Fir jaroor doob jayega Paytm

Axis Bank open to working with Paytm if RBI permits, says MD & CEO Amitabh Chaudhry

RBI on February 1 barred Paytm Payments Bank Ltd from accepting fresh deposits and making credit transactions.www.moneycontrol.com

Birds of the same feathers flock together 😊

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

-

Hey there! Welcome to TFC! View fewer ads on the website just by signing up on TF Community.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Paytm now tieup with 3rd party banks to continue Paytm Payment Gateway business

- Thread starter Abhishek012

- Start date

- Replies 93

- Views 7K

Working as nodal bankWhat will axis do with Paytm? It already has freecharge 😅.

Will replace Paytm Payments Bank as default account for Paytm users. Axis is trying to capture market share how it tried with its credit cards. 🙂What will axis do with Paytm? It already has freecharge 😅.

That won't be a permanent wedding as One97 will to get banking licence again in some other name soon in order to keep their margin intact & then will replace it.Will replace Paytm Payments Bank as default account for Paytm users. Axis is trying to capture market share how it tried with its credit cards. 🙂

AlgoTrader

TF Legend

My vote is for 1 & 3 . We can do all the political bashing, but this is non compliance out of pure arrogance of "too big to fail"What could have caused this out of the reasons below?

1. Mere arrogance of Paytm given the number of users.

2. Political issues as rumours are floating.

3. A genuine act of RBI to streamline financial systems.

This is all fire fighting, no long term plan.That won't be a permanent wedding as One97 will to get banking licence again in some other name soon in order to keep their margin intact & then will replace it.

They should have learnt from ban on Amex and HDFC. No player is bigger than the game.My vote is for 1 & 3 . We can do all the political bashing, but this is non compliance out of pure arrogance of "too big to fail"

chandra.prakash

TF Premier

After tie-up with third party bank, Paytm join the family with Gpay, phone and other UPI app, let's see what's about the customer service, because it's customer support is very bad.

AlgoTrader

TF Legend

exactly and I wish they do it again for hdfc for their arrogance and malpractice of showing one card and providing anotherThey should have learnt from ban on Amex and HDFC. No player is bigger than the game.

#Exclusive After Paytm Payments Bank and a set of lending companies, Reserve Bank of India has now come hard on fintechs offering commercial/corporate cards. According to three sources, RBI has asked Visa and Mastercard to stop transactions of vendor payments.Paytm now tieup with 3rd party banks to continue Paytm Payment Gateway business:

Update: Paytm Payments Bank Limited, an associate of Paytm receives RBI directions. Paytm to expand its existing relationships with leading third-party banks to distribute payments and financial services products. Read more here:

Sub: Disclosure under Regulation 30 of the SEBI (ListingObligations and Disclosure Requirements) Regulations, 2015

Dear Sir/ Ma’am,

The Company would like to update that it has been informed by its associate entity, Paytm Payments Bank Limited (“PPBL”), that the Reserve Bank of India (“RBI”) vide its press release dated January 31, 2024 has given it further directions under section 35A of the Banking Regulation Act, 1949. PPBL is taking immediate steps to comply with RBI directions, including working with the RBI to address their concerns as quickly as possibl

We are enclosing herewith a press release to be issued by the Company in this regard. The Company will hold a conference call on Thursday, February 1, 2024 from 3:30 p.m. (IST) to 4:15 p.m. (IST) regarding the same.

Please see below the mandatory pre-registration link for attending the call:

Video Conferencing, Web Conferencing, Webinars, Screen Sharing

Zoom is the leader in modern enterprise video communications, with an easy, reliable cloud platform for video and audio conferencing, chat, and webinars across mobile, desktop, and room systems. Zoom Rooms is the original software-based conference room solution used around the world in board...paytm.zoom.us

This is for your information and appropriate dissemination. The disclosure will also be hosted on the Company's website viz. www.paytm.com. Kindly take the same on record.

Thanking you

Yours Sincerely,

For One 97 Communications Limited

View attachment 41814

Paytm Payments Bank Limited (“PPBL”), an associate of OCL (One 97 Communications Limited), receives RBI directions. OCL to expand its existing relationships with leading third-party banks to distribute payments and financial services products.

The Company (OCL) would like to update that it has been informed by its associate, Paytm Payments Bank Limited (“PPBL”), that the Reserve Bank of India (“RBI”) vide its Press Release dated January 31, 2024, has given it further directions under section 35A of the Banking Regulation Act, 1949. PPBL is taking immediate steps to comply with RBI directions, including working with the regulator to address their concerns as quickly as possible.

The Company has been informed that this does not impact user deposits in their savings accounts, Wallets, FASTags, and NCMC accounts, where they can continue to use the existing balances.

OCL, as a payments company, works with various banks (not just Paytm Payments Bank), on various payments products. OCL started to work with other banks since starting of the embargo. We now will accelerate the plans and completely move to other bank partners. Going forward, OCL will be working only with other banks, and not with Paytm Payments Bank Limited. The next phase of OCL’s journey is to continue to expand its payments and financial services business, only in partnerships with other banks.

We offer acquiring services to merchants in partnership with several leading banks in the country and will continue to expand third-party bank partnerships. The Paytm Payment Gateway business (online merchants) will continue to offer payment solutions to its existing merchants. OCL’s offline merchant payment network offerings like Paytm QR, Paytm Soundbox, Paytm Card Machine, will continue as usual, where it can onboard new offline merchants as well.

With regard to the direction on termination of nodal account of OCL and Paytm Payments Services Limited (PPSL) by February 29, 2024, OCL and PPSL will move the nodal to other banks during this period.

OCL will pursue partnerships with various other banks, to offer various payment products to its customers.

OCL’s other financial services such as loan distribution, insurance distribution and equity broking, are not in any way related to Paytm Payments Bank Limited and are expected to be unaffected by this direction.

Depending on the nature of the resolution, the Company expects this action to have a worst case impact of Rs. 300 to 500 crores on its annual EBITDA going forward. However, the Company expects to continue on its trajectory to improve its profitability.

Separately, in response to market rumours, our founder has reconfirmed to us that he has not taken any margin loans, or otherwise pledged any shares that are directly or indirectly owned by him.

We would take this opportunity to clarify that as per banking regulations, Paytm Payments Bank Limited is run independently by its management and board. While OCL is allowed to have two board seats on the board of Paytm Payments Bank Limited, as a part of its shareholder agreement, OCL exerts no influence on the operations of Paytm Payments Bank Limited, other than as a minority board member, and minority shareholder.

While there has been no communication from Mastercard yet but Visa has sent out a communication to its fintech partners asking them to stop Business Payment Service Provider (BPSP) transactions.

The communication from Visa reads: "We have been directed by the regulator to ensure that all Business Payment Service Provider (BPSP) transactions be kept in abeyance till further notice. Hence, we kindly ask that all BPSP merchants/merchant ids registered by yourselves with Visa be immediately suspended till advised by us to the contrary. For avoidance of doubt, any transaction authorized prior to the communication would be settled in the ordinary course of business.

We kindly ask that you send us a confirmation at the earliest that such merchants/merchant IDs have been blocked and transactions ceased. Failure to adhere to these instructions could result in regulatory sanction and non-compliance assessment under the Visa rules."

A senior official, whose fintech is directly impacted by this decision, said, "There's some miscommunication or misrepresention to RBI, otherwise there’s no reason they would be doing this. This is coming from a point of view that there’s quite a bit of transactions happening in the ecosystem in the name of tuition fee, rental payments and the likes of it...which is becoming too large to manage. RBI's concerns might be the source of the money and where it is going."

"It's a kneejerk reaction by the RBI.

While we haven't got any official communication from RBI directly but what we have been told is that the RBI came to Visa and Mastercard and asked them to explain what is Business Payment Service Provider (BPSP) transactions. It is like either you come and explain this to us or stop these transactions."

Companies such as EnKash, Paymate among others operate in this segment.

"Our huge part of business came from this. As per industry estimates, spends happening on commercial cards at one point was somewhere about Rs 25000 crore per month, out of which 20%-25% was for vendor payments," the official quoted above claimed.

2024 won't be good for many 😂#Exclusive After Paytm Payments Bank and a set of lending companies, Reserve Bank of India has now come hard on fintechs offering commercial/corporate cards. According to three sources, RBI has asked Visa and Mastercard to stop transactions of vendor payments.

While there has been no communication from Mastercard yet but Visa has sent out a communication to its fintech partners asking them to stop Business Payment Service Provider (BPSP) transactions.

The communication from Visa reads: "We have been directed by the regulator to ensure that all Business Payment Service Provider (BPSP) transactions be kept in abeyance till further notice. Hence, we kindly ask that all BPSP merchants/merchant ids registered by yourselves with Visa be immediately suspended till advised by us to the contrary. For avoidance of doubt, any transaction authorized prior to the communication would be settled in the ordinary course of business.

We kindly ask that you send us a confirmation at the earliest that such merchants/merchant IDs have been blocked and transactions ceased. Failure to adhere to these instructions could result in regulatory sanction and non-compliance assessment under the Visa rules."

A senior official, whose fintech is directly impacted by this decision, said, "There's some miscommunication or misrepresention to RBI, otherwise there’s no reason they would be doing this. This is coming from a point of view that there’s quite a bit of transactions happening in the ecosystem in the name of tuition fee, rental payments and the likes of it...which is becoming too large to manage. RBI's concerns might be the source of the money and where it is going."

"It's a kneejerk reaction by the RBI.

While we haven't got any official communication from RBI directly but what we have been told is that the RBI came to Visa and Mastercard and asked them to explain what is Business Payment Service Provider (BPSP) transactions. It is like either you come and explain this to us or stop these transactions."

Companies such as EnKash, Paymate among others operate in this segment.

"Our huge part of business came from this. As per industry estimates, spends happening on commercial cards at one point was somewhere about Rs 25000 crore per month, out of which 20%-25% was for vendor payments," the official quoted above claimed.

pinki

TF Legend

#Exclusive After Paytm Payments Bank and a set of lending companies, Reserve Bank of India has now come hard on fintechs offering commercial/corporate cards. According to three sources, RBI has asked Visa and Mastercard to stop transactions of vendor payments.

