CosmicCat

TF Ace

I earned around ₹12 Short-Term Capital Gains (STCG) this financial year (FY 2023-24) by closing several debt mutual funds, which I had opened this financial year only just for exploration, as I got started with Mutual Funds recently. Their total purchase amount was around ₹5,000 only.

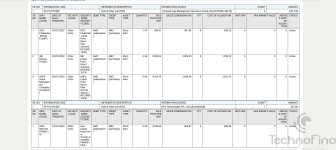

I have attached a picture here of how it is reported in my AIS.

I have been filing ITR-4 all these years as I'm a Self-Employed Professional (Software Engineer) and availed 44ADA each time.

AFAIK, ITR-4 doesn't have any provision to mention capital gains, because I have been filing my taxes myself all these years, and never noticed the option to mention capital gains.

So, should I file ITR-3 by mentioning this ~₹12 STCG? Or continue filing ITR-4 (To avail 44ADA) and exclude this STCG?

As I don't have any CA to seek guidance from nearby me, so can please anybody help me out with this query? I would really appreciate your help.

I have attached a picture here of how it is reported in my AIS.

I have been filing ITR-4 all these years as I'm a Self-Employed Professional (Software Engineer) and availed 44ADA each time.

AFAIK, ITR-4 doesn't have any provision to mention capital gains, because I have been filing my taxes myself all these years, and never noticed the option to mention capital gains.

So, should I file ITR-3 by mentioning this ~₹12 STCG? Or continue filing ITR-4 (To avail 44ADA) and exclude this STCG?

As I don't have any CA to seek guidance from nearby me, so can please anybody help me out with this query? I would really appreciate your help.

Attachments

Last edited: