Credit Karma

TF Premier

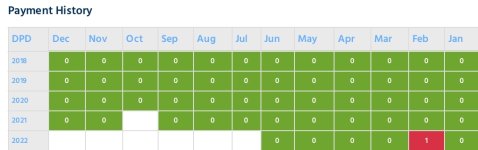

I have a 1 day late payment on my credit report in Feb 2022. It was wrongly marked by PNB. I am trying to get it removed but it is not yet removed.

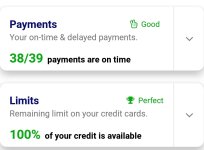

I have on-time payment ratio of 38/39 with 4.5+ years of credit history.

But I'm thinking that what happens if they don't remove it?

Will it affect my chances of getting approved for CC's?

Will I get pre-approved offers?

What impact will it have on future if it is not removed?

I have on-time payment ratio of 38/39 with 4.5+ years of credit history.

But I'm thinking that what happens if they don't remove it?

Will it affect my chances of getting approved for CC's?

Will I get pre-approved offers?

What impact will it have on future if it is not removed?