ICICI Bank recently launched its flagship credit card, the ICICI Bank Emeralde Private Metal Credit Card. It was issued to a select few individuals in India. However, within a few days of the launch, ICICI Bank decided to devalue this product.

The devaluation occurred when ICICI Bank silently updated the MITC of the Emeralde Private Metal Credit Card on November 1, 2023. If customers want to redeem their reward points against a statement credit, they will now receive 1 reward point = Rs. 0.40, whereas it was previously 1 reward point = Rs. 1.

It's unclear why ICICI Bank made this change without public notification and without providing a 30-day notice period. Regardless, it's worth noting that ICICI Bank has a history of not strictly adhering to RBI guidelines.

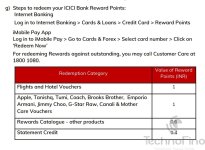

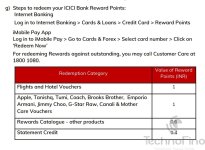

Old (5th Oct, 2023) and New (1st Nov, 2023) MITC cooy attached.

The devaluation occurred when ICICI Bank silently updated the MITC of the Emeralde Private Metal Credit Card on November 1, 2023. If customers want to redeem their reward points against a statement credit, they will now receive 1 reward point = Rs. 0.40, whereas it was previously 1 reward point = Rs. 1.

It's unclear why ICICI Bank made this change without public notification and without providing a 30-day notice period. Regardless, it's worth noting that ICICI Bank has a history of not strictly adhering to RBI guidelines.

Old (5th Oct, 2023) and New (1st Nov, 2023) MITC cooy attached.