keep the higher limit and lower utilization for longer periods, the bank will consider you as a person with credit discipline.Higher credit limit , won’t affect your debt to income ratio.

Debt to income is the amount of emi/fixed loan that you pay against your income

A credit limit is not a debt , but yes if you utilise the amount and then convert the same into EMI then it falls under debt and only then will impact your debt to income ratio

But if you have acquired that limit in a short span of time, you are potentially a risk for new lenders.

Banks do consider the current limit and your annual income when calculating the limit for their product.

For people with relatively lower credit histories, if they already have a higher limit w.r.t annual income, limits for new products will be lower.

For credit limit allocation debt to income is not that important , but what matters their is debt to credit ratio which is your credit utilisation .Technically, it's not a debt, but you have the potential to be in that debt. That is why I mentioned the time frame: if you keep the higher limit and lower utilization for longer periods, the bank will consider you as a person with credit discipline.

But if you have acquired that limit in a short span of time, you are potentially a risk for new lenders.

Banks do consider the current limit and your annual income when calculating the limit for their product.

For people with relatively lower credit histories, if they already have a higher limit w.r.t annual income, limits for new products will be lower.

Generally if you have higher limit on your card , even if you got that in shorter time frame , generally people ask for LE to multiple banks once there has been a substantial increase in their income in that case at shorter time frame your limit would shoot up , which is perfectly OK .

The only thing that matters here is credit utilisation , a higher utilisation will indeed give lower limits , but a higher credit limit with very less utilisation will give higher limits in future cards or loans

Try checking the bobcard app mine was the same error but the appshowed enhanced limitTried to opt for the limit enhancement but then encountered an error looks like the feature is not ready yet.

I got an LE offer to it went from 32500 to a Wapping 42250 😆 that is a 30% increase

Avangerritesh

TF Select

Same for me card 8 months oldNo limit Enhancement offer for me.

Has anyone received credit limit increase offer this year?

Ak Singh

TF Legend

Which bob credit card is best as Ltf.no . 0 .

And which bob cc is best as paid.also?

raghu.rokda

TF Legend

Premier LTF is best..Which bob credit card is best as Ltf.

And which bob cc is best as paid.also?

Snapdeal is best as paid but nowadays they give virtual snapdeal card LTF as additional card

@Shubham Yadav @anirban.choudhury @VISHESH_BANSAL @Harry1Has anyone received credit limit increase offer this year?

Similar threads

- Question

- Replies

- 31

- Views

- 4K

- Replies

- 5

- Views

- 360

- Replies

- 2

- Views

- 256