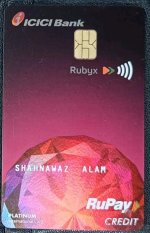

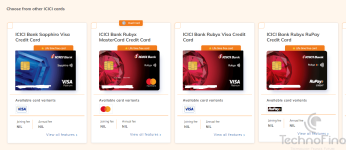

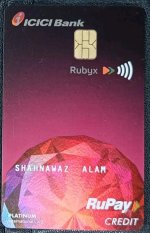

ICICI launch RuPay Rubyx Credit Card | Offers & details:

Welcome Benefits:

Travel & shopping vouchers worth Rs. 5,000 or more as a welcome gift.

You get the welcome gift within 30 days after payment of the joining fee.

Milestone Benefits:

You get 3,000 Reward Points on spending Rs. 3 lakhs and 1,500 Reward Points for every subsequent spends of Rs. 1 lakh in an anniversary year.

A maximum of 15,000 additional Reward Points can be earned in a year as a Milestone benefit.

The renewal fee is waived off on a minimum expenditure of Rs. 3 lakh in the previous year.

Discounts on BookMyShow

- Avail 25% discount upto Rs.150 on purchase of minimum 2 movie tickets per transaction on www.bookmyshow.com. The offer can be availed two times in a month

- Successful booking is on first come first serve basis and is subject to daily stock availability.

- To book your movie ticket and for detailed Terms & Conditions, please click here.

Discount on Booking at INOX

- Avail 25% discount upto Rs.150 on purchase of minimum 2 movie tickets per transaction on www.inoxmovies.com, Inox app or Inox Box Office. The offer can be availed two times in a month

- Successful booking is on first come, first-serve basis and is subject to daily stock availability

- Book your ticket now on www.inoxmovies.com

- Enrich your travel experience with complimentary access to select lounges at airports and railway stations in India with your ICICI Bank Rubyx RuPay Credit Card. To avail, please present your card at the lounge reception

- Eligible cardholders holding the ICICI Bank Rubyx RuPay Credit Card are entitled to 2 complimentary railway lounge visits per quarter.

- Eligible cardholders holding the ICICI Bank Rubyx RuPay Credit Card are entitled to 2 complimentary airport lounge accesses per quarter by spending minimum of Rs 5,000 or above in a calendar quarter on the card to avail this facility in the next calendar quarter. Over and above the allowed number of complimentary visits, each subsequent visit will be charged as per rates applicable to each lounge service provider.

- Access to railway lounges will be applicable only for primary cardholders.

- Eligible cardholders must present their valid, unexpired eligible cards, and a valid air ticket or boarding pass for travel on the same or next day, at the entrance to the Participating Lounges

- An authorisation amount of Re. 1 shall be taken on each eligible card presented at the entrance to the Participating Lounge

1% fuel surcharge waived off on fuel transactions at any fuel outlet.

Rubyx Credit Card Fees and Charges

| Fee | Charges |

|---|---|

| First year annual fee | Rs 3,000 plus GST |

| Second year onwards annual fee | Rs 2,000 plus GST (Waived on spending Rs 3,00,000 and more) |

| Finance charge for cash advance | 3.40% per month |

| Overdue interest in extended credit | 3.40% per month |

| Over-limit charge | 2.50% of over-limit amount, subject to a minimum of Rs 500 |

| Cash advance charge | 2.50% of advanced amount, subject to a minimum of Rs 300 |

| Redemption handling fee | Rs 99 |

| Late payment charge |

|

| Return cheque fee | 2% of amount due, subject to a minimum of Rs 450 |

| Auto-Debit return fee | 2% of amount due, subject to a minimum of Rs 450 |

| Cash payment at branches fee | Rs 100 per transaction |

| Outstation cheque processing fee | 1% of cheque value, subject to a minimum of Rs 100 |

| Foreign currency transaction fee | 3.5% of transacted/converted amount |

| Duplicate statement | Rs 100 |

| Card replacement fee | Rs 100 |

| Charge slip fee | Rs 100 per slip |

- You pay a Joining Fee of ₹ 3,000 + goods and services tax and get welcome vouchers of shopping and travel worth Rs 5000+ within 30 days of payment of joining fees.

- You Pay an Annual Fee of ₹ 2,000 + goods and services tax from 2nd year onwards. This fee is waived off if you spend more than ₹ 3,00,000 in the previous year.