cc_dc_explorer

TF Premier

This is a little big post. Please bear with me.

SBI posted a finance charge of 1450 INR approx with some taxes to me for not paying Total Due amount. See my previous post (https://www.technofino.in/community...l-outstanding-was-credited.27904/#post-722404). However this was not the case, Total amount due at statement generation date was 42k. And after 4 day of the bill generation a refund credit of 2100 was done from Flipkart. So I paid the remaining amount which was 40k finally. The total credit for the whole statement period became 42,100 RS. So the bill was fully paid.

I initially ignored and paid the finance charges along with GST as I thought who will spend time to raise issue with their shitty customer care service. But in next month they again added 25 INR finance charges along with GST. I was furious this time as all the finance charges was paid already. This time I escalated and reached out to nodal team. They reversed the total charges 1450 + 25 + GST's and told me to pay total due amount from next time to avoid finance charges.

Here comes their malpractice, they say

So Please check your finance charges actively.

HERE IS THE FINAL EMAIL I TRIGGERED TO THEIR NODAL TEAM TODAY FOR THIS MALPRACTICE FOR THIS MONTH STATEMENT....

TOTAL AMOUNT DUE/OUTSTANDING: 4095 (during statement generation of this month)

TOTAL REFUND/REVERSAL : 1624 (approx including finance charges and gst)

CURRENT OUTSTANDING : 4095 - 1624 = 2471 (approx)

Dear SBI PNO,

I am writing to follow up on our recent communication regarding my SBI credit card ending in 6837. In our previous email exchange (July 17 2024), you stated that

"Finance Charges: We would like to inform you that in case the payments are missed or outstanding on the card is received less than the total amount due/ total outstanding amount, then interest charges are applied on the balance amount, thus the payment starts revolving on the account, this is also applicable on all the fresh charges incurred, in the same month by the cardholder."

i.e. If the payment received is less than the total outstanding amount due before the due date.

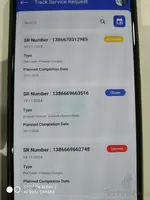

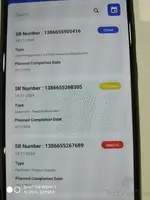

However, I am now experiencing a contradictory situation where your system is preventing me from making the full payment due. My total due/outstanding amount is INR 4095, but I am consistently receiving error messages preventing me from making this full payment:

SBI posted a finance charge of 1450 INR approx with some taxes to me for not paying Total Due amount. See my previous post (https://www.technofino.in/community...l-outstanding-was-credited.27904/#post-722404). However this was not the case, Total amount due at statement generation date was 42k. And after 4 day of the bill generation a refund credit of 2100 was done from Flipkart. So I paid the remaining amount which was 40k finally. The total credit for the whole statement period became 42,100 RS. So the bill was fully paid.

I initially ignored and paid the finance charges along with GST as I thought who will spend time to raise issue with their shitty customer care service. But in next month they again added 25 INR finance charges along with GST. I was furious this time as all the finance charges was paid already. This time I escalated and reached out to nodal team. They reversed the total charges 1450 + 25 + GST's and told me to pay total due amount from next time to avoid finance charges.

Here comes their malpractice, they say

- If you do not pay TOTAL due/outstanding amount of statement then finance charges will apply.

- But they wont allow you to pay more than CURRENT outstanding amount. If there is any credit for example in above case (2100 INR), then the CURRENT outstanding value decreases by 2100 . Now they wont allow you to pay more than CURRENT OUTSTANDING (42000 - 2100) as per recent RBI rule.

So Please check your finance charges actively.

HERE IS THE FINAL EMAIL I TRIGGERED TO THEIR NODAL TEAM TODAY FOR THIS MALPRACTICE FOR THIS MONTH STATEMENT....

TOTAL AMOUNT DUE/OUTSTANDING: 4095 (during statement generation of this month)

TOTAL REFUND/REVERSAL : 1624 (approx including finance charges and gst)

CURRENT OUTSTANDING : 4095 - 1624 = 2471 (approx)

Dear SBI PNO,

I am writing to follow up on our recent communication regarding my SBI credit card ending in 6837. In our previous email exchange (July 17 2024), you stated that

"Finance Charges: We would like to inform you that in case the payments are missed or outstanding on the card is received less than the total amount due/ total outstanding amount, then interest charges are applied on the balance amount, thus the payment starts revolving on the account, this is also applicable on all the fresh charges incurred, in the same month by the cardholder."

i.e. If the payment received is less than the total outstanding amount due before the due date.

However, I am now experiencing a contradictory situation where your system is preventing me from making the full payment due. My total due/outstanding amount is INR 4095, but I am consistently receiving error messages preventing me from making this full payment:

- "Payment amount cannot exceed RS 2470.31"

- "Payment amount is more than 2352.68"

It seems like I pointed at the blunder mistake they are doing and they are still busy finding what to reply.

It seems like I pointed at the blunder mistake they are doing and they are still busy finding what to reply.