My Credit Bureau Experience Journey - Part 1

Experian

Disclaimer: This is just my experience , not a comprehensive review of their products and/or services..... YMMV

Experian

Disclaimer: This is just my experience , not a comprehensive review of their products and/or services..... YMMV

Annual fee of ₹499 (including GST) --- My opinion utter waste of money. Your subscription money is down in the drain.

Free report is as good as paid except that we get "Premium plan subscriber' badge , in which there is nothing premium in there.

Non functional score simulator ( no matter whatever the input is, output is always +8 score),

No option to refresh (No link or no push button).God knows whether it is auto refreshing on open or periodically refreshing, no refresh date on dashboard

My secured loan (OD) classified as unsecured( all other 3 bureaus reported correctly). Took good 4 days to talk to someone after rasing the issue online and got standard answer 'wait for 30 days', I doubt anything happens after 30 days, it may even take 3 months or longer by the sound of it.

Very "Uncustomarily customer support" ( if there is a word like that )

The above were the salient features of Experian permium subscription plan that I was previliged to experience...

A few SS of Experian premium...

---------

EDIT 1 (28/06/2023)

Would like to elaborate on my experience in contacting customer support:

When I found a secured loan classified as unsecured loan in the report, I tried to contact their suppoprt on the number given in their web site after registering my request online.

There is no answer from the phone and it kept on disconnecting itself for consecutie two days( I think).

Then I wrote to their nodal officer about this and still wating for his/her reply (already it is more than a week).

Then tried again contacting by phone numer, this time I am lucky, call gets connected but they played musical chairs for sometime by advising me to contact this number, that number etc. and at the end, the support person gave me the stock reply 'See ya in 30 days' by throwing some call reference number on my face and adivsed me to mention this reference number in future so that I don't nee to explain my agony again and again...

I am still unsure if they grasp my issue.

My issue of classifying the loan as 'unsecured' instead of "secured" should not have arisen in the first place , as "Collateral Value" field contains the correct value but suprisingly Collateral Type doesn't conatain any value.

All other three bureaus contain correct values for these two fields. It means the data sent by ICICI to all the four bureaus was correct. It is only the experian's data capture/interpretaion is at fault. Biazzare thing is for me, there is no one to talk to and explain this simple point... GOD knows how long this will take to resolve (if at all) meanwhile we customers have to experience the brunt of it.

That is why I called this as a "Uncustomarily customer support"

End of EDIT 1

---------------

END Part 1

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

My Credit Bureau Experience Journey - Part 2

CRIF

Disclaimer: This is just my experience , not a comprehensive review of their products and/or services..... YMMV

CRIF

Disclaimer: This is just my experience , not a comprehensive review of their products and/or services..... YMMV

Annual fee ₹900 ..

Inconsistent scoring mechanism hence very volatile .. uses their own random mechanism to determine the score (not based on generally acceptable industry standard).

I am not sure how many lenders use this bureau to determine the creditworthiness of their customers, it would most likely not provide the true, stable and dependable customer credit rating in my view..

1) They are not incorporating "Credit mix" as a co-factor in determining their scoring. Most of the bureaus suggest us to maintain a good and healthy credit mix ratio between 'Secured and Unsecured loans', which industry generally considers as a fair factor. Not for CRIF..

When my 1st secured loan (1 month ago) was added to the then current portfolio of 6 Credit Card accounts, I think my score was reduced marginally( may be around 10, could not remember exactly).

Today my 2nd secured loan (gold loan) was added and guess what my score was down by MASSIVE 103 points citing the reason "Considerably high proportion of active contracts" .

I am not sure what they mean by high proportion of active contracts to WHAT? active contracts to total contracts(open+ closed) or or high recently open contracts? not sure. Anyway I have total 6 Credit cards and 2 Secured loans for the last 5 years and 4 enquiries.

In the last one year 3 CCs and 2 Secured loans, they are referring "Proportion of active contracts".... I have all 8 contracts which are active. No closed accounts... Anyway I will get better understanding going forward, may be in another one year.

2)The CRIF's main scoring factors keep changing

Generally bureaus keep their main scoring factors fairly stable ( whatever the basis they consider appropriate.) like CIBIL says 4 factors. payment history, credit utilization, credit mix and enquiries. For CRIF these factors change randomly. Here is an example:

As on 18th June : 4 factors: ( "missed recent payments" appeared twice)

As on the 24/06/2023, Added a new factor:

As on today (28/06/2023) , the GIANT score killer comes in " Considerably high proportion of active contracts" and out goes two factors i.e. "decent utilization of credit limit" and "consistent decrease in o/s balance."

