A small information those who looking for 'ultimate' card (nothing conclusively mentioned here, just a note).

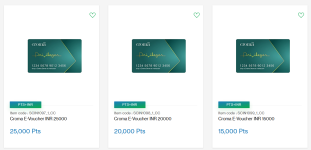

View attachment 10902

- as many of you aware, not all brands available in sc 360 portal.

- still if you okay with the available brands, do note that redemption must be as per their wish not based on your points.

Ex: I hope many of you try to redeem on ITC, Taj, Vistara or somewhat electronics based brands rather departmental store brands because that would reduce your overall return value. So, here as of now 'Chroma' available in only 3 denominations, so either you have to accumulate points within time to match those required points or can use 'pts+pay' (that is useless option and further reduce overall return value).

- Note, points has only '3 years validity' (better than some banks, just in case if not aware), so accumulate your points match to above required denomination in those 3 years.

- And another big note is that 'Voucher brands do change in those 3 years'. Example 'Chroma' may entirely dissappear in next 3 years (anything can happen!).

Now, to get 15,000 pts one must spend - 4,50,000 (very very few bonus offers in SC, so one can only get max 5000 like that when those offers running).

It must be done within 3 years = min. 150000/year (on tight budget).

Problem: By that time of 3 years, your option can also limited to like below too..

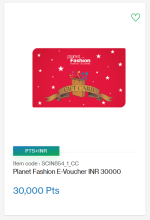

View attachment 10904

- Imagine your favorite brand here, this 'Planet Fashion' minimum denomination is 30,000 pts. So, by the time of expiring those points if one doesn't have required points (ex: In above example that person accumulated only 15,000 pts), either have to redeem some other brands or use 'pts+pay'.

---------

Few observations would like to share here, keep it in mind that reward based cards always dangerous one should be ready with whatever comes by the time of expiry date of points or one's accumulated with required points, anything can happen and we should be in a position to anticipate/digest those changes.

another observation:

If a person spend, 450000 to get 15,000 worth of Chroma voucher using 'Ultimate' card (with 900 GST), what will be the actual return (still 3.33%?) if one can get 15,000 worth of Chroma voucher on 5x using 'Magnus' card (12pts/200) or 'Select' card (less annual fee + 10pts/200) using their respective redemption options (worst case, 1RP=0.2p st.cr)?

View attachment 10907