Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

-

Hey there! Welcome to TFC! View fewer ads on the website just by signing up on TF Community.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

IDFC First Bank Debit Card Rewards Mess – Customers Harassed for Bank’s Mistake?

- Thread starter TechnoFino

- Start date

- Replies 105

- Views 7K

Did you get mail or while redeeming you noticed ?i have 80k points blocked redemption 😭

Don’t know what’s going on. The bank patched a loophole that many took advantage of. Closing accounts because of this is not great. We should be grateful to the bank for the benefits we have received so far and support them, as no other bank has offered such advantages. Moreover, IDFC has the best app interface and provides the highest interest rates on savings accounts.

vickyprasad

TF Buzz

Getting error on redemption " points redemption failed, Please try again later."Did you get mail or while redeeming you noticed ?

Tamraj Kilvish

TF Premier

I wish other banks don't do follow this, else we will get only 1 to 2 rupees on cc payment from Cred Mobikwik or any other 😭

Isse acha Autopay rakh lo and peace of mind.I wish other banks don't do follow this, else we will get only 1 to 2 rupees on cc payment from Cred Mobikwik or any other 😭

NIKHILIRM

TF Buzz

Recently, the IDFC First Bank debit card became a hot topic in the rewards community. The reason? It had one of the most lucrative reward systems in force. Customers quickly discovered new ways to maximize these rewards across different types of payments.

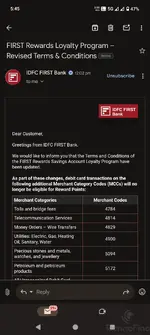

In particular, many in the credit card community began paying lakhs of credit card bills using the IDFC First Bank debit card — earning about 2.5% value back. Crazy, right? Even the bank thought so. Soon, they imposed multiple MCC (merchant category code) restrictions to block rewards for credit card bill payments.

But as the saying goes: if there’s a will, there’s a way. People always find loopholes. That’s where fintech apps entered the scene.

Wrong MCC Tagging – A Known Scam

If you remember, I had previously posted about how wrong MCC tagging is a common scam in India.

These mismatches aren’t “mistakes.” Payment gateway providers verify documents before assigning MCCs, so when this happens, they are 100% responsible. Yet, it’s the customers who suffer the consequences later.

- A grocery shop runs a POS machine categorized as a fuel station.

- An online gift voucher platform shows up as a hotel merchant.

The Current Problem

After IDFC First Bank restricted several MCCs, some fintech apps began offering credit card bill payment via debit cards, using MCCs that weren’t blocked.

And now comes the million-dollar question:

- Customers paid lakhs of rupees in credit card bills.

- In return, they earned lakhs worth of reward points.

Whose fault is this? Customers? Absolutely not.

How IDFC Responded

Instead of admitting the loophole, IDFC First Bank began calling customers and interrogating them:

At first, these questions sound fine — a bank must ensure savings accounts aren’t misused for business purposes.

- “What is the source of your funds?”

- “Are these business transactions?”

But then they went further. They started asking:

Really? Now the bank will decide which app I should use to pay my own bills?

- “Why did you use VI, Goodscore, etc. to pay your credit card bills? Why not CRED?”

It didn’t stop there. They accused customers of exploiting rewards, pointed to their redemption history, and in some cases, froze accounts citing ‘suspicious activity.’ And if you’ve ever dealt with IDFC freezes, you know how tough it is — local branches barely help, and accounts remain frozen for weeks or months.

And they didn’t stop there. They went a step further and even blocked a few merchants. For example, when customers tried paying their credit card bills on Zavo, the transactions failed right after entering the OTP on the payment page. Imagine this — I have my own money in my bank account, but I can’t use it to pay my bill through Zavo. This feels like dictatorship, and I’m honestly surprised that no concerned authority has taken any action till now.

Serious Concerns That Arise

This approach makes no sense. If IDFC doesn’t want rewards to be earned on certain apps, they should:

- Why is IDFC First Bank forcing customers to use CRED while questioning them for using other legitimate apps like VI or Goodscore?

