Credit Cardiya

TF Buzz

I recently received a call from a guy claiming to be from IDFC Bank. Based on my research, I believe he was actually from the bank. He told me that I was pre-qualified for a lifetime free (LTF) RuPay credit card from IDFC and asked if I wanted to apply.

Thinking that an LTF card was a good deal, I agreed and applied. Eventually, my application got approved after kyc and all that in kyc also banks usually tell about card's detail but anyway.

However, when I received the approval message, I noticed it was an IDFC Power Plus Card. After a little research, I found out that this card isn’t LTF—it has a ₹499 + GST joining fee!

I immediately called the guy back and asked for an explanation. He confidently told me, "The card is LTF." I believed him for a moment and let it go.

But once the card was generated online, I noticed that the joining fee had already been charged! I called him again, and this time, he shamelessly insisted, "The card is LTF. Just pay the fee, and it will be reversed in the second statement." At this point, I knew I had been scammed.

I started considering not activating the card at all. To be sure, I cross-checked with IDFC customer care, and they confirmed that the card was NOT LTF.

I called the guy once again and demanded an explanation. This time, he passed the call to his "senior." I threatened to escalate the issue, and his senior eventually admitted that it was mis-selling. Despite this, he kept insisting that I should keep the card. But I had already decided to close it.

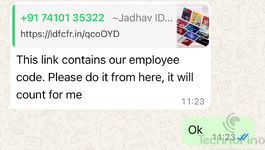

Suddenly, an idea struck me! Since I’m an SBI Card customer😁😅😜, I called IDFC customer care, explained my situation, and provided proof of the call recordings and WhatsApp chats. I asked how the bank could allow such mis-selling and tell 5hem to nake my card lifetime free 🙃 😜.

The agent apologized but told me that making the card LTF wasn’t possible. However, she reversed the first-year fee as compensation. Since the card also offers a ₹500 fuel voucher as a welcome benefit, I decided to keep it for two years and then reevaluate if it’s worth it. Also thinking of act same after year to wave of 2nd year fee😅😅

🔹 Moral of the story: Always research credit cards before applying, and never blindly trust agents—they only care about hitting their sales targets! I had applied because I have experience with hdfc and sbi as I got their paid tata neu plus card and simply click as LTF.

Thinking that an LTF card was a good deal, I agreed and applied. Eventually, my application got approved after kyc and all that in kyc also banks usually tell about card's detail but anyway.

However, when I received the approval message, I noticed it was an IDFC Power Plus Card. After a little research, I found out that this card isn’t LTF—it has a ₹499 + GST joining fee!

I immediately called the guy back and asked for an explanation. He confidently told me, "The card is LTF." I believed him for a moment and let it go.

But once the card was generated online, I noticed that the joining fee had already been charged! I called him again, and this time, he shamelessly insisted, "The card is LTF. Just pay the fee, and it will be reversed in the second statement." At this point, I knew I had been scammed.

I started considering not activating the card at all. To be sure, I cross-checked with IDFC customer care, and they confirmed that the card was NOT LTF.

I called the guy once again and demanded an explanation. This time, he passed the call to his "senior." I threatened to escalate the issue, and his senior eventually admitted that it was mis-selling. Despite this, he kept insisting that I should keep the card. But I had already decided to close it.

Suddenly, an idea struck me! Since I’m an SBI Card customer😁😅😜, I called IDFC customer care, explained my situation, and provided proof of the call recordings and WhatsApp chats. I asked how the bank could allow such mis-selling and tell 5hem to nake my card lifetime free 🙃 😜.

The agent apologized but told me that making the card LTF wasn’t possible. However, she reversed the first-year fee as compensation. Since the card also offers a ₹500 fuel voucher as a welcome benefit, I decided to keep it for two years and then reevaluate if it’s worth it. Also thinking of act same after year to wave of 2nd year fee😅😅

🔹 Moral of the story: Always research credit cards before applying, and never blindly trust agents—they only care about hitting their sales targets! I had applied because I have experience with hdfc and sbi as I got their paid tata neu plus card and simply click as LTF.