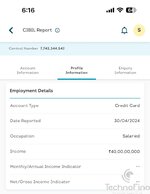

PNB Platinim closed in cibil but balance due 4,407 - (upgraded to pnb select new account in cibil)Hi bro well first you need to identify which accounts to clean up in CIBIL and then call/email the banks and keep following up with them until the cards are closed and/or removed from CIBIL. It is a pain and you need a lot of patience... Especially when it comes to removing the accounts from CIBIL.

For me Citi was the easiest to deal with and BoB was the most difficult. IndusInd took around two weeks to close the card and around a month to remove it from CIBIL. BoB also took more than a week to close the cards but it took close to two months and endless follow ups to remove the cards from CIBIL. I had to escalate it until PNO to get the cards removed. HDFC is another story, the cards were closed immediately and removed from CIBIL but another card that I closed long ago was still stuck there like a ghost. I had to do multiple follow ups to get that one removed. And then the cards were still showing up in netbanking and had to raise yet another request to get those removed. Reducing CL was easy though they all tried a lot to talk me out of it.

HDFC Regalia rupay not closed - balance 3,45,701 (changed to mastercard network - new account in cibil)

IDFC classic - balance 0 (account not closed yet in CIBIL) - (reapplied wealth cc new account in cibil)

HSBC platunim - not closed in cibil balance 21,817 - (upgraded to HSBC Cashback - new account in cibil)

will have to follow up with bank.. thanks