are u suggesting apply for 1 more CB card and then close to get cashkaro points?PS: That was the first 2 second application ever 😀 lol! Somone online wasnt lying.

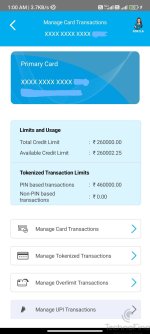

Likely it had all my data from before as SBI CB was barely a month hold / or retrieved again.

Approved Sent in 2-5 days. Literally no steps after putting Name, Number, OTP. Boom! No Aadhar, No PAN!

😀

PS:

Now Im wondering if I can reapply for SBI CB and get two. LOL! or get CK Bonus and then close one.

is it worth Cibil hit and account entry?