Deleted member 26954

TF Premier

Ref to my recent post, Thanks everyone for your suggestions on Infinia Metal. I considered all points and did some calculations...There are 2 scenarios

1. If Spend is around 7.5 Lac (In normal scenario, Infinia is offered with this much spend..I am not considering special cases of LTF Infinia):

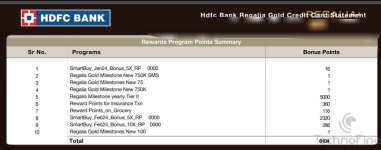

(a) Regalia Gold:

RP's: 20,000

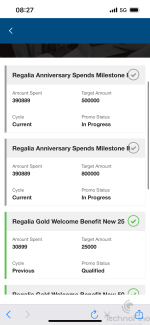

Bonus RP's: 10,000 (5 Lac milestone)

Bonus RP's: 5,000 (8 Lac milestone)

Total RP's: 35,000

A = Value of RP's @ 30 paise = Rs 10,500 (Considering average redemption and not special cases like Gold catalogue/smartbuy flight @ 1:0.5)

B = Quarterly vouchers of Rs 1,500 X 4 = Rs 6,000

C = Flight Vouchers of Rs 5,000 X 2 = Rs 10,000 (5k @ 5 lac and 5k @ 7.5 lac) (Not considering airport drop voucher)

Total Benefit = A + B + C = Rs 26,500

(b) Infinia Metal:

RP's: 25,000

RP's for annual fees = 12,500

A = Value of RP's @ 50 paise = Rs 18,750 (Considering average redemption and not special cases)

B = Annual Fees = Rs 14,750

Net Benefits = A - B = Rs 4,000

Infinia Metal is a BIG loser in this case

Even if you consider RP's value at 1:1 where you have very limited choice to redeem

A = Value of RP's = 25,000

B = Annual Fees RP's value = 12,500

C = Annual Fees incl GST = Rs 14,750

Net Benefits = A + B - C = Rs 22,750

Benefits of Infinia Metal is way below Regalia Gold despite the fact, you will be forced to you redeem infinia RP's only in flight booking or buying apple products

********************************************

2. If Spend is around 10 Lac

(a) Regalia Gold:

RP's: 26,666

Bonus RP's: 10,000 (5 Lac milestone)

Bonus RP's: 5,000 (8 Lac milestone)

Total RP's: 46,666

A = Value of RP's @ 30 paise = Rs 12,500 (Considering average redemption and not special cases like Gold catalogue)

B = Quarterly vouchers of Rs 1,500 X 4 = Rs 6,000

C = Flight Vouchers of Rs 5,000 X 2 = Rs 10,000 (5k @ 5 lac and 5k @ 7.5 lac) (Not considering airport drop voucher)

Total Benefit = A + B + C = Rs 28,500

(b) Infinia Metal:

RP's: 33,000

RP's for annual fees = 0 (Annual Fees Waived off)

A = Value of RP's @ 50 paise = Rs 18,750 (Considering average redemption and not special cases)

B = Annual Fees = 0

Net Benefits = A - B = Rs 18,750

Infinia Metal is a BIG loser in this case

Even if you consider RP's value at 1:1 where you have very limited choice to redeem

A = Value of RP's = 33,000

B = Annual Fees = 0

Net Benefits = 33,000

Only 4.5k benefit compared to Regalia Gold which is actually less (refer to point #2 in final conclusion)

MY FINAL CONCLUSION:

1. Infinia Metal is only beneficial if you redeem rewards to book flights through smartbuy or apple products else it is a BIG LOSER compared to Regalia GOLD.

2. 1:1 redemption is actually not a 1:1 as you buy the flight ticket or apple product at FULL value and forego discounts available..This ratio is 1:0.85 (As shared by other experts)

3. Infinia Metal will give you serious stress to spend only on Infinia metal card and you might miss out on other great offers on other cards. Example: Currently Amex is giving maximum offers on Swiggy, Zomato, Blinkit etc.

