Shraaj

TF Premier

How CIBIL Score is Calculated in India ?

Check CIBIL Score formula & learn how does it calculated.

Now, This is the Ratio, that our Credit Score comes from and has an Impact on Gaining and Losing Credit Score in Points.

1. PAYMENT HISTORY-

This is the Most Important Factor, Now see the Parameter/Table

Now, You Can ADD THE POINTS - Eg-

1. If you have just recently paid like 0-4 months then add 15-25 Points.

2. If there is no delay in payment then add 85-95 Points

3. No Bankruptcy - Add 75-85 Points

Now, See even if you don't pay the bank/NBFC then also you will get a score but see the points gap,

2. DEBT BURDEN/CREDIT UTILIZATION-

Now, See if you don't have any burden then also point score will be less or even if you have heavy debt burden then marks will be deducted or less score. So, I will add 20-29% which is 145-155 points along with previous points.

3. LENGTH OF CREDIT HISTORY-

The most important thing look at the points in increasing order along with years,so better to keep our old products active.

Add No.of Months like which is the longest credit report product for you mine is in 12-23 months, so I will add 105-115 points with the previous one. (It can be seen in the cibil report or directly in OneScore App)

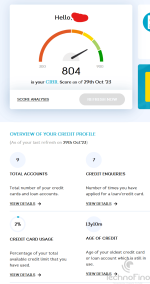

4.RECENT SEARCHES FOR CREDIT/CREDIT ENQUIRIES-

Now, See How Many Enquiries have you made in CIBIL in the Last 6 Months that also impact, Add this previous one.

5. TYPES OF CREDIT/MIXTURE OF CREDIT ACCOUNTS-

It is always healthy if you have a mixture of Loans like Credit Card, Personal loans, Home loans, etc. Now, see the table

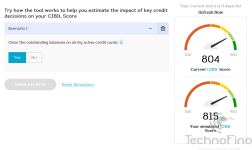

NOW, ADD All those Five Things and final outcome would be your expected Credit Score,offcourse it would be not accurate but it's 90-95% Accurate.This Formula has been applied to 20 Different People and the Results were +/-20 Points are here and there.

Try and comment.

Check CIBIL Score formula & learn how does it calculated.

Now, This is the Ratio, that our Credit Score comes from and has an Impact on Gaining and Losing Credit Score in Points.

1. PAYMENT HISTORY-

This is the Most Important Factor, Now see the Parameter/Table

Now, You Can ADD THE POINTS - Eg-

1. If you have just recently paid like 0-4 months then add 15-25 Points.

2. If there is no delay in payment then add 85-95 Points

3. No Bankruptcy - Add 75-85 Points

Now, See even if you don't pay the bank/NBFC then also you will get a score but see the points gap,

2. DEBT BURDEN/CREDIT UTILIZATION-

Now, See if you don't have any burden then also point score will be less or even if you have heavy debt burden then marks will be deducted or less score. So, I will add 20-29% which is 145-155 points along with previous points.

3. LENGTH OF CREDIT HISTORY-

The most important thing look at the points in increasing order along with years,so better to keep our old products active.

Add No.of Months like which is the longest credit report product for you mine is in 12-23 months, so I will add 105-115 points with the previous one. (It can be seen in the cibil report or directly in OneScore App)

4.RECENT SEARCHES FOR CREDIT/CREDIT ENQUIRIES-

Now, See How Many Enquiries have you made in CIBIL in the Last 6 Months that also impact, Add this previous one.

5. TYPES OF CREDIT/MIXTURE OF CREDIT ACCOUNTS-

It is always healthy if you have a mixture of Loans like Credit Card, Personal loans, Home loans, etc. Now, see the table

NOW, ADD All those Five Things and final outcome would be your expected Credit Score,offcourse it would be not accurate but it's 90-95% Accurate.This Formula has been applied to 20 Different People and the Results were +/-20 Points are here and there.

Try and comment.