bugmenot

TF Legend

-- Edited Post --

Final Update

Official PDFs are now out

Magnus - https://www.axisbank.com/docs/default-source/default-document-library/credit-cards/mgtc.pdf

Reserve - https://www.axisbank.com/docs/default-source/default-document-library/credit-cards/rstc.pdf

Revision of Axis Bank Miles/Rewards Transfer Program - https://www.axisbank.com/docs/defau...les-rewards-transfer-terms-and-conditions.pdf

Update: 2nd August

MyZone - https://www.axisbank.com/docs/default-source/default-document-library/credit-cards/mztc.pdf

Privilege - https://www.axisbank.com/docs/default-source/default-document-library/credit-cards/pvtc.pdf

Select - https://www.axisbank.com/docs/default-source/default-document-library/credit-cards/sltc.pdf

Ace - https://www.axisbank.com/docs/default-source/default-document-library/credit-cards/actc.pdf

Magnus devaluation highlights

Aap Chronology Samajiye

1. Flipkart - https://axisbank.com/docs/default-s...flipkart-credit-card-terms-and-conditions.pdf

Below given links are not opening now as they have been removed. You may check attached PDFs.

2. Reserve - https://axisbank.com/docs/default-s...-reserve-credit-card-terms-and-conditions.pdf

3. Select - https://axisbank.com/docs/default-s...k-select-credit-card-terms-and-conditions.pdf

4. Privilege - https://axisbank.com/docs/default-s...rivilege-credit-card-terms-and-conditions.pdf

5. MyZone - https://www.axisbank.com/docs/defau...-my-zone-credit-card-terms-and-conditions.pdf

By following the format, it is quite easy to create Magnus link, which could behttps://axisbank.com/docs/default-source/default-document-library/credit-cards/axis-bank-magnus-credit-card-terms-and-conditions.pdf

Final Update

Official PDFs are now out

Magnus - https://www.axisbank.com/docs/default-source/default-document-library/credit-cards/mgtc.pdf

Reserve - https://www.axisbank.com/docs/default-source/default-document-library/credit-cards/rstc.pdf

Revision of Axis Bank Miles/Rewards Transfer Program - https://www.axisbank.com/docs/defau...les-rewards-transfer-terms-and-conditions.pdf

Update: 2nd August

MyZone - https://www.axisbank.com/docs/default-source/default-document-library/credit-cards/mztc.pdf

Privilege - https://www.axisbank.com/docs/default-source/default-document-library/credit-cards/pvtc.pdf

Select - https://www.axisbank.com/docs/default-source/default-document-library/credit-cards/sltc.pdf

Ace - https://www.axisbank.com/docs/default-source/default-document-library/credit-cards/actc.pdf

Magnus devaluation highlights

- Revision in welcome benefits, which are more or less matching with the leaked screenshots

- Change in annual fee - ₹12,500 + GST

- No more renewal benefit

- Spend criteria for fee waiver is now double - 25L

- Exclusion of government institutions and utilities MCCs for earning ERs

- RIP 25,000ER/1L milestone benefit

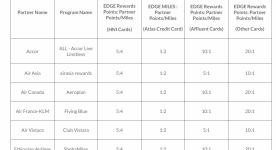

- Revised transfer ratio of 5:2

- 5L ER points cap for transfer

- Burgundy account scheme

- Spend criteria for fee waiver is revised to 35L

- Exclusion of government institutions and utilities MCCs for earning ERs

- Revised transfer ratio of 5:2

- 5L ER points cap for transfer

- Burgundy private account scheme

Aap Chronology Samajiye

- 📄 Few leaked screenshots of PDF started floating for Magnus and Reserve having potential devaulation

- 🐦Few folks on Twitter acknowledged the upcoming devaulation by contacting their RMs or insiders from CC department

- 🎧 Customer Care team were like "Whot Daa Phaak" is going on. They were unaware about these news, some were saying yes and some no

- 😡 Outrage | Speculation | Twitter Space | Points Transfer Tricks

- ✋ Then rumour mills started about devaulation being on hold

- 🔗 Official links of devaulation PDF started popping but "Darling of Cards" was missing

- 🔌 Axis pulled the plug and links started showing "404 - Not Found" except for unlucky Flipkart card

- 💣 BOMB - Axis Gift Edge devaulation

- 📩 Mass credit card cancellation and notice seeking clarification regarding commercial transactions

- 📉 Official PDF of Magnus and Reserve released

- 📉 Official PDF of MyZone, Privilege, Select and Ace released

1. Flipkart - https://axisbank.com/docs/default-s...flipkart-credit-card-terms-and-conditions.pdf

Below given links are not opening now as they have been removed. You may check attached PDFs.

2. Reserve - https://axisbank.com/docs/default-s...-reserve-credit-card-terms-and-conditions.pdf

3. Select - https://axisbank.com/docs/default-s...k-select-credit-card-terms-and-conditions.pdf

4. Privilege - https://axisbank.com/docs/default-s...rivilege-credit-card-terms-and-conditions.pdf

5. MyZone - https://www.axisbank.com/docs/defau...-my-zone-credit-card-terms-and-conditions.pdf

By following the format, it is quite easy to create Magnus link, which could be

Attachments

-

20230708_140407.jpg191.8 KB · Views: 6,292

20230708_140407.jpg191.8 KB · Views: 6,292 -

Screenshot_2023_0708_173519.jpg353.4 KB · Views: 3,261

Screenshot_2023_0708_173519.jpg353.4 KB · Views: 3,261 -

axis-bank-flipkart-credit-card-terms-and-conditions.pdf67.7 KB · Views: 30

-

axis-bank-my-zone-credit-card-terms-and-conditions.pdf114.8 KB · Views: 32

-

axis-bank-reserve-credit-card-terms-and-conditions.pdf151.3 KB · Views: 42

-

axis-bank-privilege-credit-card-terms-and-conditions.pdf114.3 KB · Views: 26

-

axis-bank-select-credit-card-terms-and-conditions.pdf161.1 KB · Views: 23

-

mgtc.pdf293.3 KB · Views: 20

-

rstc.pdf135.2 KB · Views: 17

-

axis-bank-miles-rewards-transfer-terms-and-conditions.pdf494 KB · Views: 6

-

actc.pdf67.3 KB · Views: 8

-

mztc.pdf116.2 KB · Views: 7

-

pvtc.pdf115 KB · Views: 6

-

sltc.pdf161.7 KB · Views: 8

Last edited: