connectabjp

TF Buzz

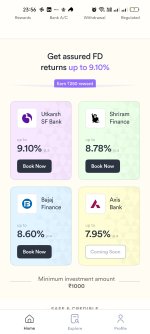

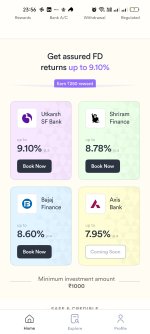

Hello guys, just stumbled upon this Stable Money app which has partnered with Utkarsh bank, Bajaj fiserv, axis and Shriram finance

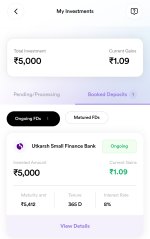

After some research i went ahead with Utkarsh bank as the fd is secured upto of 5lacs for the banks.

.

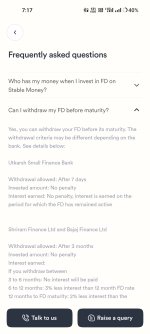

As stable money is not holding any amount here the money is safe: when you make any investment, your money directly goes to the bank. Stable Money never holds any of your funds.

The platform is free and provides good dashboard view of investments.

What I liked about us you don't need to open a bank account to open a fd which is great.

What is ₹5 Lakhs RBI insurance for bank FD?

As per RBI, any deposits in a bank, including FDs, are insured up to ₹5 Lakhs per depositor per bank. The insurance amount includes your deposited amount and the interest earned on that deposit. This insurance is provided by DICGC which is an RBI subsidiary.

The ₹5L insurance is applicable for deposits such as savings, fixed, current, recurring, etc. It covers your deposits in each bank separately.

Link of app

You can use my refferal link

After some research i went ahead with Utkarsh bank as the fd is secured upto of 5lacs for the banks.

.

As stable money is not holding any amount here the money is safe: when you make any investment, your money directly goes to the bank. Stable Money never holds any of your funds.

The platform is free and provides good dashboard view of investments.

What I liked about us you don't need to open a bank account to open a fd which is great.

What is ₹5 Lakhs RBI insurance for bank FD?

As per RBI, any deposits in a bank, including FDs, are insured up to ₹5 Lakhs per depositor per bank. The insurance amount includes your deposited amount and the interest earned on that deposit. This insurance is provided by DICGC which is an RBI subsidiary.

The ₹5L insurance is applicable for deposits such as savings, fixed, current, recurring, etc. It covers your deposits in each bank separately.

Link of app

You can use my refferal link