I guess they want to provide really really latest credit worthiness by choosing the dynamic relevant factors at that point in time , but in the end it is depicting highly unstable and inconsistent score. By following this approach, this month say one person has highly desirable score but in a very short period the same person becomes highly undesirable person from the credit worthiness perspective because of this dynamic scoring factors.

This is not useful for the businesses as well (i.e. for Lenders).

I am sure my score will go up a bit later, meanwhile the score is too dynamic for my taste which doesn't reflect the reality in my humble opinion...

3) Design of the login screen( for the registered user) not the best practice to say the least....

When we are registering for the first time we have to give all relevant details to identify ourselves like name, pan, mobile nu, email etc.. This is normal.

What is not normal is , after registering and paying for the subscription also, we need to enter all these details each and every time for login to check our report... How lazy they are. They could not even a design new simple login screen for the registered users.. I searched everywhere I could not find registered users login page. If any one shows a simple login screen , I will eat my hat...

4) Thankfully I don't need to contact their customer support yet, hence no comments on support side.

5) No score simulator (thank GOD)

6) No Alerts.

Alerts are particularly useful in the case of a new enquiry / new account... In this category only CIBIL takes the winner's prize...

7) One last "good" thing about CRIF is, this is the first agency that updates the credit data at the earliest out of all the four... By today I have all my 8 accounts reported in CRIF . Experian & CIBIL have 7 accounts and Equifax has 6 accounts ....

End - Part 2

My Credit Bureau Experience Journey - Part 3

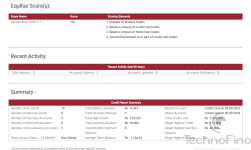

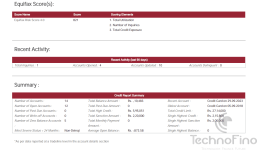

EQUIFAX

Disclaimer: This is just my experience , not a comprehensive review of their products and/or services..... YMMV

Annual fee (900 + GST = 1062), again, money down in the drain...

The fee is almost equal to CIBIL( with 10% off) but no where near the quality of CIBIL.

1) Logging in itself is a puzzle from the home page:

If we click on the login link on the home page we get this:

Don't know whose login is that for. Anyway after few clicks on links you will get to login:

Home page looks like thism Here it should show the current Score ( just common sense). To know the score you need to go to reports sections , open the full report and check the report.. So user friendly ( may be not)...

2) The funny part is, after paying ₹1062 , you get to refresh the report only 5 times a month, and run the score simulator for only 10 times.

Not sure the purpose of these restrictions for a paid subscription. This is restriction piss*s me off big time as I paid for the annual subscription only to track my scoring regularly to see which event triggers a change in the score.

In this aspect Experian is so much better as it allows us to refresh every day free of cost.( but in paid you get nothing new in Experian)

3) Score Simulator - Again not much to talk about..

My current score is 758. When I start score simulator it gets the base score as 736 ( which was my previous score). Again this puts me off , and didn't explore it any more. Starting point itself is wrong while predicting... So, no pointing in trying this...

My current score screen:

Score simulator screen:

To add salt to the wound, restrictions on this 'wonderful' simulator:

4) Regarding scoring methodology,

As it limits the refresh only for 5 times, I could not time it to run at the right time, because we don't know which banks data gets updated when. They randomly get updated. So, not sure how the scoring works...

5)Support: This is the biggest joke...

In my two months subscription , there were two system outages . One time 3 days in a row and another time about 5 days in a row. Simply I just could not login after giving my credentials. It came up with this error, thats it..

and when I call and send emails about this, no one really cares and gives standard replies like below:

Initially they acted like there is no fault from their side:

After some persistence from my side, they came up with this message 3 or 4 times ( for 4 days).

and then this funny one:

Wrote to Nodal officer, as usual no rpely...

Finally ,it fixed itself and no one contacted me till now.

Very disappointing journey so far with Equifax...

CIBIL

Regarding CIBIL, I think there are many more experienced experts here in our community and most of us know it enough anyway, I am skipping write up on CIBIL..

With this I CONCLUDE my JOURNEY

Last edited: