Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

-

Hey there! Welcome to TFC! View fewer ads on the website just by signing up on TF Community.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Infinia ATM Withdrawal fees

- Thread starter smakmagik

- Start date

- Replies 44

- Views 7K

Solution

cash advance charges (ATM withdrawal fees) [normal fees - 2.5%, min 500 rs] is not applicable on HDFC Infinia credit card, but interest will be charged on cash advance amount.

Check MITC for written proof.

Check MITC for written proof.

True I just shared a quite old memories. My apologies.We know that cash withdrawal incurs charges. There’s no confusion about that.

We are trying to figure out if the interest charges can be avoided by making advance payments.

Hunter44

TF Buzz

Update on this experiment: The Rs 100 cash withdrawal shows up in my list of unbilled transactions. However, there is nothing with regards to the interest charges yet. If I’m getting charged this interest, it seems like I’ll only know about it at the end of cycle when the bill is generated. Let’s see.I suppose one way to find out is trial and error. I just walked down to an ATM and withdrew Rs.100 using Infinia. Let’s see what happens!

Update on this experiment: The Rs 100 cash withdrawal shows up in my list of unbilled transactions. However, there is nothing with regards to the interest charges yet. If I’m getting charged this interest, it seems like I’ll only know about it at the end of cycle when the bill is generated. Let’s see.

call customer support, they may give some headsup. Before unnecessary interest.

thanks for doing this really useful experiment, would be interesting to see the end result.. for the experiment to be foolproof you will probably have to make sure that the entire statement period u have credit balance reflecting in the card to possibly avoid the interest getting triggered at any point.. If successful this will be the best "inbuilt debit card" within a credit card!Update on this experiment: The Rs 100 cash withdrawal shows up in my list of unbilled transactions. However, there is nothing with regards to the interest charges yet. If I’m getting charged this interest, it seems like I’ll only know about it at the end of cycle when the bill is generated. Let’s see.

Hunter44

TF Buzz

Spoke to three different customer care agents, spoke to Infinia concierge, spoke to RM, spoke to Branch Manager. None of them had come across this scenario before. None of them had a confident answer. Branch Manager was easily the most knowledgeable among all the people I spoke to. He was able to explain some additional nuances of credit extension through excess payment (and how certain additional checks and balances kick in when you make excess payment). Even he was only able to speculate on what could potentially happen.call customer support, they may give some headsup. Before unnecessary interest.

Still no notification or update regarding the interest charges. Waiting for cycle statement which will come in 10 days.

Hunter44

TF Buzz

Yep, payment due is sufficiently negative. I made a really large excess payment earlier. 😂for the experiment to be foolproof you will probably have to make sure that the entire statement period u have credit balance reflecting in the card to possibly avoid the interest getting triggered at any point..

Exactly. If this works, then Infinia users will never have to worry about converting forex cash ever again.If successful this will be the best "inbuilt debit card" within a credit card!

There is still 2.36% forex charges. So cards like niyo global debit card with zero forex and flat 354 fee will beat it easily, when withdrawing more than 15K INR.Yep, payment due is sufficiently negative. I made a really large excess payment earlier. 😂

Exactly. If this works, then Infinia users will never have to worry about converting forex cash ever again.

Hunter44

TF Buzz

You’re right. I use Niyo as my primary card for foreign currency cash too.There is still 2.36% forex charges. So cards like niyo global debit card with zero forex and flat 354 fee will beat it easily, when withdrawing more than 15K INR.

Why did you specifically mention 15k INR? Is there some additional fee for cash withdrawal below 15k INR?

Answer lies in the post only 😅.You’re right. I use Niyo as my primary card for foreign currency cash too.

Why did you specifically mention 15k INR? Is there some additional fee for cash withdrawal below 15k INR?

15K is breakeven point for 2.36% forex fee from infinia vs 354 flat fee from niyo global debit card.

Just to add some more points, niyo global debit card has 1L debit limit in every 24 hours, so niyo may not be useful if several lakhs are required.

And some ATMs (specifically the ones that don't charge for withdrawal) allow only 50K or so in one transaction. So, for 1L also it may have 708 charges for 2 withdrawals (still lesser than Infinia).

Last edited:

Hunter44

TF Buzz

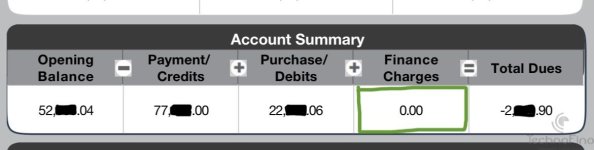

Results from the experiment: ZERO finance charges for an ATM withdrawal when an excess payment was done in advance to make the payment due sufficiently negative. (refer attached image)Update on this experiment: The Rs 100 cash withdrawal shows up in my list of unbilled transactions. However, there is nothing with regards to the interest charges yet. If I’m getting charged this interest, it seems like I’ll only know about it at the end of cycle when the bill is generated. Let’s see.

