callsignmaverick

TF Premier

Since this is my first post here, let me start the post by giving a little background about me in credit cards context.

I have been using credit cards for almost 14 years now and started my journey with the humble Citi Rewards as my first credit card. When I got into the credit card world, it wasn't for points or prestige. It was just simple math - You are getting an amount interest free period of 50 days.

Slowly, I started getting into the points & rewards game and started building up my credit card portfolio. I remember the cards that gave me most points till around 5-6 years back were SBI Elite and SC Ultimate. Then once my salary account was moved to HDFC (from ICICI due to job change), I got hold of DCB. Just to point out, life was much simpler back then, you saw a card you liked - you checked the eligibility criteria and if you could meet it then apply. No FYF, LTF fundas. In fact except Magnus Burgundy I never asked for a free card (yes I was naive). I had DCB free for some years only because I met their annual spend criteria. After DCB, got hold of INFINIA in few years and then came Magnus followed by Magnus Burgundy [both came thanks to Axis burgundy account]. And I had to say Axis spoiled me, I had made lakhs of points of Ultimate, DCB, Infinia before but this was madness. The rewards were too good, but as someone who comes from a financial background I knew it would be mess sooner or later.

Now let me come back to the main topic, why the need for Emeralde Private when you already have INFINIA, Magnus Burgundy & Yes Marquee (recently acquired)?

One word answer - Exclusivity. At my age and with the years of experience in the credit card domain, plain points or benefits don't excite me as much as the exclusivity factor. I still remember the envious looks that I used to get 2-3 years back when I would pull out of my DCB or Infinia. In fact, till few months back most of my friends in the same financial bracket as me couldn't get INFINIA. But now that's kind of gone, while Infinia is still relatively exclusive - off late lot of people have started getting upgraded to INFINIA quite easily, which also makes me believe that an INFINIA devaluation is not far. And more importantly the card loses its exclusivity/snob factor. Less I talk about Magnus the better.

What cards I would have loved to get from an Exclusivity point of view:

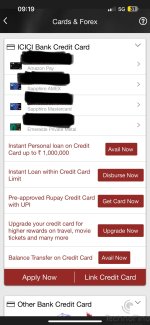

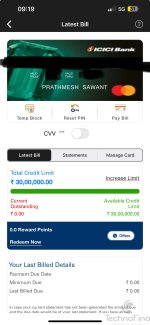

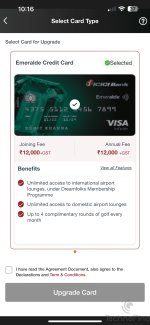

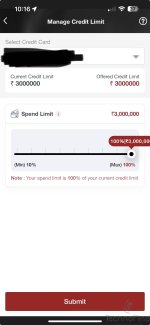

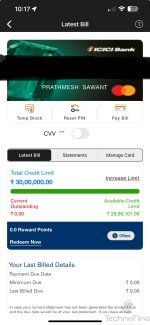

So yesterday finally after almost 1.5 months, I got the card approved and I can see it on IMobile. The physical card should arrive in a day or two. While it was a long wait, it was definitely worth it because ICICI almost doubled my INFINIA credit limit and has offered a limit of 30L on the card. Another thing that makes the card worth it was the difficulty in getting it. Will become my daily driver card along with INFINIA from next month onwards.

I have been using credit cards for almost 14 years now and started my journey with the humble Citi Rewards as my first credit card. When I got into the credit card world, it wasn't for points or prestige. It was just simple math - You are getting an amount interest free period of 50 days.

Slowly, I started getting into the points & rewards game and started building up my credit card portfolio. I remember the cards that gave me most points till around 5-6 years back were SBI Elite and SC Ultimate. Then once my salary account was moved to HDFC (from ICICI due to job change), I got hold of DCB. Just to point out, life was much simpler back then, you saw a card you liked - you checked the eligibility criteria and if you could meet it then apply. No FYF, LTF fundas. In fact except Magnus Burgundy I never asked for a free card (yes I was naive). I had DCB free for some years only because I met their annual spend criteria. After DCB, got hold of INFINIA in few years and then came Magnus followed by Magnus Burgundy [both came thanks to Axis burgundy account]. And I had to say Axis spoiled me, I had made lakhs of points of Ultimate, DCB, Infinia before but this was madness. The rewards were too good, but as someone who comes from a financial background I knew it would be mess sooner or later.

Now let me come back to the main topic, why the need for Emeralde Private when you already have INFINIA, Magnus Burgundy & Yes Marquee (recently acquired)?

One word answer - Exclusivity. At my age and with the years of experience in the credit card domain, plain points or benefits don't excite me as much as the exclusivity factor. I still remember the envious looks that I used to get 2-3 years back when I would pull out of my DCB or Infinia. In fact, till few months back most of my friends in the same financial bracket as me couldn't get INFINIA. But now that's kind of gone, while Infinia is still relatively exclusive - off late lot of people have started getting upgraded to INFINIA quite easily, which also makes me believe that an INFINIA devaluation is not far. And more importantly the card loses its exclusivity/snob factor. Less I talk about Magnus the better.

What cards I would have loved to get from an Exclusivity point of view:

- Axis Private [Well quite someway to go for this]

- Amex Platinum [All my friends used to swear by this card few years back, now everyone swears because of it. Customer service has gone down big time. Almost anyone who can pay the fees has this card can get it. Personally, I feel Amex has ruined it for most of their old customers. Most of my friends who held this card for many years, cancelled this last year or early this year. So this was ruled out completely]

- Amex Centurion [Well with no. 2 not happening, this will never happen considering its offered only to select few Amex Platinum customers with high spends]

- Axis Reserve [Was willing to overlook the reward transfer rate but then Axis hit the final nail in the coffin with the removal of transfers]

- ICICI Emeralde Private [Seemed most sensible of the lot with benefits outweighing the fees and the fact that very very very few people have it, this would take care of the exclusivity factor]

So yesterday finally after almost 1.5 months, I got the card approved and I can see it on IMobile. The physical card should arrive in a day or two. While it was a long wait, it was definitely worth it because ICICI almost doubled my INFINIA credit limit and has offered a limit of 30L on the card. Another thing that makes the card worth it was the difficulty in getting it. Will become my daily driver card along with INFINIA from next month onwards.