Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

-

Hey there! Welcome to TFC! View fewer ads on the website just by signing up on TF Community.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

IDFC First Bank is Not Following RBI Guidelines

- Thread starter TechnoFino

- Start date

- Replies 87

- Views 8K

If you do 10 upi transactions per day straight for 5 days, they'll freeze your savings account as well 😂😂😂

EternallyHopeful

TF Premier

Looks like many banks are doing this and flagrantly violating RBI guidelines. Thanx for bringing people's attention to this issue and spreading awareness. And do let us know what response you eventually get from IDFC and what action they eventually take.

Aniket

TF Prestige

Not happened in my case. 😐Same happened with me in case of Kotak.

I simply went ahead and told them to close the card as I found their practice in violation of guidelines.

Kisi mein kuch kisi mein kuch

Master Direction – Credit Card and Debit Card – Issuance and Conduct Directions, 2022 (Updated as on March 07, 2024)Please share the full guidelines. I will attach the file with the removal request email.

Point no. 6. a. vii.

Link: https://rbi.org.in/Scripts/BS_ViewMasDirections.aspx?id=12300

see my above message, if the card was closed without activating it... only then email kotak and request them to remove, if they don't file complaint with the rbi.Ok I have closed my kotak zen card in February month till now account is not deleted from my cibil report. What I have to do?

Maybe 10 or 20 people apply for review purposes, but 99.99% of people apply to actually use the card. I also applied to use the card for one year, but since IDFC First messed up with regulatory guidelines, I’ll definitely hold them accountable.While bank is on wrong side of RBI guidelines in this case, they will surely seek clarification/modification in guidelines regarding charges if people start using this loophole to get cards for reviewing/trophy collection. It costs them money to print and deliver a card, specially a metallic one.

Also bank might block the user for any new card in future (remember card issuance is issuer's discretion, its not a users right)

anisharya16

TF Premier

Same happened with me with SBI pulse. Some agent told me it's LTF, so I applied, but after receiving I did not activate the card, after few days I got statement which had annual fees mentioned. I understand that I got scammed, but even if it was a paid card I had applied for, if I didn't activate the card how come they generate statement with annual fees.

Nirmal Andy

TF Buzz

Even SBI charges joining fee before activating card, I see few people posted on FB.Hello TFCians,

Recently, I applied for the IDFC First Mayura Credit Card just for review purposes, as this card is not value for money, as I mentioned in my review article. I only planned to hold it for the first year. I've written a detailed review of this product, which you can check here: https://www.technofino.in/community...eview-is-it-truly-a-super-premium-card.31050/

After applying for the credit card, my application was approved within seconds, and the Mayura card began reflecting on my IDFC First mobile app within minutes. I hadn't activated the card, nor had I created a PIN. Essentially, I just applied, got approved, and did nothing further. Five days later, my Mayura card was delivered. Upon checking the IDFC First Bank app after delivery, I was shocked to find a charge of ₹7,078.82 on my Mayura card.

View attachment 68278

According to RBI guidelines, the bank cannot charge a joining fee until you activate the card. I decided not to activate the card and raised the issue with IDFC First Bank to understand why they weren't adhering to the guidelines.

To my further surprise, the next day, I received an SMS from CIBIL informing me that a new account had been added to my CIBIL report. When I checked my report, I found that IDFC First Bank had added the IDFC First Mayura credit card account, even though I hadn't activated the card yet.

View attachment 68277

As per RBI guidelines, the bank cannot add a newly opened credit card account to CIBIL or any other credit bureau report until the customer activates the card. But IDFC First Bank is doing the opposite. I don’t understand how such a well-established bank can fail to follow such basic guidelines.

While I know the rule and won’t accept any justification from the bank, many people may not be aware of these regulations and could be misled by the banks themselves. The RBI should take strict action against such banks to ensure they adhere to the guidelines, and banks must start following the rules out of fear of stringent action from the RBI.

RajeshV

TF Premier

I'm unable to understand how the guideline you quoted means this. It only says it should be closed without charges if not activated. So they're allowed to waive the charges and thereby not charge you, no?According to RBI guidelines, the bank cannot charge a joining fee until you activate the card. I decided not to activate the card and raised the issue with IDFC First Bank to understand why they weren't adhering to the guidelines.

aparnahm

TF Premier

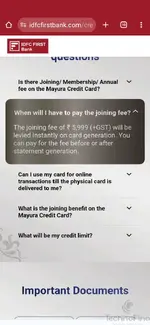

Answer to your post. I have an invite to apply for the card, saw this when I clicked on the link.Hello TFCians,

Recently, I applied for the IDFC First Mayura Credit Card just for review purposes, as this card is not value for money, as I mentioned in my review article. I only planned to hold it for the first year. I've written a detailed review of this product, which you can check here: https://www.technofino.in/community...eview-is-it-truly-a-super-premium-card.31050/

After applying for the credit card, my application was approved within seconds, and the Mayura card began reflecting on my IDFC First mobile app within minutes. I hadn't activated the card, nor had I created a PIN. Essentially, I just applied, got approved, and did nothing further. Five days later, my Mayura card was delivered. Upon checking the IDFC First Bank app after delivery, I was shocked to find a charge of ₹7,078.82 on my Mayura card.

View attachment 68278

According to RBI guidelines, the bank cannot charge a joining fee until you activate the card. I decided not to activate the card and raised the issue with IDFC First Bank to understand why they weren't adhering to the guidelines.

To my further surprise, the next day, I received an SMS from CIBIL informing me that a new account had been added to my CIBIL report. When I checked my report, I found that IDFC First Bank had added the IDFC First Mayura credit card account, even though I hadn't activated the card yet.