The ATM withdrawal entry shows up as the following line item in the statement:

HDFCBANK BANGALORE-URB IN(Ref# ****), with amount equal to the Rs 100 that I withdrew from the HDFC ATM.

No other line items in the statement related to the ATM cash withdrawal transaction.

Conclusion:

- Feel free to use an Infinia like a Debit card for domestic ATM Cash Withdrawals. Zero withdrawal charges and interest charges can be avoided by making advance excess payment.

- Infinia can be used for ATM Cash withdrawal of foreign currency with 2.36% forex charges, by making advance excess payment. (Currently untested but will test this soon).

Attachments

suhas.gopal

TF Buzz

You made the excess payment before withdrawing or after withdrawal? My friend had did the same as experiment on Infinia and withdrew 3000 rupees. He was charged 57 Rupees as interest for the amount on billing. He has asked for the breakup of interest. The CC executive told only the cash withdrawal charges are not there but even if you deposit the amount on same day of withdrawal, the interest for that day will be charged.Results from the experiment: ZERO finance charges for an ATM withdrawal when an excess payment was done in advance to make the payment due sufficiently negative. (refer attached image)

The ATM withdrawal entry shows up as the following line item in the statement:

HDFCBANK BANGALORE-URB IN(Ref# ****), with amount equal to the Rs 100 that I withdrew from the HDFC ATM.

No other line items in the statement related to the ATM cash withdrawal transaction.

Conclusion:

- Feel free to use an Infinia like a Debit card for domestic ATM Cash Withdrawals. Zero withdrawal charges and interest charges can be avoided by making advance excess payment.

- Infinia can be used for ATM Cash withdrawal of foreign currency with 2.36% forex charges, by making advance excess payment. (Currently untested but will test this soon).

Hunter44

TF Buzz

I made the excess payment BEFORE the ATM withdrawal (same day, but before).You made the excess payment before withdrawing or after withdrawal?

Hi, did you get a chance to test this?Infinia can be used for ATM Cash withdrawal of foreign currency with 2.36% forex charges, by making advance excess payment. (Currently untested but will test this soon).

Hunter44

TF Buzz

Tested in Korea and Japan. Worked as expected. No interest charges by HDFC. Only forex charges. Got charged a small fee by the foreign bank for withdrawal though.Hi, did you get a chance to test this?

silent.night

TF Buzz

Tested in Korea and Japan. Worked as expected. No interest charges by HDFC. Only forex charges. Got charged a small fee by the foreign bank for withdrawal though.

Did the large pre-payment you made before withdrawal cover only the amount you subsequently withdrew or did it also cover all other outstanding payments you had on the card?

Further, was your available credit limit after pre-payment and withdrawal still equal to (or more than) total credit limit?

I'm wondering if having other non-cash-withdrawal outstanding purchases (Let's say totalling 50,000) will still cause interest to be charged if you prepay let's say 10,000 rupees and then withdraw 5,000 rupees.

shashankrt

TF Ace

Well.. If there are really no cash withdrawal charges on infinia then it's great way to withdraw cash in foreign counties even if not an emergency. Most debit cards charge 300 + for cash withdrawal plus 3.5 % forex. Might as well use infinia and pay back the card bill immediately same day.Even without the information not being explicitly disclosed. Cash withdrawal is one feature that should never be used, unless in exigencies such as being stuck in a foreign county with no other alternative. Apart from such an emergency situation I don't think the customer cohort that is the target group for Infinia will ever need to use the feature to manage their working capital requirements.

Now HDFC is on BBPS which does not allow paying in excess to make outstanding negative so end of this "trick".

@silent.night @shashankrt

@silent.night @shashankrt

You can still make excess payment through CRED..as it’s imps and not thru BBPSNow HDFC is on BBPS which does not allow paying in excess to make outstanding negative so end of this "trick".

@silent.night @shashankrt

RBI made BBPS mandatory for "backend cc bill payment processing", frontend can be anything incl imps/upi/debit card/net banking. Banks like Standard Chartered & amex are not yet on BBPS so their card system can accept payment via any method like earlier. Cred I am guessing only allows you to pay in advance for current outstanding but I am pretty sure it won't let you pay enough to make a cc outstanding negative & if it does then it is in violation of rbi rules & will have to stop it sooner or later.You can still make excess payment through CRED..as it’s imps and not thru BBPS

shashankrt

TF Ace

Nope. If you have HDFC Account and link your infinia, you can pay any amount using direct cc payment option via net banking.Now HDFC is on BBPS which does not allow paying in excess to make outstanding negative so end of this "trick".

@silent.night @shashankrt

Similar threads

- Replies

- 30

- Views

- 2K

- Replies

- 1

- Views

- 116

- Replies

- 1

- Views

- 272

- Replies

- 3

- Views

- 370