Well said, For ITD there are much bigger fishes to catch than these petty thousands or lakhsJust because something has been reported in AIS doesn't necessarily mean tax notice. Often entries are double counted in AIS.

Guess only those PPL who mindlessly rotated money between cc and bank account will have to worry especially if the AIS report is significantly higher than ITR.

For others it's ok and relax. Even if Bank reports say 14 lakh in AIS and the ITR is 30 lakh it's fine

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

-

Hey there! Welcome to TFC! View fewer ads on the website just by signing up on TF Community.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

(Caution) Check your AIS. Banks have reported high value Credit Card spends for FY22-23.

- Thread starter moriarty

- Start date

- Replies 200

- Views 25K

shashankrt

TF Ace

Depends. If you have too many unaccounted deposits - then yes. Else you atleast need to provide interest credits for each account.Accha itr file karne ke liya sabhi bank ko ka statement Dena padega kya ca ko ??

Upto 10L per CC issuing bank in not problem, correct? each bank will update IT only if cumulative spends on all the card issued by them in > 10L / financial year?No specific instructions as such mentioned by the ITD.

This is the bare text form section 285BA section read with rule 114E.

"

Payments made by any person of an amount aggregating to—

(i) one lakh rupees or more in cash; or

(ii) ten lakh rupees or more by any other mode,

against bills raised in respect of one or more credit cards issued to that person, in a financial year."

"

From a plain reading, it can be interpreted that they are referring to payments made against the credit card bill. However, a bank can adopt a different approach and consider the total purchases made in a financial year in its calculation. We don't have any case law yet to get a proper analysis of the text.

As a safe approach I will suggest that one should make sure that

1) Their Debit transactions are under 10L, ignoring any reversal of that debit transaction.

2) Total Amount of Bills raised during the year is less than 10L

3) Total Credits(Payments) are under 10L.

It's worth noting that your income should ideally match your expenses. If you can justify your expenses and have a legitimate source of income to cover them, you should not have to worry about such reporting.

Y e s 😁Upto 10L per CC issuing bank in not problem, correct? each bank will update IT only if cumulative spends on all the card issued by them in > 10L / financial year?

s1t2y3a3m6

TF Legend

Is debit card spend on wallet reload and transfer to bank reported RBI if high value includes?

@TechnoFino

@TechnoFino

That is called credit card money rotation and should be avoided except for unavoidable emergenciesWhat about deposits in bank accounts from CC, any limits there?

What is the bad thing about this ?Upto 10L per CC issuing bank in not problem, correct? each bank will update IT only if cumulative spends on all the card issued by them in > 10L / financial year?

I mean..... for a salaried person with 15L(ITR) and if the credit card spends reported by the bank is >12L.... it will create a problem ?

I get the logic of, a person's total income should be greater than total expenditures...

No, it may create a problem for those who file ITR for 5L or below 😅What is the bad thing about this ?

I mean..... for a salaried person with 15L(ITR) and if the credit card spends reported by the bank is >12L.... it will create a problem ?

I get the logic of, a person's total income should be greater than total expenditures...

yes.. it willl.. even more coz its payment that gets reportedWhat if I have paid the amount before bill generation will this still count for the 10 lakh slab?

No o oIs debit card spend on wallet reload and transfer to bank reported RBI if high value includes?

@TechnoFino

Not in ais

high value? how high is high 🙂 if v high then high to very high chances of questions from high officials in higher authorities.. so Hi(re) a highly quality CA to highlight the accounts and save you from hiding transactions. keep your head high and accounts higher..@s1t2y3a3m6No o o

Not in ais

Mostly PPL ask abouthigh value? how high is high 🙂 if v high then high to very high chances of questions from high officials in higher authorities.. so Hi(re) a highly quality CA to highlight the accounts and save you from hiding transactions. keep your head high and accounts higher..

40k hdfc millniea

& Maybe 5-7 l rbl dc in a year

One can easily justify that .

yes for sure.. reasonable expenses.. but offlate seeing some crazy stories so "high" is too open ended.. 50L grocery spend, some 25L UPI transfer in the year with 5L income, 6cr cc spend.. etcetc.. ufff..Mostly PPL ask about

40k hdfc millniea

& Maybe 5-7 l rbl dc in a year

One can easily justify that .

bsc0008

TF Select

By chance recently watched V for Vendetta movie 😉high value? how high is high 🙂 if v high then high to very high chances of questions from high officials in higher authorities.. so Hi(re) a highly quality CA to highlight the accounts and save you from hiding transactions. keep your head high and accounts higher..@s1t2y3a3m6

Alex292929

TF Premier

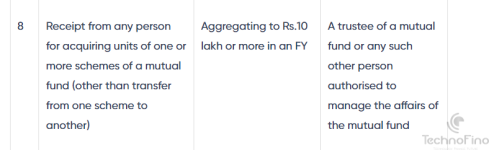

can you guys also see purchase and sale of security and mutual funds in SFT AIS?

Alex292929

TF Premier

Like sometime i buy sell securities for short term. so the total seems hugeyes . .

Similar threads

- Replies

- 12

- Views

- 2K