PepperMoney Dreams RuPay Prepaid Card Launched in GFF 2023 Event held by NPCI.

Charges:

• Lifetime Free (0 Joining Fees + 0 Annual Fees).

Benefits:

• 1% Unlimited cashback on any transaction (as of now).

• Location Specific Offers/Rewards on hitting milestone of Peppers.

• Currently live in Lucknow & Indore.

Early Access:

• You can apply for this prepaid card via Pepper Money app. You'll need Mobile number & PAN to share with them.

• Click here to signup on the app.

• 100₹ cashback on first transaction

FAQs:

• What is the Pepper Money Dreams Card?

The Pepper Money Dreams Card is the ultimate spending card. Add money from any bank account and let the magic of exclusive cashback and offers unfold with every purchase! Additionally, enjoy secure payments as your card won’t be directly linked to your bank account.

• Where can I use my Pepper Money Dreams Card?

Anywhere you go! The Pepper Money Dreams Card can take care of all your spending needs – online or offline. Enjoy the convenience of using the card for shopping, food, movies, at cafes or your local grocery store. It’s your go-to card for every transaction anywhere you go.

• Are there any hidden charges that I have to pay for the Pepper Money Dreams Card?

The Pepper Money Dreams Card does not have any secrets.

While applying for this card, there are NO hidden charges – No joining fees, annual charges, or any minimum balance requirements. That’s the magic of this card, making it the most rewarding card in your wallet.

• Why do I only see Lucknow and Indore specific cards? When will you launch in my city?

The Pepper Money Dreams card is the card for the cities of India. Lucknow and Indore are our launch cities and we are soon coming to a number of different cities like Ahmedabad, Pune, etc. Write to us at contact@peppermoney.in and tell us why we must come to your city.

• Why do I need to add money to my Pepper Money Dreams Card before making any purchases?

Pepper Money Dreams Card is a prepaid card that puts you in charge of your spending. Just add the amount you want onto your card from any bank account, and voila! Your card will be charged up and ready to make purchases both offline and online.

Unlock a world of safe and delightful payments as your card is not directly linked to your bank account. So, load up your card and let the magic begin!

• What are peppers?

Everytime you complete key milestones on the Pepper Money app or transact with your Pepper Money Dreams Card, you receive ‘peppers’. These magical tokens unlock exclusive offers, cashbacks, and surprises in your city, making every transaction a wonderful one. If you don’t find these exclusive offers right now, we are bringing something exciting for you very soon!

• How do I claim an offer on the app?

As you collect more and more peppers, use their power to claim exclusive deals and rewards across your favorite brands.

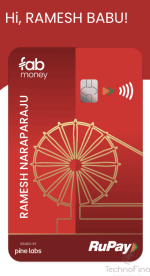

Card Unboxing & First Look:

Thank you ❤️ for your time & reading this article.

Charges:

• Lifetime Free (0 Joining Fees + 0 Annual Fees).

Benefits:

• 1% Unlimited cashback on any transaction (as of now).

• Location Specific Offers/Rewards on hitting milestone of Peppers.

• Currently live in Lucknow & Indore.

Early Access:

• You can apply for this prepaid card via Pepper Money app. You'll need Mobile number & PAN to share with them.

• Click here to signup on the app.

• 100₹ cashback on first transaction

FAQs:

• What is the Pepper Money Dreams Card?

The Pepper Money Dreams Card is the ultimate spending card. Add money from any bank account and let the magic of exclusive cashback and offers unfold with every purchase! Additionally, enjoy secure payments as your card won’t be directly linked to your bank account.

• Where can I use my Pepper Money Dreams Card?

Anywhere you go! The Pepper Money Dreams Card can take care of all your spending needs – online or offline. Enjoy the convenience of using the card for shopping, food, movies, at cafes or your local grocery store. It’s your go-to card for every transaction anywhere you go.

• Are there any hidden charges that I have to pay for the Pepper Money Dreams Card?

The Pepper Money Dreams Card does not have any secrets.

While applying for this card, there are NO hidden charges – No joining fees, annual charges, or any minimum balance requirements. That’s the magic of this card, making it the most rewarding card in your wallet.

• Why do I only see Lucknow and Indore specific cards? When will you launch in my city?

The Pepper Money Dreams card is the card for the cities of India. Lucknow and Indore are our launch cities and we are soon coming to a number of different cities like Ahmedabad, Pune, etc. Write to us at contact@peppermoney.in and tell us why we must come to your city.

• Why do I need to add money to my Pepper Money Dreams Card before making any purchases?

Pepper Money Dreams Card is a prepaid card that puts you in charge of your spending. Just add the amount you want onto your card from any bank account, and voila! Your card will be charged up and ready to make purchases both offline and online.

Unlock a world of safe and delightful payments as your card is not directly linked to your bank account. So, load up your card and let the magic begin!

• What are peppers?

Everytime you complete key milestones on the Pepper Money app or transact with your Pepper Money Dreams Card, you receive ‘peppers’. These magical tokens unlock exclusive offers, cashbacks, and surprises in your city, making every transaction a wonderful one. If you don’t find these exclusive offers right now, we are bringing something exciting for you very soon!

• How do I claim an offer on the app?

As you collect more and more peppers, use their power to claim exclusive deals and rewards across your favorite brands.

Card Unboxing & First Look:

Thank you ❤️ for your time & reading this article.

Last edited: