Rutvik28

TF Buzz

Hello,

I have a very interesting question/doubt on an insurance premium payment through axis magnus credit card after it getting devalued recently.

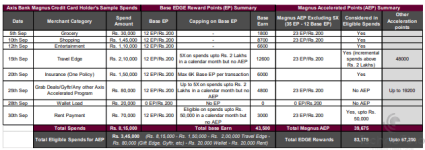

So the question goes like this, if I pay insurance premium of more than 1.5 lacs in a month in multiple transactions (considering the individual transactions are less than 1 lac), then if I pay more insurance premium in the same month will I get 35 reward points on 200rs spent for next set of transactions or the normal reward rate of 12 reward points per 200rs ?

And if let's say the answer is 35 reward points per 200rs, then how will the cap of 6000 reward points per transaction be applied for those transactions ?

I have an insurance premiums of ~3-4 lacs coming in the Oct end and November month, so I was thinking if I can pay all the premiums in the month of November, then will I get more reward points instead of paying in separate months.

I have a very interesting question/doubt on an insurance premium payment through axis magnus credit card after it getting devalued recently.

So the question goes like this, if I pay insurance premium of more than 1.5 lacs in a month in multiple transactions (considering the individual transactions are less than 1 lac), then if I pay more insurance premium in the same month will I get 35 reward points on 200rs spent for next set of transactions or the normal reward rate of 12 reward points per 200rs ?

And if let's say the answer is 35 reward points per 200rs, then how will the cap of 6000 reward points per transaction be applied for those transactions ?

I have an insurance premiums of ~3-4 lacs coming in the Oct end and November month, so I was thinking if I can pay all the premiums in the month of November, then will I get more reward points instead of paying in separate months.