Want to share my experience of getting a PNB credit card after months of delays, thanks to bank's incompetence and not accepting their fault. Also, want to show that banks cannot have everything their way if you can prove them wrong.

Before people jump to the conclusion that why can't I simply provide the ITR, I was in college for the past 2 years and therefore I did not file an ITR.

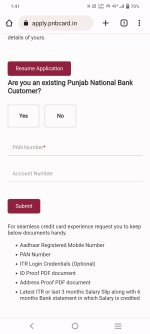

Dec-22: Filed for PNB Rupay Select online and completed VKYC after 2 days

Feb-23: VKYC approved and bank asked for ITR. I told bank that it is nowhere mentioned but they said it is mandatory as per RBI guidelines. Filed a complaint with RBI Ombudsman but rejected under Clause 16.

Mar-23: Filed RTI against both RBI and PNB. Asked RBI whether ITR is mandatory as per what PNB bank officials mentioned. Same day, filed RTI against PNB asking for their internal policy document regarding CC eligibility and if ITR is mandatory why is it not updated on their site.

Apr-23: Received reply through RTI by RBI that they haven't advised anything of that sort to PNB and got a reply from PNB that ITR is mandatory and they will update it on the website shortly. Mailed the MD desk attaching copies of both RTI asking why the information has not been updated and that banks need to be transparent regarding the eligibility criteria.

May-23: Received a call from the bank that they apologise for it and will update the site ASAP. I asked them to remove the CIBIL hit as bank had not disclosed this clearly while applying. Executive on the call asked me to share salary slips, bank statement, offer letter and company ID card. Got approval after 2 days.

Feel free to ask for the copy of RTI filed. 🙂

Before people jump to the conclusion that why can't I simply provide the ITR, I was in college for the past 2 years and therefore I did not file an ITR.

Dec-22: Filed for PNB Rupay Select online and completed VKYC after 2 days

Feb-23: VKYC approved and bank asked for ITR. I told bank that it is nowhere mentioned but they said it is mandatory as per RBI guidelines. Filed a complaint with RBI Ombudsman but rejected under Clause 16.

Mar-23: Filed RTI against both RBI and PNB. Asked RBI whether ITR is mandatory as per what PNB bank officials mentioned. Same day, filed RTI against PNB asking for their internal policy document regarding CC eligibility and if ITR is mandatory why is it not updated on their site.

Apr-23: Received reply through RTI by RBI that they haven't advised anything of that sort to PNB and got a reply from PNB that ITR is mandatory and they will update it on the website shortly. Mailed the MD desk attaching copies of both RTI asking why the information has not been updated and that banks need to be transparent regarding the eligibility criteria.

May-23: Received a call from the bank that they apologise for it and will update the site ASAP. I asked them to remove the CIBIL hit as bank had not disclosed this clearly while applying. Executive on the call asked me to share salary slips, bank statement, offer letter and company ID card. Got approval after 2 days.

Feel free to ask for the copy of RTI filed. 🙂

Last edited: