devsfinance

TF Premier

Hello Everyone,

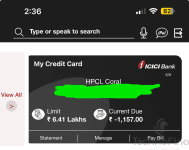

I have recently started my credit card journey. My first card was from Icici with a limit of 3L they provided me it without any documents due to Alumni offer may be. Around 2.5 months old now and had no credit score prior.

After that from reading and resources from this amazing community I got to know that I should not be applying to many cards as it can drop my credit score and hence the chances of getting cards as well.

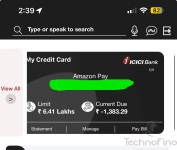

Other than that I got suggestions from others to use my card below 30% and pay on time other than that I found a thread Cibil Formula revealed which suggests that usage in 1 to 9% is giving most score and hence I have had my spend around that much only and also paid

My first score which got generated was 772 after around 10 days of first payment and then after my second payment my new report shows my score is 755. To get a LE in my card and following thread Share ICICI LE Journey I have done 0 spends till now in this cycle however I can have spends as well.

So please suggest as to what I should be doing to get good score as I want to add more cards to my portfolio later. Also please suggest when should I apply for my next CC?

I have recently started my credit card journey. My first card was from Icici with a limit of 3L they provided me it without any documents due to Alumni offer may be. Around 2.5 months old now and had no credit score prior.

After that from reading and resources from this amazing community I got to know that I should not be applying to many cards as it can drop my credit score and hence the chances of getting cards as well.

Other than that I got suggestions from others to use my card below 30% and pay on time other than that I found a thread Cibil Formula revealed which suggests that usage in 1 to 9% is giving most score and hence I have had my spend around that much only and also paid

My first score which got generated was 772 after around 10 days of first payment and then after my second payment my new report shows my score is 755. To get a LE in my card and following thread Share ICICI LE Journey I have done 0 spends till now in this cycle however I can have spends as well.

So please suggest as to what I should be doing to get good score as I want to add more cards to my portfolio later. Also please suggest when should I apply for my next CC?