View attachment 68277

As per RBI guidelines, the bank cannot add a newly opened credit card account to CIBIL or any other credit bureau report until the customer activates the card. But IDFC First Bank is doing the opposite. I don’t understand how such a well-established bank can fail to follow such basic guidelines.

While I know the rule and won’t accept any justification from the bank, many people may not be aware of these regulations and could be misled by the banks themselves. The RBI should take strict action against such banks to ensure they adhere to the guidelines, and banks must start following the rules out of fear of stringent action from the RBI.

Attachments

Avatar Aang

TF Ace

Same thing with SC and Amex cards. They come pre activated and JF is posted even if you don't activate the card.

Mentioning fees will be charged instantly, doesn't justify this... coz rbi already instructed banks to not to do that.Answer to your post. I have an invite to apply for the card, saw this when I clicked on the link.

If not activated in 30 days, bank have to close the card without any fees, so why would a bank post joining fees even before card activation? Why would a customer contact bank and ask for reversal of joining fees in case they want to close the card without activating it....I'm unable to understand how the guideline you quoted means this. It only says it should be closed without charges if not activated. So they're allowed to waive the charges and thereby not charge you, no?

aparnahm

TF Premier

My intention was to show their blatancy. I am not justifying their behaviour. Pls check my 2nd comment in the thread.Mentioning fees will be charged instantly, doesn't justify this... coz rbi already instructed banks to not to do that.

vivian

TF Buzz

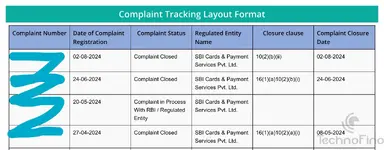

Same experience from SBICARD. SBICard activated CC without consent, charged joining fee and reported non payment of joining fee and penalty to CIBIL. Refused to close the card after 30 days of non-activation, refused to reverse the joining fee, refused to withdraw late payment report made to CIBIL. SBICARD Nodal Officer lied to RBI BO shamelessly.

6 months since I first reported to SBICARD and almost 5 months since I reported to RBI BO. RBI BO complaint in process since last 110+ days. I still haven't even opened the CC package. Hope RBI BO wakes up before SBICARD charges me with next year renewal fee.

CC issuers are taking RBI on a ride.

6 months since I first reported to SBICARD and almost 5 months since I reported to RBI BO. RBI BO complaint in process since last 110+ days. I still haven't even opened the CC package. Hope RBI BO wakes up before SBICARD charges me with next year renewal fee.

CC issuers are taking RBI on a ride.

vivian

TF Buzz

I am actually waiting since March 2024. Still my non activated CC account with SBICard isn't removed from my CIBIL even after 135 days of taking the matter to RBI BO with all proofs.Actually you can ask IDFC First bank to remove the entry from your CIBIL, RBI has clearly mentioned that if bank added a credit account before card activation, they have to remove the account from cibil within 30 days.

PS : My RBI BO complaint is still in process. Will update if and when RBI BO wakes up and choose violence.

Neo

TF Select

I am curious to know how customer care of IDFC has responded in this regard.

In my case, I reached out to IndusInd Bank to enquire about the no charge of joining fee if I don't activate the credit card.

In two different calls , the L1 support team has mentioned to me that I have to pay the card joining fee even if choose not to activate the card 😱 and by default the card is in Active status. In one call, they provided a reasoning that my credit card has been delivered through Bluedart and I shared the OTP with Bluedart to confirm the delivery. And this is sufficient for the bank to put my card in active status. I am not sure whether card 'Active' status is different from 'Activating' the card. L1 support team claims that Card Active Status = Joining fee will be charged.

In my case, I reached out to IndusInd Bank to enquire about the no charge of joining fee if I don't activate the credit card.

In two different calls , the L1 support team has mentioned to me that I have to pay the card joining fee even if choose not to activate the card 😱 and by default the card is in Active status. In one call, they provided a reasoning that my credit card has been delivered through Bluedart and I shared the OTP with Bluedart to confirm the delivery. And this is sufficient for the bank to put my card in active status. I am not sure whether card 'Active' status is different from 'Activating' the card. L1 support team claims that Card Active Status = Joining fee will be charged.

Deleted member 28936

TF Select

As far as I remember, I applied for the SC Ultimate card and they charged 5k on the first day but I never activated the card (and did nothing, never called them and never picked their call). After the 30 days, they sent me the second month statement refunding that charge in the statement and closing the card as it was not activated.If not activated in 30 days, bank have to close the card without any fees, so why would a bank post joining fees even before card activation? Why would a customer contact bank and ask for reversal of joining fees in case they want to close the card without activating it....

write a detail thread on it... I'll surely amplify this for you.Same experience from SBICARD. SBICard activated CC without consent, charged joining fee and reported non payment of joining fee and penalty to CIBIL. Refused to close the card after 30 days of non-activation, refused to reverse the joining fee, refused to withdraw late payment report made to CIBIL. SBICARD Nodal Officer lied to RBI BO shamelessly.

6 months since I first reported to SBICARD and almost 5 months since I reported to RBI BO. RBI BO complaint in process since last 110+ days. I still haven't even opened the CC package. Hope RBI BO wakes up before SBICARD charges me with next year renewal fee.

CC issuers are taking RBI on a ride.

View attachment 68382

Similar threads

- Replies

- 13

- Views

- 2K

- Replies

- 7

- Views

- 393

- Replies

- 11

- Views

- 607

- Replies

- 92

- Views

- 9K