- A debit card is linked to our own money. Unless the government has restricted something, we should have full freedom to decide where we spend it. Where does IDFC First Bank get the authority to dictate which apps we can use?

- How can a bank block certain merchants when they are not illegal? Just because they have to give rewards, they can’t simply block a merchant.

But what they cannot do is harass customers who are simply using legal apps in India.

- Impose more MCC restrictions, or

- Shut down the debit card rewards program altogether.

The Real Issue

It looks like IDFC First Bank’s debit card product manager made a blunder by offering rewards at an unsustainably high rate. And now, instead of taking accountability, the bank is shifting the blame onto customers.

What You Can Do (Solution)

If you have received such calls or had your account frozen by IDFC First Bank:

If the bank still doesn’t resolve your issue, escalate further by filing a complaint with the RBI Banking Ombudsman portal.

- Write to IDFC’s Principal Nodal Officer (PNO) department.

- Ask the same questions raised above.

- Share this thread if needed as reference.

- Demand a clear resolution.

Now they have stopped. Problem solved.

Attachments

tempmirzaa

TF Premier

Any Bank should start showing MCC code on OTP page.

Why should customers guess where the transaction is tagged grocery, fuel, hotel, or gift voucher?

Wrong MCC tagging no rewards customer frustration.

Why should customers guess where the transaction is tagged grocery, fuel, hotel, or gift voucher?

Wrong MCC tagging no rewards customer frustration.

kimikfuria

TF Buzz

IDFC seems to have a review of the funds flow on the account, from source of funds to destination to avoid any suspicious transaction like Money La_ndering and T_rriost Fin_ncing and mostly they are just monitoring the transactions.

I work for revolut and based on the above post its just to avoid and bad reputation to the bank and RBI has strict guidelines against this and no one of us would like being under scrutiny for PMLA 🙂

I work for revolut and based on the above post its just to avoid and bad reputation to the bank and RBI has strict guidelines against this and no one of us would like being under scrutiny for PMLA 🙂

Whats revolut. ?IDFC seems to have a review of the funds flow on the account, from source of funds to destination to avoid any suspicious transaction like Money La_ndering and T_rriost Fin_ncing and mostly they are just monitoring the transactions.

I work for revolut and based on the above post its just to avoid and bad reputation to the bank and RBI has strict guidelines against this and no one of us would like being under scrutiny for PMLA 🙂

Dr.AMAN

TF Ace

Revolut is a british neobank. I have seen a few European NRIs carrying the revolut card in their wallet when they come to India. It looks dopeWhats revolut. ?

yeah right. they didn't care anything for years & when their net profit suddenly declined by 32% they remembered all these rules & regulations.IDFC seems to have a review of the funds flow on the account, from source of funds to destination to avoid any suspicious transaction like Money La_ndering and T_rriost Fin_ncing and mostly they are just monitoring the transactions.

I work for revolut and based on the above post its just to avoid and bad reputation to the bank and RBI has strict guidelines against this and no one of us would like being under scrutiny for PMLA 🙂

nobody in india cares about rules as long as they make money, but when profit goes down, the aam admi gets blamed.

Same like our IT companies. When they are in profit, give peanuts bonus but when it declines, layoff the entire team.nobody in india cares about rules as long as they make money, but when profit goes down, everything gets scrapped.

515451 weath debit card points in May 2025 without using for such payments? 🤔First of all, I have 800 reward points on my IDFC First Bank account. I don’t use the IDFC Bank debit card to pay my credit card bills, and everything I’ve mentioned here is based on the experiences of other members, not my own. So, I don’t have any strong reason to be upset with IDFC First Bank. In fact, my primary bank account is with IDFC First, and I’m quite satisfied with their services. However, that doesn’t mean I won’t question them if I come across something that seems wrong.

Absolutely, if the bank detects any suspicious activity, they should monitor, question the customer, and even block transactions if necessary. But as a general rule, banks usually verify by contacting the customer and then allow future transactions. Remember, Zavo is not illegal, nor are they engaged in anything that warrants being blocked by banks. And this issue is not limited to Zavo, recently, IDFC First Bank has blocked a few other merchants as well. Most importantly, this is not a credit card transaction but a debit card transaction. A bank cannot restrict a customer from using their own money. All this drama seems to have been done just to stop customers from earning reward points. If that was the intention, the bank could have simply excluded the MCC, but instead, they chose other methods, which is not correct.

I don’t know why you think I’m being silly, but after reading this, I’m quite sure you’re not fully aware of customers’ rights. In India, a customer can open a bank account with any bank of their choice. Just as a customer cannot dictate terms to a bank, a bank also cannot dictate which apps or platforms a customer is allowed to use.

As I mentioned, I personally don’t use IDFC debit cards for such payments. If I were affected, I would definitely escalate the matter to the RBI Ombudsman or even the consumer court. And I strongly suggest that those who are directly affected should take this step, because that’s the only way we’ll get proper resolution.

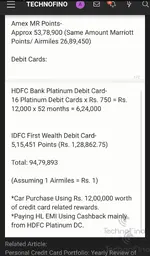

Recently, I posted a video on the TechnoFino YouTube channel where I shared how I’ve earned over ₹1 crore worth of credit card reward points in the last few years.

Yes, you read that right - ₹1 crore worth of rewards, purely through smart and disciplined use of credit cards.

Credit cards are an amazing financial tool if used responsibly. They can help you save money, earn travel benefits, and enjoy exclusive perks. But if you want to maximize your reward points, you need to follow a few golden rules:

1. Choose Your Credit Card Wisely...

Yes, you read that right - ₹1 crore worth of rewards, purely through smart and disciplined use of credit cards.

Credit cards are an amazing financial tool if used responsibly. They can help you save money, earn travel benefits, and enjoy exclusive perks. But if you want to maximize your reward points, you need to follow a few golden rules:

1. Choose Your Credit Card Wisely...

- TechnoFino

- 1 crore credit card reward points credit card credit card reward points reward reward points

- Replies: 17

- Forum: Super Premium Credit Cards

Attachments

515451 weath debit card points in May 2025 without using for such payments? 🤔

View attachment meme.mp4

I am worried for your account brother 😂515451 weath debit card points in May 2025 without using for such payments? 🤔

Recently, I posted a video on the TechnoFino YouTube channel where I shared how I’ve earned over ₹1 crore worth of credit card reward points in the last few years.

Yes, you read that right - ₹1 crore worth of rewards, purely through smart and disciplined use of credit cards.

Credit cards are an amazing financial tool if used responsibly. They can help you save money, earn travel benefits, and enjoy exclusive perks. But if you want to maximize your reward points, you need to follow a few golden rules:

1. Choose Your Credit Card Wisely...

- TechnoFino

- 1 crore credit card reward points credit card credit card reward points reward reward points

- Replies: 17

- Forum: Super Premium Credit Cards

But Respect++

Old brother, I’m done with this. I redeemed all my points long ago, I've mainly used their card back when they first launched their reward system.515451 weath debit card points in May 2025 without using for such payments? 🤔

Recently, I posted a video on the TechnoFino YouTube channel where I shared how I’ve earned over ₹1 crore worth of credit card reward points in the last few years.

Yes, you read that right - ₹1 crore worth of rewards, purely through smart and disciplined use of credit cards.

Credit cards are an amazing financial tool if used responsibly. They can help you save money, earn travel benefits, and enjoy exclusive perks. But if you want to maximize your reward points, you need to follow a few golden rules:

1. Choose Your Credit Card Wisely...

- TechnoFino

- 1 crore credit card reward points credit card credit card reward points reward reward points

- Replies: 17

- Forum: Super Premium Credit Cards

This is my primary account and they never asked anything from me.I am worried for your account brother 😂

But Respect++

I think he meant it like " you just called out the owner of Technofino, may your account rest in peace " in a fun jovial way 😅This is my primary account and they never asked anything from me.

Similar threads

- Replies

- 11

- Views

- 455

- Replies

- 44

- Views

- 8K

- Replies

- 92

- Views

- 9K

- Article

- Replies

- 3

- Views

- 406