New Wallet | 5% SBI Cashback card load & 1.18% charges for bank transfer trick:

Play Store:

IOS Store: https://apps.apple.com/in/app/giverly/id6447155723

Download the app and complete mini kyc (full kyc also available).

Generate virtual card, activate ecom transaction.

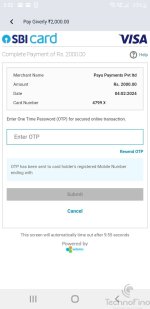

Now go to add money option enter your 5% SBI Cashback credit card details and check merchant name on card otp page -

"Payu Payments Pvt ltd" - Merchant category - "Travel".

"Updated - Now New Merchant Name: "GIVERLY INDIA PRIVA" Came and MCC 5399 - GENERAL MERCHANDISE OR CONVENIENCE FOOD STORES".

Note - You can also cancel and try again until you get "Payu Payments Pvt ltd" (Travel Category MCC - 4722). @BUDHRAJ told, same was showing yesterday as well but after trying again it changed. Looks like they have 2 or maybe more PG.

However, both merchant name MCC is eligible for 5% SBI Cashback credit card.

Bank transfer trick -

1) You can load Rs1000 free of cost on mobikwik wallet every month.

2) Mobikwik wallet load with century coupon code - charges after cashback - 1.95% (century coupon code applied multiple times).

3) Snapay app >> Low priority (T+4) >> choose RuPay >> Only 1.18% charges >> pay >> Pay with this new app virtual card

Warning: currently this card is detect as credit card, maybe soon Snapay will find out this is prepaid card.

Note - Only Easebuzz payment page supported this card as credit card, if Payu page open then this card is not supported on Low priority (T+4).

when i click Visa/mastercard option Payu gateway page open. so, i choose RuPay option to get Easebuzz payment page. You can also try Visa/mastercard, net banking or other option if Payu gateway page will open.

4) Snapay >> Pay with Rewards trick >> charges almost 0.5% to 1.5% after cashback (Snapay >> Pay with Rewards will give higher cashback at the end of the month) >> Pay with this new app virtual card.

Note - If you dnt know about Snapay or Snapay >> Pay with Rewards trick then ask someone else. Dnt irritate me 😜😜

Ultra pro max level short me bolu toh - Snapay >> T+1 >> Pay with Rewards >> will give you zillion cashback points (375 to 750 zillion points) and Rs180 to Rs220 cashback (if you pay 20k on first transaction) and then next transaction, do Rs3000 payment and redeem your Pay with Rewards Cashback + redeem your zillion cashback points.

Note - You can also redeem your zillion points on mobikwik.

Another thing, you can also choose Intermiles point earning instead of zillion cashback points. Intermiles point will give you higher rewards and you can use Intermiles point to buy Amazon gv at 5% off + 5% extra cashback on SBI Cashback credit card.

And like i said, Pay with Rewards will give higher cashback at the end of the month. Sometimes we got Rs220 cashback + 750 zillion points (750 divide by 4 = Rs187.50).

If you guys understand clearly then the charges will be 0.5% to 1.5% (At the beginning of the month, Snapay >> Pay with Rewards give less cashback).

Remember the first transaction is 20k to earn all "Snapay >> Pay with Rewards cashback" and 2nd transaction do Rs3000 to redeem your cashback.

As an experiment, do a transaction of Rs 100 for the first time, if everything goes well then use a higher amount.

Play Store:

IOS Store: https://apps.apple.com/in/app/giverly/id6447155723

Download the app and complete mini kyc (full kyc also available).

Generate virtual card, activate ecom transaction.

Now go to add money option enter your 5% SBI Cashback credit card details and check merchant name on card otp page -

"Payu Payments Pvt ltd" - Merchant category - "Travel".

"Updated - Now New Merchant Name: "GIVERLY INDIA PRIVA" Came and MCC 5399 - GENERAL MERCHANDISE OR CONVENIENCE FOOD STORES".

Note - You can also cancel and try again until you get "Payu Payments Pvt ltd" (Travel Category MCC - 4722). @BUDHRAJ told, same was showing yesterday as well but after trying again it changed. Looks like they have 2 or maybe more PG.

However, both merchant name MCC is eligible for 5% SBI Cashback credit card.

Bank transfer trick -

1) You can load Rs1000 free of cost on mobikwik wallet every month.

2) Mobikwik wallet load with century coupon code - charges after cashback - 1.95% (century coupon code applied multiple times).

3) Snapay app >> Low priority (T+4) >> choose RuPay >> Only 1.18% charges >> pay >> Pay with this new app virtual card

Warning: currently this card is detect as credit card, maybe soon Snapay will find out this is prepaid card.

Note - Only Easebuzz payment page supported this card as credit card, if Payu page open then this card is not supported on Low priority (T+4).

when i click Visa/mastercard option Payu gateway page open. so, i choose RuPay option to get Easebuzz payment page. You can also try Visa/mastercard, net banking or other option if Payu gateway page will open.

4) Snapay >> Pay with Rewards trick >> charges almost 0.5% to 1.5% after cashback (Snapay >> Pay with Rewards will give higher cashback at the end of the month) >> Pay with this new app virtual card.

Note - If you dnt know about Snapay or Snapay >> Pay with Rewards trick then ask someone else. Dnt irritate me 😜😜

Ultra pro max level short me bolu toh - Snapay >> T+1 >> Pay with Rewards >> will give you zillion cashback points (375 to 750 zillion points) and Rs180 to Rs220 cashback (if you pay 20k on first transaction) and then next transaction, do Rs3000 payment and redeem your Pay with Rewards Cashback + redeem your zillion cashback points.

Note - You can also redeem your zillion points on mobikwik.

Another thing, you can also choose Intermiles point earning instead of zillion cashback points. Intermiles point will give you higher rewards and you can use Intermiles point to buy Amazon gv at 5% off + 5% extra cashback on SBI Cashback credit card.

And like i said, Pay with Rewards will give higher cashback at the end of the month. Sometimes we got Rs220 cashback + 750 zillion points (750 divide by 4 = Rs187.50).

If you guys understand clearly then the charges will be 0.5% to 1.5% (At the beginning of the month, Snapay >> Pay with Rewards give less cashback).

Remember the first transaction is 20k to earn all "Snapay >> Pay with Rewards cashback" and 2nd transaction do Rs3000 to redeem your cashback.

As an experiment, do a transaction of Rs 100 for the first time, if everything goes well then use a higher amount.

Last edited: