Most of you know the debit cards which are useful, but it’s difficult to keep track of which platforms to use, how to use because of devaluations/ limits.

I had written down current working methods for my personal use but thought of sharing with the community. Will appreciate any feedback. So here goes:

1)

RBL signature plus dc: sbi unipay

1b)

RBL Enterprise dc: sbi unipay

2)

HDFC PLATINUM debit card: can be used on hdfc bill pay and sbi unipay

3)

HDFC Millennia debit card: can be used to load Amazon/Mobikwik wallets for 1%. Can use hdfc bill pay or sbi unipay for 2.5%

4)

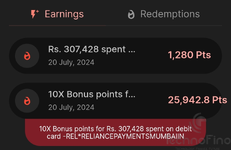

indus visa signature, visa platinum and mastercard world : Use paytm and cred (Dreamplug Paytech merchant) for visa variants. Sbi unipay, HDFC Payzapp and

Cheq(not working for most) for mastercard variant.

5)

FI money ( infinity or salary variant) : pay 1.5k multiple times through cred using fi upi.

6)

IDFC Debit cards: Pay cc bill using sbi unipay.

7)

Axis Liberty dc : pay cc through sbi unipay for qtly voucher. Can use upi as well anywhere; no exclusions using upi. Bonus tip: Use axis gyftr portal / amazon to buy amazon gv from Liberty dc for weekend cashback.

8)

Citi Priority on sbi unipay

9)

sbi physical debit card on sbi unipay

SBI Unipay fails for trx above 1L. If trx fails, it is usually auto refunded within 5 working days. Please try with small amount first.

Update: Alternative to SBI unipay: ‘Airtel’ (2 merchant names, both work), ‘jio finance’ app Canara bbps website. They only support bbps cc bill payment. These give 4900 (utility) mcc.

Update 2:

P B R G and

thomasjackson mentioned even Dhani Pay has utility MCC (so an alternative to SBI Unipay). Non-BBPS cc can be paid. But KYC required. (havent tried myself)

Update 3: Full details with calculations on rewards added here:

https://www.technofino.in/community...-card-bill-from-debit-cards.25788/post-634404

Update 4: SBI dc rewards update from 1st May. Details here

https://www.technofino.in/community...-card-bill-from-debit-cards.25788/post-643329

Ongoing issues 1) : Some have reported

idfc dc is blocked while account is active. You can complaint to idfc, it gets solved in 3-5 days.

2)

Indus dc points are not regular, so will have to wait and still no guarantee that you will get the points or correct number of points.

3)

mastercard dc not working for some users on sbi unipay.

4)

Jio finance app does not show failed trx in their history. But processes auto refunds after 2-3 working days. Do take screenshot as proof when payment fails.

AU bank and standard chartered bank dc: see here

https://www.technofino.in/community/threads/best-debit-card-for-credit-card-bill-payment-2024.26178/