No waiting period.Thanks for the reply, I opened advantage account on Friday so can I upgrade my account to Super tommorow ?

Is there any waiting period for account upgrade from the time of opening?

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

-

Hey there! Welcome to TFC! View fewer ads on the website just by signing up on TF Community.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Offer Fulfilled! How I Got My RuPay Select Wellness Debit Card the Cheapest Way Possible

- Thread starter saurzx

- Start date

- Replies 147

- Views 12K

The offer has been fulfilled by the bank/company.

This is WAY too much work for me. I would easily pay 2000rs in lieu of these steps to get a rupay select dc.

How to get rupay select? I recently got EMTRupay Select then EMT

Sumedh03

TF Buzz

How did you get both in advantage?No waiting period.

Thought select was only for super and above.

Also which you applied first select or emt and can you apply both on the same day?

Sumedh03

TF Buzz

Do they upgrade instantly and what documents are requiredNo waiting period.

I have a Super Savings Account with them. I got the RSDC in October & EMT in November when applying via the BOB app was available.How to get rupay select? I recently got EMT

Within a day it will be upgraded. Note the upgrade will be successful only when your MAB is 25K for the Super Savings account. No Docs required.Do they upgrade instantly and what documents are required

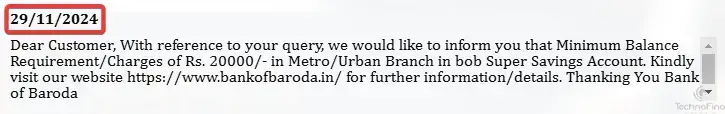

But MAB for Super savings account is 20k right?MAB is 25K

In December, I visited the BOB branch to set my Auto Sweep limit to the maximum. During my visit, the DBM informed me that the updated criterion for the Super Savings Account to ₹25,000. When I mentioned that the BOB website states the requirement as ₹20,000, he clarified that the ₹20,000 limit applies only to accounts opened online and they will soon update the website also that 25K will be the MAB for Super Savings account. Not verified by me, I keep more than 25K.But MAB for Super savings account is 20k right?

No additional documentation are required, only funding is required. But a much easier way is to open a new Super Saving Account with 20k and then downgrade if you wish to. Otherwise you can continue with Super Savings Account.Do they upgrade instantly and what documents are required

Check the OP for Select Debit Card. Just open Super Savings Account with 20k IP and after Account opening apply for RSDC and EMT both Debit Cards by app itself. When both cards get delivered and activated, then visit the branch and fill a scheme change form (downgrade to Advantage Saving Account). And Voila! You will have 2 premium debit cards with only 2k AMB. Though these debit cards won't be LTF/FYF. But the benefits justifies the fee.How did you get both in advantage?

Thought select was only for super and above.

Also which you applied first select or emt and can you apply both on the same day?

In December, I visited the BOB branch to set my Auto Sweep limit to the maximum. During my visit, the DBM informed me that the updated criterion for the Super Savings Account to ₹25,000. When I mentioned that the BOB website states the requirement as ₹20,000, he clarified that the ₹20,000 limit applies only to accounts opened online and they will soon update the website also that 25K will be the MAB for Super Savings account. Not verified by me, I keep more than 25K.

HiI recently decided to get the RuPay Select Wellness Debit Card, while keeping my costs (MAB+Issuance+Annual Fee) to a minimum. After some research, I found that Bank of Baroda offers this card at the lowest Annual Fee of ₹590 with no issuance fee (better than JSFB). Here’s my journey and the rollercoaster ride it took me on!

20/08/2024: The Branch Visit

I went to a Bank of Baroda branch and requested to open a normal savings account with zero or ₹1000/₹2000 MAB, but I emphasized that I must get the RuPay Select Debit Card with it. The branch executive wasn’t fully aware of the account variants that qualified for this card. She didn’t deny my request but wasn’t certain either, promising to open the account and attempt to request the card.

I filled out the paper form, attached copies of my Aadhaar and PAN, and provided a photo. The server was down (as is often the case with PSBs), so she took my number and promised to inform me when the account was opened. I reminded her again: No RuPay Select Card, no account. Later at 4:00 PM, she called me for two OTPs to confirm the account opening. I reminded her about the card, and she assured me that if I didn’t want the account later, I could close it within 14 days without any charges.

21/08/2024: Waiting for the Card

She informed me that she couldn’t apply for the RuPay Select Debit Card immediately but would raise an internal request. I received no further updates that day.

22/08/2024: Another Visit to the Bank

I went back to the bank. The same executive told me that a senior staff member was now handling my debit card request. After exchanging numbers with the senior lady, I was asked to wait. In the late afternoon, she called me to confirm that my account had been opened and the debit card request was processed. However, she informed me that the RuPay Select Card is only applicable to accounts with a ₹50,000 MAB.

The account opened for me was a BOB Super Saving Account (though the MAB was actually ₹20,000, with a sweep-in threshold of ₹50,000). I didn’t want this type of account, so I was advised to visit the branch and fill out a closure form to close it without any charges.

23/08/2024: No Bank Visit

I didn’t visit the bank that day.

24/08/2024 - 26/08/2024: Holidays

Although the 24th was a bank holiday, I received an SMS saying my debit card had been dispatched.

27/08/2024: Card Delivered

My RuPay Select Debit Card was delivered! I logged in to the RuPay website and saw all the benefits: OTT subscriptions, spa and gym offers, health check-ups, golf sessions, and cab vouchers. However, I hadn’t made any transactions or activated the card yet.

28/08/2024: Account Downgrade Request

I visited the branch and asked her to downgrade my account to the BOB Advantage Savings Account. She said she had already tried downgrading it to a BOB Lite Account (a zero-balance account), but it didn’t go through. She asked me to fill out a scheme change form for the Advantage Savings Account and warned that my RuPay Select Debit Card might be deactivated during the process. I clearly asked her if she would intentionally deactivate it, she assured me she won’t, but the system could do that. I gave my consent to proceed.

29/08/2024: Downgrade Success, Card Problems Begin

In the evening, I checked the BOB World app, and my account had been successfully downgraded to a BOB Advantage Savings Account. I deposited ₹2500 and tried to redeem one of the RuPay offers. To my surprise, the transaction failed—my card wasn’t even reaching the OTP page. Even payments on other sites failed, although UPI was working. This led me to believe my debit card had been deactivated, though it didn’t show as blocked in the app.

30/08/2024: A Last-Minute Save

To confirm my suspicion, I went to the nearest BOB ATM and attempted to withdraw cash. Sure enough, the transaction was declined—both for withdrawal and balance check. I resigned myself to the fact that my card had been deactivated and planned to close the account.

So, I went to the branch to close my account. But, just before heading inside the branch, I tried one last time at the BOB ATM adjacent to the bank—and surprise, surprise! It worked! I successfully withdrew money. Immediately after, I redeemed my Amazon Prime Video offer on the RuPay website, and it worked perfectly!

It was a bumpy ride, but in the end, I managed to secure my RuPay Select Wellness Debit Card while keeping my costs low (₹2000 MAB+₹590 annual fee).

***Update 28/09/2024***

Debit Card will not be FYF with this route. Charged 590/- today.

There is only RuPay Select DI Debit Card in bob website there is no RuPay Select Wellness Debit Card

can u pls confirm the name of debit card?

You will be charged DC fees if you downgrade the account within the first 6 months of getting the DCs.Check the OP for Select Debit Card. Just open Super Savings Account with 20k IP and after Account opening apply for RSDC and EMT both Debit Cards by app itself. When both cards get delivered and activated, then visit the branch and fill a scheme change form (downgrade to Advantage Saving Account). And Voila! You will have 2 premium debit cards with only 2k AMB. Though these debit cards won't be LTF/FYF. But the benefits justifies the fee.

I know the same but I did not argue with the DBM as I was maintaining more than 25K and the bank has not notified me anything about the MAB change.

Rupay Select Wellness Debit Card is the one and only RSDC from BOB.Hi

There is only RuPay Select DI Debit Card in bob website there is no RuPay Select Wellness Debit Card

can u pls confirm the name of debit card?

https://www.bankofbaroda.in/personal-banking/digital-products/cards/debit-cardsYou will be charged DC fees if you downgrade the account within the first 6 months of getting the DCs.

I know the same but I did not argue with the DBM as I was maintaining more than 25K and the bank has not notified me anything about the MAB change.

Rupay Select Wellness Debit Card is the one and only RSDC from BOB.

i can only see RuPay Select DI Debit Card Here

can u also pls share link where u can see RuPay Select Wellness Debit Card of bob site

Shd i ask in branch to give RuPay Select Wellness Debit Card?

S U D O

TF Premier

+1https://www.bankofbaroda.in/personal-banking/digital-products/cards/debit-cards

i can only see RuPay Select DI Debit Card Here

can u also pls share link where u can see RuPay Select Wellness Debit Card of bob site

Shd i ask in branch to give RuPay Select Wellness Debit Card?

Same question

https://www.bankofbaroda.in/personal-banking/digital-products/cards/debit-cards

i can only see RuPay Select DI Debit Card Here

can u also pls share link where u can see RuPay Select Wellness Debit Card of bob site

Shd i ask in branch to give RuPay Select Wellness Debit Card?

BOB Wellness RSDC is named as RuPay Select DI Debit Card on the website. When you apply the card you will get the wellness variant, don't worry.+1

Same question

Apply using the BOB World App or net banking.

Sumedh03

TF Buzz

I applied for select yesterday at 6 pm but when I click view your cards it says card details not available.BOB Wellness RSDC is named as RuPay Select DI Debit Card on the website. When you apply the card you will get the wellness variant, don't worry.

Apply using the BOB World App or net banking.

View attachment 83391

Where can I see my card details and it's delivery status

Also should I apply emt now or wait for select to be seen on app and delivered.

within 3 - 4 days, delivery will take around 15 days via speed post.I applied for select yesterday at 6 pm but when I click view your cards it says card details not available.

Where can I see my card details and it's delivery status

You can order now, no need to wait.Also should I apply emt now or wait for select to be seen on app and delivered.

Thank you😀BOB Wellness RSDC is named as RuPay Select DI Debit Card on the website. When you apply the card you will get the wellness variant, don't worry.

Apply using the BOB World App or net banking.

View attachment 83391

Currently I have advantage account I will get it upgraded to super savings and then apply

Any idea regarding classic salary account will they provide Select DC for free?

Similar threads

Offer Fulfilled!

Bank Of Baroda - Rupay Select Debit Card Benefits vs Cost

- Replies

- 21

- Views

- 2K

- Replies

- 273

- Views

- 11K

- Question

- Replies

- 6

- Views

- 811