Now that Axis Magnus's devaluation is confirmed, I thought of comparing it with HDFC Infinia. I own both the cards (actually both me and wife currently hold Magnus and Infinia). So I've personal interest in the comparison.

Joining/Annual Fees and Benefits

First, regarding the fees. Both have similar joining fees of Rs 12500, though you can get Infinia plastic at a cheaper price of Rs 10000. The cards have similar renewal fees as well. Again, Infinia plastic is actually cheaper. But the significant advantage of HDFC Infinia is that they also give back equal number of points on paying annual fees. Axis Magnus is going to discontinue to that. That way, HDFC Infinia scores above Magnus on joining/annual fee benefits

General Spends

Infinia has a general reward rate of 5 points per Rs 150 spend, while Magnus has a rate of 6 points per Rs 200 spend, upto Rs 200000 per month. After that the rate goes up to 35 points per Rs 200.

So unless you've Magnus + Burgundy, Infinia does better for general spends. It also scores over Magnus + Burgundy if you are converting points into cash equivalent. But for higher monthly spends and Burgundy and transferring to airline/hotels, Magnus wins hands down. Now remember Burgundy 5:4 is time bound and Axis may change it any day. So I would rather go with Infinia.

TravelEdge/SmartBuy

Magnus offers 5x on TravelEdge for Hotel and flight booking, but now capped at 2L per month. After that the reward rate drops to 35 points per Rs 200. On the other hand, Infinia offers 5x on flight booking and 10x on hotel booking, but caps it to 15000 points per month. There is also a daily cap of 7500 points, so the actual Infinia benefits might even be lower.

For higher monthly spends on hotel and airline booking, Magnus + Burgundy beats Infinia by a huge margin. But for spends less than Rs 50000 for hotel bookings and Rs 1L for airline bookings, Infinia does very well. The monthly cap of 15000 points on Infinia makes it less attractive if your monthly (or even one time) spends are significant. If you spend 5-6L on hotel/airline once or twice in a year, you would want to seriously consider keeping Magnus and opening Burgundy account. Otherwise you can live with Infinia.

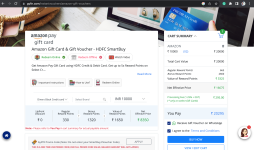

Gyftr Amazon Pay

Infinia still offers 5x on Amazon Pay vouchers whereas Magnus has scaled it down to 2x. With that context, Infinia scores inline with Magnus + Burgundy and beats Magnus handsomely

Conclusion

While Magnus has been devalued to a huge extent, it's still a good card for those who can keep Burgundy relationship, especially if monthly spends are significantly higher than Infinia's monthly cap. If you have (like me) multiple Magnus cards in the family, there is no point holding more than one. In fact, it's now detrimental to split expenses on 2 cards. I will surrender one of Magnus cards, but will keep the other and also maintain Burgundy status. Will review this decision a year from now when my Magnus comes for renewal again.

If I missed something or there are errors, please bring to my attention. Will update accordingly.

Joining/Annual Fees and Benefits

First, regarding the fees. Both have similar joining fees of Rs 12500, though you can get Infinia plastic at a cheaper price of Rs 10000. The cards have similar renewal fees as well. Again, Infinia plastic is actually cheaper. But the significant advantage of HDFC Infinia is that they also give back equal number of points on paying annual fees. Axis Magnus is going to discontinue to that. That way, HDFC Infinia scores above Magnus on joining/annual fee benefits

General Spends

Infinia has a general reward rate of 5 points per Rs 150 spend, while Magnus has a rate of 6 points per Rs 200 spend, upto Rs 200000 per month. After that the rate goes up to 35 points per Rs 200.

|

|

| |||||||||||||

| General Spends | Points | Cash/Cash Equivalent | Miles/Hotel Points | Points | Cash/Cash Equivalent | Miles/Hotel Points | Points | Cash/Cash Equivalent | Miles/Hotel Points | ||||||

| 20000 | 666. (3.33% ) | 666. (3.33% ) | 666. (3.33% ) | 1200 (6% ) | 240 (1.2% ) | 480 (2.4% ) | 1200 (6% ) | 240 (1.2% ) | 960 (4.8% ) | ||||||

| 100000 | 3330. (3.33% ) | 3330. (3.33% ) | 3330. (3.33% ) | 6000 (6% ) | 1200 (1.2% ) | 2400 (2.4% ) | 6000 (6% ) | 1200 (1.2% ) | 4800 (4.8% ) | ||||||

| 300000 | 9990. (3.33% ) | 9990. (3.33% ) | 9990. (3.33% ) | 35250 (11.75% ) | 7050 (2.35% ) | 14100 (4.7% ) | 35250 (11.75% ) | 7050 (2.35% ) | 28200 (9.4% ) |

So unless you've Magnus + Burgundy, Infinia does better for general spends. It also scores over Magnus + Burgundy if you are converting points into cash equivalent. But for higher monthly spends and Burgundy and transferring to airline/hotels, Magnus wins hands down. Now remember Burgundy 5:4 is time bound and Axis may change it any day. So I would rather go with Infinia.

TravelEdge/SmartBuy

Magnus offers 5x on TravelEdge for Hotel and flight booking, but now capped at 2L per month. After that the reward rate drops to 35 points per Rs 200. On the other hand, Infinia offers 5x on flight booking and 10x on hotel booking, but caps it to 15000 points per month. There is also a daily cap of 7500 points, so the actual Infinia benefits might even be lower.

| Travel Portal |

|

|

| |||||||||||

| Hotel | Points | Cash/Cash Equivalent | Miles/Hotel Points | Points | Cash/Cash Equivalent | Miles/Hotel Points | Points | Cash/Cash Equivalent | Miles/Hotel Points | |||||

| 50000 | 15000 (30% ) | 15000 (30% ) | 15000 (30% ) | 15000 (30% ) | 3000 (6% ) | 6000 (12% ) | 15000 (30% ) | 3000 (6% ) | 12000 (24% ) | |||||

| 100000 | 15000 (15% ) | 15000 (15% ) | 15000 (15% ) | 30000 (30% ) | 6000 (6% ) | 12000 (12% ) | 30000 (30% ) | 6000 (6% ) | 24000 (24% ) | |||||

| 300000 | 15000 (5% ) | 15000 (5% ) | 15000 (5% ) | 77500 (25.83% ) | 15500 (5.17% ) | 31000 (10.33% ) | 77500 (25.83% ) | 15500 (5.17% ) | 62000 (20.67% ) | |||||

| Airline | ||||||||||||||

| 50000 | 8250 (16.5% ) | 8250 (16.5% ) | 8250 (16.5% ) | 15000 (30% ) | 3000 (6% ) | 6000 (12% ) | 15000 (30% ) | 3000 (6% ) | 12000 (24% ) | |||||

| 100000 | 15000 (15% ) | 15000 (15% ) | 15000 (15% ) | 30000 (30% ) | 6000 (6% ) | 12000 (12% ) | 30000 (30% ) | 6000 (6% ) | 24000 (24% ) | |||||

| 300000 | 15000 (5% ) | 15000 (5% ) | 15000 (5% ) | 77500 (25.83% ) | 15500 (5.17% ) | 31000 (10.33% ) | 77500 (25.83% ) | 15500 (5.17% ) | 62000 (20.67% ) |

For higher monthly spends on hotel and airline booking, Magnus + Burgundy beats Infinia by a huge margin. But for spends less than Rs 50000 for hotel bookings and Rs 1L for airline bookings, Infinia does very well. The monthly cap of 15000 points on Infinia makes it less attractive if your monthly (or even one time) spends are significant. If you spend 5-6L on hotel/airline once or twice in a year, you would want to seriously consider keeping Magnus and opening Burgundy account. Otherwise you can live with Infinia.

Gyftr Amazon Pay

Infinia still offers 5x on Amazon Pay vouchers whereas Magnus has scaled it down to 2x. With that context, Infinia scores inline with Magnus + Burgundy and beats Magnus handsomely

| Gyftr |

|

|

| |||||||||||

| APay | Points | Cash/Cash Equivalent | Miles/Hotel Points | Points | Cash/Cash Equivalent | Miles/Hotel Points | Points | Cash/Cash Equivalent | Miles/Hotel Points | |||||

| 20000 | 3300 (16.5% ) | 3300 (16.5% ) | 3300 (16.5% ) | 2400 (12% ) | 480 (2.4% ) | 960 (4.8% ) | 2400 (12% ) | 480 (2.4% ) | 1920 (9.6% ) | |||||

| ASV | ||||||||||||||

| 20000 | 3300 (16.5% ) | 3300 (16.5% ) | 3300 (16.5% ) | 3600 (18% ) | 720 (3.6% ) | 1440 (7.2% ) | 3600 (18% ) | 720 (3.6% ) | 2880 (14.4% ) |

Conclusion

While Magnus has been devalued to a huge extent, it's still a good card for those who can keep Burgundy relationship, especially if monthly spends are significantly higher than Infinia's monthly cap. If you have (like me) multiple Magnus cards in the family, there is no point holding more than one. In fact, it's now detrimental to split expenses on 2 cards. I will surrender one of Magnus cards, but will keep the other and also maintain Burgundy status. Will review this decision a year from now when my Magnus comes for renewal again.

If I missed something or there are errors, please bring to my attention. Will update accordingly.

Last edited: