PiperatGatesofDawn

TF Ace

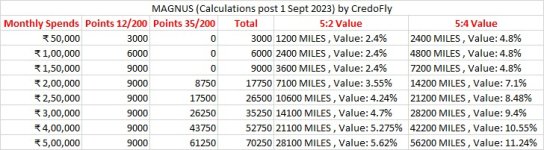

Official notification just came. Most importantly 5:2 now. And requires a Burgundy Private account to keep 5:4.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Looks ok. Neither Magnus nor Reserve looks exceptional. Much heavier than Magnus though. And biggest reason is 2x on Forex spends. Huge benefit for frequent travelers. Even with the moronic TCS coming in September.Also Reserve was never a status card, nobody knows about it and it even looks worse than Magnus. Only advantage is lower FX markup and interest charges.

Samsung Visa Infinite offers 2x based on 15ER per 100INR vs 15ER per 200INR on Reserve. So both are 30ER per 200INR on international spends.Looks ok. Neither Magnus nor Reserve looks exceptional. Much heavier than Magnus though. And biggest reason is 2x on Forex spends. Huge benefit for frequent travelers. Even with the moronic TCS coming in September.

Samsung Visa Infinite offers 2x based on 15ER per 100INR vs 15ER per 200INR on Reserve. So both are 30ER per 200INR on international spends.

Only thing would be FX markup in which Reserve has the upper hand but you can't even compare the fees.

For slightly more you can go AMEX Plat Charge and get MR points welcome benefit or the Taj Vouchers as you can negotiate it. Also 3x on foreign spends, and 5x reward multiplier for a lot of useful brands and Gyftr. And the product, services, offers are way way way better than anything that Axis offers. You cannot even compare them.

And now the transfer rate is better in AMEX than in Reserve for Hilton and Marriot, for other partners it's 2:1 which is still better than Axis unless you have a Burgundy account.

Just with the offers and multipliers I'd prob stick to AMEX.

Now between the two AMEX Plat is a no brainer compared to Reserve, BestBanker can prob benefit from all the people dropping their Axis Reserve card.

Completely agree. Reserve led the pack for me. Though I got the card May end only, I have been able to make some good points out of it. I think Axis has chopped Reserve most brutally…for me, Magnus still will give about 10% return especially given the 35points above 1.5L criteria. Already a burgundy, so will use the 5:4 ratio till the party continues. But will close Reserve next year once it comes up for renewalHuh??? We're comparing Samsung to Reserve? That's insane. Do they both redeem at the same rate? Reserve has the best international spends rewards of 10.23% and nobody compares to that. Also you can compare the fees if you have the right kinds spends. Obviously, you don't have the right spends so understandable it looks expensive to you. Spend 10-15L in forex and let me know how that Samsung vs. Reserve equation looks.

And please don't say get a Magnus and get 5:4... that's an error that Axis, given it's track history can claw back at any time. They're in the right mood now to do that too.

When the value of Reserve was being discussed... it wasn't being discussed in relation to Samsung Infinite... it's value was being discussed in context of the Reserve card holder who spends like someone who can afford and sees value in a 59k fee card. And for them - that 10.23% is a great benefit.

Also, Amex Platinum's 3x is garbage. Because if you consider Re. 1/mile and Re. 0.5/MB, X=1.25%. 3x = 3.75%. Factor in your forex markup & GST @ 4.13%. You are LOSING 0.38% with every international transaction! And the equation for the cheaper Platinum variants is worse. So much for that.

After Reserve the next best card for international spends is Citi Prestige. But even they give 3.87% returns and have some annoying MCC restrictions. But at any rate offer 60% less value than the forex champ - Reserve! Reserve is dead. Long live Reserve.

Completely agree. Reserve led the pack for me. Though I got the card May end only, I have been able to make some good points out of it. I think Axis has chopped Reserve most brutally…for me, Magnus still will give about 10% return especially given the 35points above 1.5L criteria. Already a burgundy, so will use the 5:4 ratio till the party continues. But will close Reserve next year once it comes up for renewal

Completely agree. Reserve led the pack for me. Though I got the card May end only, I have been able to make some good points out of it. I think Axis has chopped Reserve most brutally…for me, Magnus still will give about 10% return especially given the 35points above 1.5L criteria. Already a burgundy, so will use the 5:4 ratio till the party continues. But will close Reserve next year once it comes up for renewal

Good job with the chart dude... Look at value from 3L spends onwards... 🙂View attachment 23435

how is magnus giving 10%???

Good job with the chart dude... Look at value from 3L spends onwards... 🙂

Exactly as @PiperatGatesofDawn said. My average monthly spends will be between 3-4 L and I am Burgundy account holder with Axis so will continue to get 5:4 (till Lord Axis allows 😉)View attachment 23435

how is magnus giving 10%???

it is a very small time frame where you will be allowed to convert at 5:4Exactly as @PiperatGatesofDawn said. My average monthly spends will be between 3-4 L and I am Burgundy account holder with Axis so will continue to get 5:4 (till Lord Axis allows 😉)

it is a very small time frame where you will be allowed to convert at 5:4

read the whole part

??Citibank zindabad. Citibank zindabad... Citibank zindabad...

For non accelerated spend upto 1.5L... Citi is looking way better than Magnus.

why would axis want to make it better for youWhy is everyone interpreting the time bound offering as "5:4 only for a limited period of time"? Given how badly worded Axis statements are, could they not have been trying to say "This is a limited time offer where if you open a new Burgundy account within the offer period, you can keep 5:4 for the lifetime of that account"? That might be super wishful thinking, but if true could be a very solid proposition for many.