hi friends,

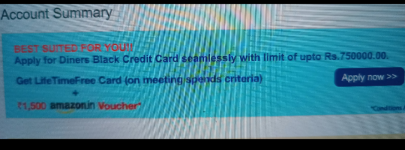

i got a preapproved DCB LIFETIME FREE* offer that i saw after logging in to my hdfc portal.

i submitted my application, but then in fine print, i saw that the bank has mentioned that the card fees will be reversed subject to minimum spend in the previous year. i think this LTF along with * is intentional misleading from the bank, as they are deviating from industry-wide definition of LTF. If you follow their logic, then almost every cc is lifetime free, as high spends lead to fees reversal for almost all cards from any bank!!! i contacted the rm over email and instead of replying over email, he has scheduled a call to explain. as usual, HDFC folks always avoid putting things on paper.

my question now:

1) how can i withdraw my application, without my credit score getting affected?

2) if the card gets processed and delivered, can i close it instantly and avoid paying any joining fees? will closing this card affect my credit score?

i got a preapproved DCB LIFETIME FREE* offer that i saw after logging in to my hdfc portal.

i submitted my application, but then in fine print, i saw that the bank has mentioned that the card fees will be reversed subject to minimum spend in the previous year. i think this LTF along with * is intentional misleading from the bank, as they are deviating from industry-wide definition of LTF. If you follow their logic, then almost every cc is lifetime free, as high spends lead to fees reversal for almost all cards from any bank!!! i contacted the rm over email and instead of replying over email, he has scheduled a call to explain. as usual, HDFC folks always avoid putting things on paper.

my question now:

1) how can i withdraw my application, without my credit score getting affected?

2) if the card gets processed and delivered, can i close it instantly and avoid paying any joining fees? will closing this card affect my credit score?