While there has been no communication from Mastercard yet but Visa has sent out a communication to its fintech partners asking them to stop Business Payment Service Provider (BPSP) transactions.

The communication from Visa reads: "We have been directed by the regulator to ensure that all Business Payment Service Provider (BPSP) transactions be kept in abeyance till further notice. Hence, we kindly ask that all BPSP merchants/merchant ids registered by yourselves with Visa be immediately suspended till advised by us to the contrary. For avoidance of doubt, any transaction authorized prior to the communication would be settled in the ordinary course of business.

We kindly ask that you send us a confirmation at the earliest that such merchants/merchant IDs have been blocked and transactions ceased. Failure to adhere to these instructions could result in regulatory sanction and non-compliance assessment under the Visa rules."

A senior official, whose fintech is directly impacted by this decision, said, "There's some miscommunication or misrepresention to RBI, otherwise there’s no reason they would be doing this. This is coming from a point of view that there’s quite a bit of transactions happening in the ecosystem in the name of tuition fee, rental payments and the likes of it...which is becoming too large to manage. RBI's concerns might be the source of the money and where it is going."

"It's a kneejerk reaction by the RBI.

While we haven't got any official communication from RBI directly but what we have been told is that the RBI came to Visa and Mastercard and asked them to explain what is Business Payment Service Provider (BPSP) transactions. It is like either you come and explain this to us or stop these transactions."

Companies such as EnKash, Paymate among others operate in this segment.

"Our huge part of business came from this. As per industry estimates, spends happening on commercial cards at one point was somewhere about Rs 25000 crore per month, out of which 20%-25% was for vendor payments," the official quoted above claimed.

e

education fees 🙂#Exclusive After Paytm Payments Bank and a set of lending companies, Reserve Bank of India has now come hard on fintechs offering commercial/corporate cards. According to three sources, RBI has asked Visa and Mastercard to stop transactions of vendor payments.

While there has been no communication from Mastercard yet but Visa has sent out a communication to its fintech partners asking them to stop Business Payment Service Provider (BPSP) transactions.

The communication from Visa reads: "We have been directed by the regulator to ensure that all Business Payment Service Provider (BPSP) transactions be kept in abeyance till further notice. Hence, we kindly ask that all BPSP merchants/merchant ids registered by yourselves with Visa be immediately suspended till advised by us to the contrary. For avoidance of doubt, any transaction authorized prior to the communication would be settled in the ordinary course of business.

We kindly ask that you send us a confirmation at the earliest that such merchants/merchant IDs have been blocked and transactions ceased. Failure to adhere to these instructions could result in regulatory sanction and non-compliance assessment under the Visa rules."

A senior official, whose fintech is directly impacted by this decision, said, "There's some miscommunication or misrepresention to RBI, otherwise there’s no reason they would be doing this. This is coming from a point of view that there’s quite a bit of transactions happening in the ecosystem in the name of tuition fee, rental payments and the likes of it...which is becoming too large to manage. RBI's concerns might be the source of the money and where it is going."

"It's a kneejerk reaction by the RBI.

While we haven't got any official communication from RBI directly but what we have been told is that the RBI came to Visa and Mastercard and asked them to explain what is Business Payment Service Provider (BPSP) transactions. It is like either you come and explain this to us or stop these transactions."

Companies such as EnKash, Paymate among others operate in this segment.

"Our huge part of business came from this. As per industry estimates, spends happening on commercial cards at one point was somewhere about Rs 25000 crore per month, out of which 20%-25% was for vendor payments," the official quoted above claimed.

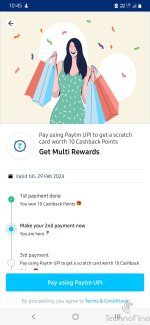

Is this even a offer?Paytm started giving offers again.

Points have no value but psychologically it's a change.

They just time passing with shit points.

Yes as a I said before it is a game being played by big fishes.. don’t get caught in between and get crushed..Paytm started giving offers again.

Points have no value but psychologically it's a change.

Look at the co relation between the paytm share price and the news coming out on those respective days.. when the price tries to go up some kind of news comes out and forcing the price to hit lower circuit in the following sessions.

Somehow someone wants to keep the share price really really down to take the appropriate action at the right time…

Of course VSS is largely at the fault for this fiasco.

But ultimately the destiny will be decided by someone else.. just watch the game and enjoy it as per your understanding…

Buy PinePerks RuPay Gift Card from Amazon using your AMEX & use that for offline swipe.@S S V my worry is if paytm POS machine is sacked taking 1500 for MRCC is tough 🙁 since most PAYTM machine by default accepted amex

Seems new 😛 can someone help me how to do that ?Buy PinePerks RuPay Gift Card from Amazon using your AMEX & use that for offline swipe.

How to get the physical card

Similar threads

- Replies

- 7

- Views

- 495

- Replies

- 2

- Views

- 765

- Replies

- 6

- Views

- 649

- Article

- Replies

- 674

- Views

- 40K