curios_mind_huh

TF Select

For those who have applied Education loan (or) have paid off one recently, there's a scheme called CSIS for Edu loans. The basic gist is Central government will pay you back the total interest charged by the bank for the total period till you have graduated (+ a maximum of 1 year depending on other criteria). You can read more about the conditions here: https://www.jansamarth.in/education-loan-central-sector-interest-subsidy-scheme.

The reason behind this post is because there have been many incidents lately where the banks don't apply for CSIS correctly and get the customer royally f***ed over. I've been a victim and when I enquired with friends, 4 out of 6 of them were too. If you come from a family income of less than 4.5 lakhs, you should be auto enrolled in CSIS scheme when you apply for an Education Loan. Once you are enrolled, it's the bank's responsibility to apply for subsidy every year on your behalf. I'll give you my personal life example:

I fought with the bank for the past year to get back my missed subsidy amount along with the interest. When I asked my bank if they've made similar mistakes to other loan applicants from the same branch, their only response was "You should be happy that your problem is resolved and leave it at that". The scary part is there are still many who don't even know about the scheme and banks are obviously cheating them out of it either intentionally or unintentionally. And when I started calling out my old collegemates, I found this to be true and there are many discrepancies with almost all of the 6 I know of.

I'd be happy to answer any questions you have in this regard.

The reason behind this post is because there have been many incidents lately where the banks don't apply for CSIS correctly and get the customer royally f***ed over. I've been a victim and when I enquired with friends, 4 out of 6 of them were too. If you come from a family income of less than 4.5 lakhs, you should be auto enrolled in CSIS scheme when you apply for an Education Loan. Once you are enrolled, it's the bank's responsibility to apply for subsidy every year on your behalf. I'll give you my personal life example:

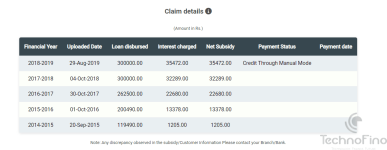

- Started Engineering degree in 2015. Applied for an Education loan in 2015 and got approved for a loan for 2.8L

- 2015-2016: Got my first installment of loan 70k from bank and they charged me an interest of Rs.1200 for this period. My bank then claimed this interest of Rs.1200 through CSIS.

- 2016-2017: Got my second installment of loan 70k from bank and they charged me an interest of 14k for this period. My bank then claimed this interest of 14k through CSIS.

- Same thing happened for 2017 till 2019 and (fortunately) then the mistakes started happening when I graduated.

- CSIS subsidy will be credited to your bank account only after your moratorium period ends. My bank put my moratorium period as February 2021 even though I graduated in 2019, meaning all the interest credits that were supposed to reach me in 2020 got delayed by a year. This might not mean much but when you are looking at a loan rate of 11.5%, a 1-year delayed subsidy of 90k will mean 10.3k loss on your part.

- Your bank is supposed to report interest every year to CSIS till the moratorium period to claim it back. It's not like you apply once and forget. And this is the responsibility of the loan officer and not the borrower. In my case, my loan officer should have applied five times starting from 2015 to 2020. But they stopped claiming CSIS after May 2019 even though they should have continued till February 2020.

- For my friend, they claimed CSIS for only one year and did not apply for the subsidy for the rest of 4 years.

I fought with the bank for the past year to get back my missed subsidy amount along with the interest. When I asked my bank if they've made similar mistakes to other loan applicants from the same branch, their only response was "You should be happy that your problem is resolved and leave it at that". The scary part is there are still many who don't even know about the scheme and banks are obviously cheating them out of it either intentionally or unintentionally. And when I started calling out my old collegemates, I found this to be true and there are many discrepancies with almost all of the 6 I know of.

I'd be happy to answer any questions you have in this regard.