4. Last but not the least, INFINIA is a OVERHYPED Card in my personal opinion. No offence to Infinia users.

I HAVE DECIDED TO DECLINE THE OFFER TO UPGRADE FROM LTF REGALIA GOLD TO PAID INFINIA.

I apologies if there is any error in my calculation...Kindly mention the same in the comments, I will correct it

1. If Spend is around 7.5 Lac (In normal scenario, Infinia is offered with this much spend..I am not considering special cases of LTF Infinia):

(a) Regalia Gold:

RP's: 20,000

Bonus RP's: 10,000 (5 Lac milestone)

Bonus RP's: 5,000 (8 Lac milestone)

Total RP's: 35,000

A = Value of RP's @ 30 paise = Rs 10,500 (Considering average redemption and not special cases like Gold catalogue/smartbuy flight @ 1:0.5)

B = Quarterly vouchers of Rs 1,500 X 4 = Rs 6,000

C = Flight Vouchers of Rs 5,000 X 2 = Rs 10,000 (5k @ 5 lac and 5k @ 7.5 lac) (Not considering airport drop voucher)

Total Benefit = A + B + C = Rs 26,500

(b) Infinia Metal:

RP's: 25,000

RP's for annual fees = 12,500

A = Value of RP's @ 50 paise = Rs 18,750 (Considering average redemption and not special cases)

B = Annual Fees = Rs 14,750

Net Benefits = A - B = Rs 4,000

Infinia Metal is a BIG loser in this case

Even if you consider RP's value at 1:1 where you have very limited choice to redeem

A = Value of RP's = 25,000

B = Annual Fees RP's value = 12,500

C = Annual Fees incl GST = Rs 14,750

Net Benefits = A + B - C = Rs 22,750

Benefits of Infinia Metal is way below Regalia Gold despite the fact, you will be forced to you redeem infinia RP's only in flight booking or buying apple products

********************************************

2. If Spend is around 10 Lac

(a) Regalia Gold:

RP's: 26,666

Bonus RP's: 10,000 (5 Lac milestone)

Bonus RP's: 5,000 (8 Lac milestone)

Total RP's: 46,666

A = Value of RP's @ 30 paise = Rs 12,500 (Considering average redemption and not special cases like Gold catalogue)

B = Quarterly vouchers of Rs 1,500 X 4 = Rs 6,000

C = Flight Vouchers of Rs 5,000 X 2 = Rs 10,000 (5k @ 5 lac and 5k @ 7.5 lac) (Not considering airport drop voucher)

Total Benefit = A + B + C = Rs 28,500

(b) Infinia Metal:

RP's: 33,000

RP's for annual fees = 0 (Annual Fees Waived off)

A = Value of RP's @ 50 paise = Rs 18,750 (Considering average redemption and not special cases)

B = Annual Fees = 0

Net Benefits = A - B = Rs 18,750

Infinia Metal is a BIG loser in this case

Even if you consider RP's value at 1:1 where you have very limited choice to redeem

A = Value of RP's = 33,000

B = Annual Fees = 0

Net Benefits = 33,000

Only 4.5k benefit compared to Regalia Gold which is actually less (refer to point #2 in final conclusion)

MY FINAL CONCLUSION:

1. Infinia Metal is only beneficial if you redeem rewards to book flights through smartbuy or apple products else it is a BIG LOSER compared to Regalia GOLD.

2. 1:1 redemption is actually not a 1:1 as you buy the flight ticket or apple product at FULL value and forego discounts available..This ratio is 1:0.85 (As shared by other experts)

3. Infinia Metal will give you serious stress to spend only on Infinia metal card and you might miss out on other great offers on other cards. Example: Currently Amex is giving maximum offers on Swiggy, Zomato, Blinkit etc.

4. Last but not the least, INFINIA is a OVERHYPED Card in my personal opinion. No offence to Infinia users.

I HAVE DECIDED TO DECLINE THE OFFER TO UPGRADE FROM LTF REGALIA GOLD TO PAID INFINIA.

I apologies if there is any error in my calculation...Kindly mention the same in the comments, I will correct it

Last edited: