Do you hold an ICICI Bank Amazon Pay Credit Card? And want to have a regular ICICI Bank Credit card?

Actually, the Amazon Pay card doesn't work on all ICICI Bank sales & offer campaigns. We get less discount on Amazon than on regular ICICI Bank credit cards on ICICI sales campaigns.

So having a regular ICICI Bank credit card is essential.

But what to do if you don't want to apply for another ICICI credit card or don't want another hard enquiry on your CIBIL or ICICI Bank is not approving your credit card application.

Solutions-

Open iMobile App & Select Amazon Pay Credit Card From Credit Card Menu

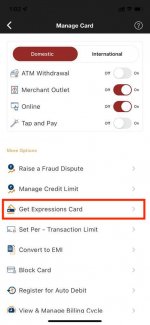

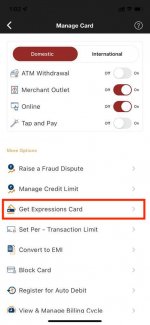

Click On Manage Card -> Under "More Options" Click On "Get Expressions Card"

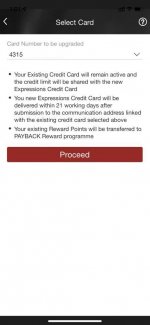

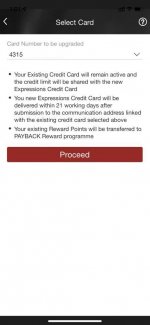

Accept T&C Upload Your Pic Or Select Card Design From Galaxy And Submit Your Request.

You can apply for ICICI Expressions Credit Card and it will be issued within 21 days.

Now, you can continue using Expressions card, or you may call ICICI Bank customer care and request them to upgrade from Expressions credit card to any regular ICICI Bank Credit card (ICICI Platinum/ICICI Coral/ICICI Rubyx/ICICI Sapphiro or even ICICI Emeralde if you meet the minimum limit requirement).

ICICI Bank's customer care agent may not accept your request to convert Expressions card to Platinum card, but it's possible, you have to call again and again to try your luck.

If you cancel your Expressions card within 15 days from card issuance, you'll not be charged any joining fees.

Note - If you already have regular ICICI Bank credit cards, this process will not work for you.

Actually, the Amazon Pay card doesn't work on all ICICI Bank sales & offer campaigns. We get less discount on Amazon than on regular ICICI Bank credit cards on ICICI sales campaigns.

So having a regular ICICI Bank credit card is essential.

But what to do if you don't want to apply for another ICICI credit card or don't want another hard enquiry on your CIBIL or ICICI Bank is not approving your credit card application.

Solutions-

Open iMobile App & Select Amazon Pay Credit Card From Credit Card Menu

Click On Manage Card -> Under "More Options" Click On "Get Expressions Card"

Accept T&C Upload Your Pic Or Select Card Design From Galaxy And Submit Your Request.

You can apply for ICICI Expressions Credit Card and it will be issued within 21 days.

Now, you can continue using Expressions card, or you may call ICICI Bank customer care and request them to upgrade from Expressions credit card to any regular ICICI Bank Credit card (ICICI Platinum/ICICI Coral/ICICI Rubyx/ICICI Sapphiro or even ICICI Emeralde if you meet the minimum limit requirement).

ICICI Bank's customer care agent may not accept your request to convert Expressions card to Platinum card, but it's possible, you have to call again and again to try your luck.

If you cancel your Expressions card within 15 days from card issuance, you'll not be charged any joining fees.

Note - If you already have regular ICICI Bank credit cards, this process will not work for you.