Who doesn't want to hold premium credit cards with a high credit limit? Sometimes banks ask you to have a certain credit limit on your existing credit card before upgrading your credit card to a higher variant card. For example, HDFC Bank asks you to have a minimum of Rs. 8 lakh limit on your existing credit card before upgrading it to the HDFC Infinia credit card.

There are lots of benefits to having a high credit limit on your credit cards.

- Your card qualifies for an upgrade to a higher variant card.

- You'll have high spending power.

- You can maintain low utilisation ratio.

- Increased chances of approval if you apply for another credit card using that card (card to card method) and many more.

But how does one get limit enhancement?

There are two options to get credit limit enhancement on your credit card.

1. Automatic Limit Enhancement

2. Manual Limit Enhancement

1. Automatic Limit Enhancement:

You don't have to do anything to get an automatic limit enhancement offer from the bank. Just use your credit card regularly and pay your credit card bill on time. That's it. The bank will review your credit card account from time to time (normally every 6 months) and offer you an automatic limit enhancement. You'll get a call/sms/email/app notification from the bank.

2. Manual Limit Enhancement:

There are a few methods you can use to request credit limit enhancement from your bank.

a. Call & Ask:

Remember one thing... If you don't ask for something, you'll not get it. So, call your bank and ask for a limit enhancement. Sometimes customer care officers do provide limit enhancement. You can also email your bank and ask for a limit enhancement.

b. Submit income documents:

you can email your income documents (i.e., salary slip, ITR) to your bank and ask for limit enhancement. The bank will review your income documents and may offer a limit enhancement.

c. Maintaining High NRV:

If you are maintaining a high NRV with your card issuer bank, then ask for an extra limit. Some banks do offer limit enhancement if you maintain a high relationship value with your bank. You can email and request a limit enhancement on the basis of your NRV.

d. Limit Enhancement On The Basis Of Other Bank Credit Cards' Limit:

Yes, a few banks offer credit card limit enhancement on the basis of your other bank credit cards' limit. It's just like a hotel loyalty programme status match.

For example, if you have a 12L limit on your HDFC Bank credit card, you can email your card statement to ICICI Bank and ask for a limit match. Sometimes the bank matches your limit; sometimes they ask for additional proof like an ITR or salary slip. This is not an official way of asking for limit enhancement, but yes, a few banks do offer limit enhancement this way. So you can try your luck.

I have used this method multiple times to match one bank's credit card limit to another bank's card.

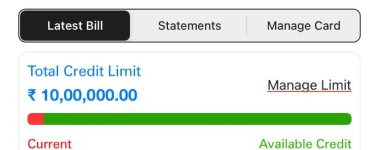

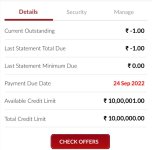

Here I'm attaching some screenshots-

My ICICI Bank Credit Card limit -

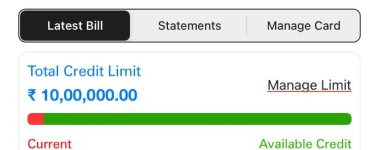

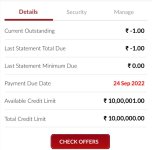

My BOB Card Limit-

My IndusInd Bank Card Limit-

Credit card limit enhancement depends on many factors, so nothing is guaranteed.

Try your luck.

There are lots of benefits to having a high credit limit on your credit cards.

- Your card qualifies for an upgrade to a higher variant card.

- You'll have high spending power.

- You can maintain low utilisation ratio.

- Increased chances of approval if you apply for another credit card using that card (card to card method) and many more.

But how does one get limit enhancement?

There are two options to get credit limit enhancement on your credit card.

1. Automatic Limit Enhancement

2. Manual Limit Enhancement

1. Automatic Limit Enhancement:

You don't have to do anything to get an automatic limit enhancement offer from the bank. Just use your credit card regularly and pay your credit card bill on time. That's it. The bank will review your credit card account from time to time (normally every 6 months) and offer you an automatic limit enhancement. You'll get a call/sms/email/app notification from the bank.

2. Manual Limit Enhancement:

There are a few methods you can use to request credit limit enhancement from your bank.

a. Call & Ask:

Remember one thing... If you don't ask for something, you'll not get it. So, call your bank and ask for a limit enhancement. Sometimes customer care officers do provide limit enhancement. You can also email your bank and ask for a limit enhancement.

b. Submit income documents:

you can email your income documents (i.e., salary slip, ITR) to your bank and ask for limit enhancement. The bank will review your income documents and may offer a limit enhancement.

c. Maintaining High NRV:

If you are maintaining a high NRV with your card issuer bank, then ask for an extra limit. Some banks do offer limit enhancement if you maintain a high relationship value with your bank. You can email and request a limit enhancement on the basis of your NRV.

d. Limit Enhancement On The Basis Of Other Bank Credit Cards' Limit:

Yes, a few banks offer credit card limit enhancement on the basis of your other bank credit cards' limit. It's just like a hotel loyalty programme status match.

For example, if you have a 12L limit on your HDFC Bank credit card, you can email your card statement to ICICI Bank and ask for a limit match. Sometimes the bank matches your limit; sometimes they ask for additional proof like an ITR or salary slip. This is not an official way of asking for limit enhancement, but yes, a few banks do offer limit enhancement this way. So you can try your luck.

I have used this method multiple times to match one bank's credit card limit to another bank's card.

Here I'm attaching some screenshots-

My ICICI Bank Credit Card limit -

My BOB Card Limit-

My IndusInd Bank Card Limit-

Credit card limit enhancement depends on many factors, so nothing is guaranteed.

Try your luck.